Key Points

- MVRV Z-Score compares Bitcoin’s market value to its realised value, then normalises the gap to highlight statistically unusual extremes.

- It is most useful for cycle context, helping frame whether price is stretched versus on-chain cost basis after accounting for typical volatility.

- The core idea is simple… when the gap between Market Cap and Realised Cap becomes unusually large relative to history, risk rises.

- Use it as context and confirmation, not as a standalone signal that “predicts” price.

- A weekly view is usually enough for regime reads… daily swings can add noise.

- This guide is part of the Bitcoin on-chain series. For the full library of indicators and explainers, see the Bitcoin on-chain indicators hub.

- If any terms feel unfamiliar, use the Crypto Glossary, then return here.

Quick Answer

MVRV Z-Score is a statistical version of MVRV that measures how far Bitcoin’s Market Cap sits above or below Realised Cap, scaled by historical volatility. Higher Z readings suggest price is unusually stretched relative to on-chain cost basis, which tends to increase late-cycle risk when spending and flows confirm distribution. Lower Z readings suggest price is closer to, or below, cost basis zones that have historically aligned with better long-horizon risk-reward. Use it as a regime filter, then confirm with cost basis bands, profit and loss behaviour, and flow metrics before forming a view.

What Is the MVRV Z-Score?

MVRV Z-Score is a normalised measure that compares Bitcoin’s market value with its realised value and adjusts for the historical variability of market value. In plain terms, it shows how stretched price is versus on-chain cost basis after accounting for typical volatility.

Z is dimensionless and designed to highlight statistically unusual periods that often align with major cycle extremes.

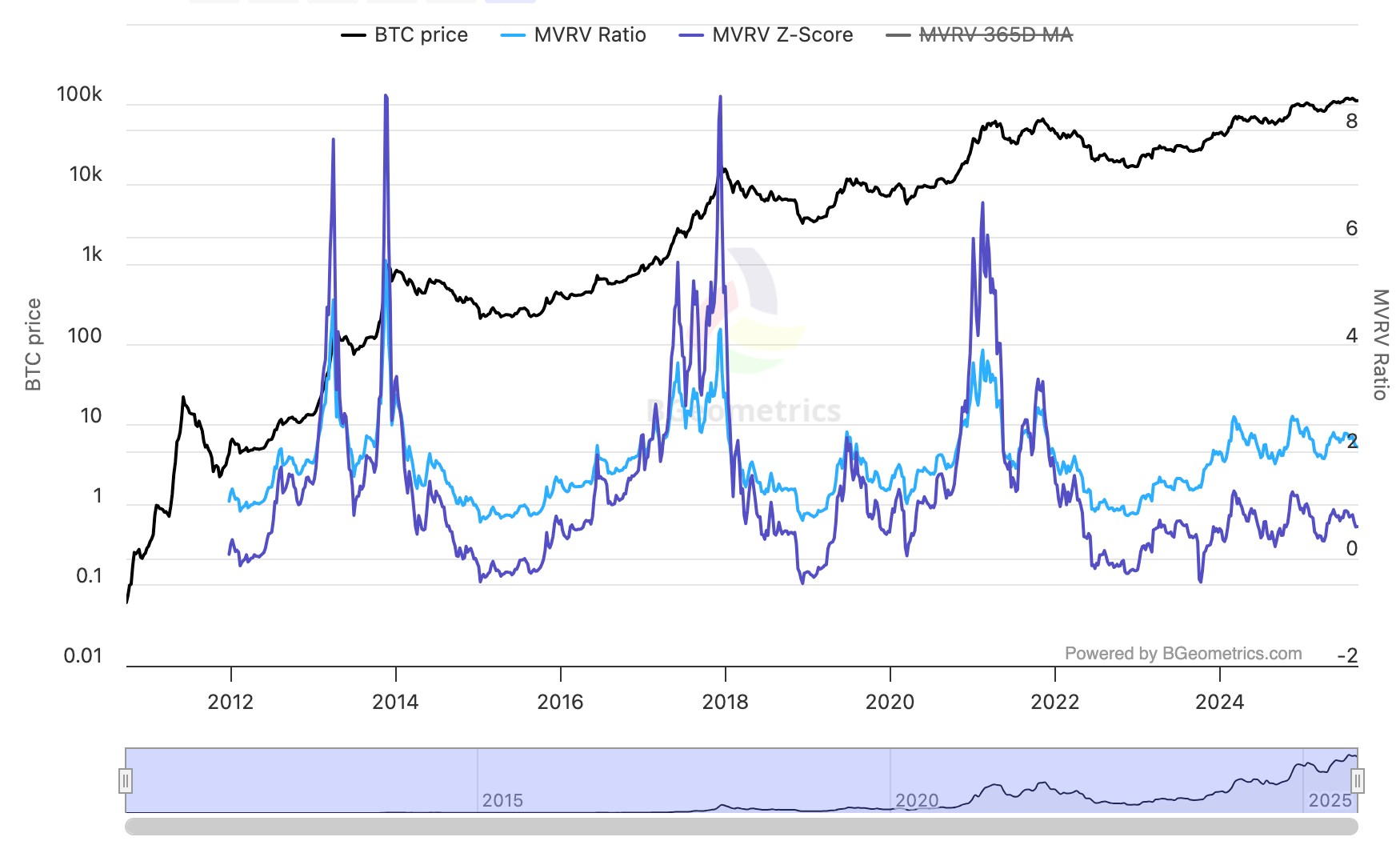

This chart normalises the gap between market and realised values to highlight statistical extremes and risk bands.

How Is MVRV Z-Score Calculated?

- Market value: current price × circulating supply.

- Realised value: each coin priced at its last on-chain move, then summed.

- Standard deviation of market value: dispersion of market value over a long history.

- Formula: Z = (Market Cap − Realised Cap) ÷ Standard Deviation of Market Cap.

The numerator tracks how far market value sits above or below realised value. The denominator scales that gap by typical historical variability so you can compare across cycles.

Why Use Z-Score Instead of Plain MVRV?

- It reduces regime bias by scaling the premium to historical variability.

- It sharpens the view of unusual extremes that plain MVRV might blur in higher-liquidity eras.

- It improves cross-cycle comparisons and makes banding more informative for risk framing.

Interpreting the Risk Bands

There are no magic numbers, but widely referenced areas help frame risk:

- ≤ 0: depressed conditions where market value is at or below realised value.

- 0–2: constructive zone, typical of early recoveries or steady advances.

- 2–4: expansion with rising risk; watch for confirmation from other indicators.

- 4–6: elevated risk; distribution and mean-reversion become more likely.

- ≥ 7: historically associated with late-cycle risk during strong advances.

Use bands as guides only. Always seek confluence.

Practical Use Cases

Cycle context

Use weekly Z to understand where price sits relative to on-chain value in a statistical sense. Rising Z within mid-bands often aligns with trend continuation; spikes into high bands that fade quickly can signal risk.

Divergences

Higher highs in price while Z makes lower highs can hint at weakening valuation breadth. The reverse can suggest value building beneath price.

Confluence with valuation and spending

Pair Z with plain MVRV, realised price bands (Market, LTH, STH), SOPR, and dormancy/CDD. When Z runs hot while SOPR flips to profit-taking and LTH bands approach, caution rises.

Common Pitfalls

- Treating a single threshold as a hard rule. Bands migrate as liquidity and participants change.

- Reading Z in isolation. Extremes are more actionable when spending behaviour and supply metrics agree.

- Ignoring the pace of change. Fast jolts into high bands that reverse can mark blow-off risk; slow climbs with rising realised cap can persist longer.

A Simple Workflow You Can Reuse

- Open MVRV Z-Score on a weekly chart.

- Note the current band and the direction of travel.

- Cross-check plain MVRV and realised price bands.

- Check SOPR for profit-taking or absorption.

- Scan dormancy/CDD for old-coin spending.

- Decide: is Z signalling manageable premium with support, or an overheated patch with distribution risk?

This comparison highlights how Z refines the read by scaling the premium to historical variability.

Mini FAQs

Is a high MVRV Z-Score automatically bearish?

No. High Z can persist during strong advances. Risk rises when Z is elevated and other indicators confirm distribution.

Which timeframe is best for MVRV Z-Score?

Weekly for cycle context. Daily is noisier and often does not change the regime read.

How is MVRV Z-Score different from MVRV?

MVRV compares Market Cap to Realised Cap. Z-Score normalises that gap to historical variability, which helps compare extremes across cycles.

How is Z-Score different from NUPL?

Z-Score focuses on the valuation gap between market and realised values. NUPL estimates what share of supply sits in profit or loss. They work well together.

Can Z-Score be used on its own?

It should not. Treat it as a statistical layer and confirm with cost basis, spending behaviour, and flow indicators.

What should be used for confirmation?

Cross check realised price bands for cost basis, SOPR or realised profit and loss for behaviour, and exchange netflows or spending age indicators for distribution pressure.

If this helped you frame risk bands properly, Alpha Insider members can access deeper Bitcoin on-chain analysis and commentary here.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in clear, simple terms

➡️ A private Telegram community where conviction is shared daily

Designed for consistent on-chain reads, week to week.

Legal And Risk Notice

This content is for education only and does not constitute financial advice. Crypto assets are volatile and you can lose money. Always do your own research and consider your risk tolerance.

Discussion