What Are Funding And Basis?

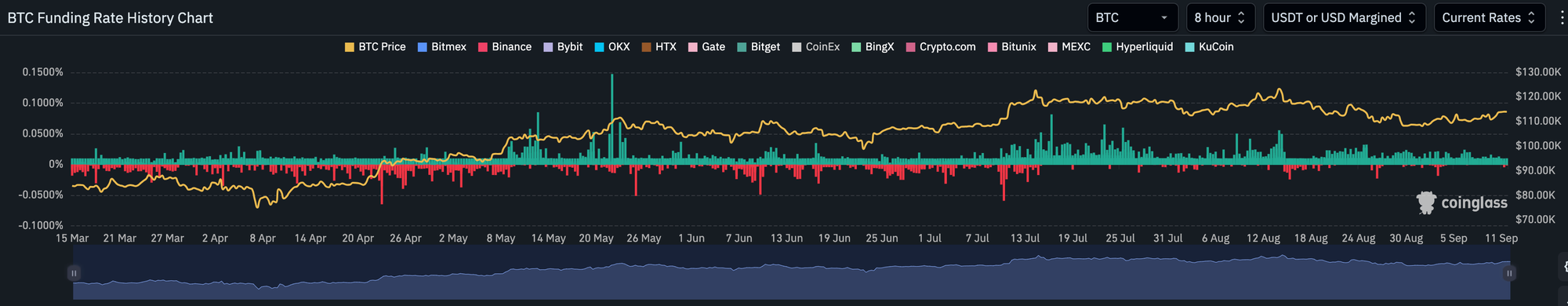

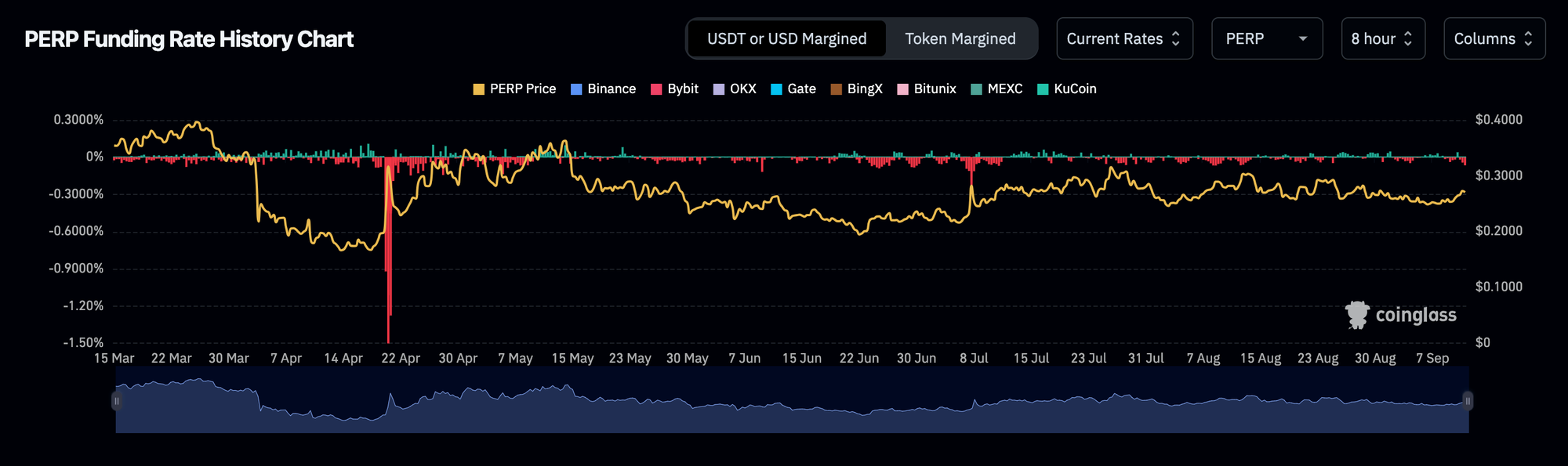

Funding is the periodic payment between longs and shorts on perpetual futures so the contract stays anchored to spot. Positive funding… longs pay shorts. Negative funding… shorts pay longs.

Basis is the premium or discount of a fixed-expiry future versus spot, usually annualised. Above zero… futures trade richer than spot. Below zero… futures at a discount. Direction and persistence matter more than a single tick.

Funding hugs zero most of the time with negative sweeps into drawdowns… sustained positive runs need spot to follow or they unwind.

Funding vs Basis… What’s The Difference?

Funding is a perp-only mechanism and can be noisy around events. Basis reads the whole term curve for dated futures, which gives a cleaner gauge of risk appetite. If funding is hot while basis is flat, leverage is paying without conviction. If funding is negative while basis holds up, shorts are pressing into firmness.

Long stretches near zero punctuated by sharp negative bursts… single prints are traps unless basis and spot confirm.

Practical Thresholds

Guide rails, not gospel… use with trend and other dials.

- Funding positive and persistent with spot leading… constructive, but fades if spot stalls.

- Funding negative across venues while price is stable… absorption, often a squeeze risk once funding normalises.

- BTC quarterly basis around 0–5% annualised… neutral; 5–15% and rising with spot… healthy; above ~15–20% without spot confirmation… prone to mean reversion.

- Basis near zero or negative while price slips… tight tape, respect risk until it steadies.

- Fast round trips around prints… usually noise… wait for a session or weekly close before changing stance.

How To Pair Funding And Basis With Other Dials

- Open interest… expanding with rising basis and tame funding is the clean build.

- Liquidations and volume… funding spikes without liquidations are less meaningful.

- Spot-perp lead/lag… if perps lead every push while spot lags, be cautious.

- Venue mix… cross-exchange alignment beats a single-exchange outlier.

Snapshot context for aggression on each side… useful when mapped against basis moves rather than in isolation.

A Simple Workflow You Can Reuse

- Keep a multi-venue funding dashboard on 1h/4h/8h… mark persistence, not spikes.

- Check fixed-date basis daily… compare to yesterday and last week.

- Map the matrix:

- Funding +, basis rising, spot leading… continuation setups.

- Funding +, basis flat/falling, spot stalling… tired longs, avoid chasing.

- Funding −, basis firm, spot steady… absorption… stalk upside once funding mean-reverts.

- Funding −, basis collapsing, spot breaking… trend down, don’t countertrade blindly.

- Execute only when spot confirms what derivatives hint at… review daily… persistence beats headlines.

Mini FAQs

Which should I trust more, funding or basis?

Use both… basis is the cleaner risk gauge, funding shows who is paying right now.

Do absolute levels matter or just the change?

The turn with persistence matters most. Levels anchor expectations and help with execution.

Why do single-exchange signals keep failing?

Microstructure and incentives differ by venue… look for cross-venue agreement before you act.

If this helped you read funding and basis without guesswork, join Alpha Insider for daily dashboards, clear triggers, and a weekly positioning watchlist. Fewer mistakes, cleaner execution, more conviction.

The Markets Unplugged members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

This isn’t noise… it’s the full playbook.

Discussion