In the last couple of years rug pulls have become less frequent but far more expensive for victims. Some reports show only a handful of major rug pulls in early 2025, yet total losses running into the billions as memecoin and DeFi scams scale up on fast, cheap networks.

If you are rotating profits from Bitcoin into newer coins in 2026, you cannot afford to skip basic checks. This guide gives you a simple, repeatable process to spot a potential rug pull before you click “buy”.

If you are new to crypto terminology, it helps to keep our main Crypto Glossary open in another tab while you read this guide. It explains key phrases such as rug pull, liquidity and DeFi in plain English so you can follow along more easily.

Key Points

- A rug pull is a crypto project where the creators drain liquidity or disable selling, leaving holders with near worthless tokens. Most of these scams live in DeFi and memecoins.

- Recent data suggests fewer rug pulls by count but higher total losses, driven by speculative tokens and memecoin launches on faster, cheaper networks.

- Before you buy any new token, run five fast checks: project basics, token distribution, contract scan, liquidity and trading, and marketing behaviour.

- Free tools such as contract scanners, honeypot detectors and block explorers can flag obvious red flags, but they are not perfect and should support, not replace, your own research.

- The safest way to protect your Bitcoin is to treat speculative altcoins as a separate, capped risk pot and never rush into projects you do not fully understand.

What Is A Rug Pull In Crypto?

A rug pull is a type of exit scam where the people behind a crypto project attract investors, then suddenly remove the value from the project, leaving everyone else holding almost worthless tokens.

This usually happens in one of two ways:

- The developers drain the liquidity pool on a decentralised exchange, so there is no meaningful market to sell into.

- The smart contract includes hidden functions that block selling or redirect funds to the creator, turning the token into a honeypot.

Most rug pulls happen in decentralised finance and speculative tokens. A team can launch a token in hours, spin up a website and social media presence, plug into an automated market maker and start attracting buyers.

Common patterns include fake coin launches, DeFi yield farms that disappear, and projects that promise unsustainably high returns.

Why Rug Pulls Are Still Dangerous In 2026

It is easy to think rug pulls were a 2021 or 2022 story, but the risk has shifted rather than disappeared.

- One 2025 review found that early 2025 saw roughly two thirds fewer rug pull incidents than the same period in 2024, but total losses surged from tens of millions to several billion dollars, as scams targeted larger pools of capital.

- Independent analysis highlights how the 2024 to 2025 memecoin boom amplified rug pull losses and even triggered political controversies in some markets.

- Wider crypto crime reviews show tens of billions of dollars moving through addresses linked to illicit activity in 2024, underlining that scams continue to evolve even as enforcement improves.

Regulators and global bodies such as the Financial Action Task Force have repeatedly warned that virtual assets can be abused for fraud and money laundering if controls are weak.

For an everyday trader or investor, this translates into a simple rule: in 2026 you may see fewer obvious cartoonish rug pulls, but the ones that slip past defences are bigger, louder and better marketed.

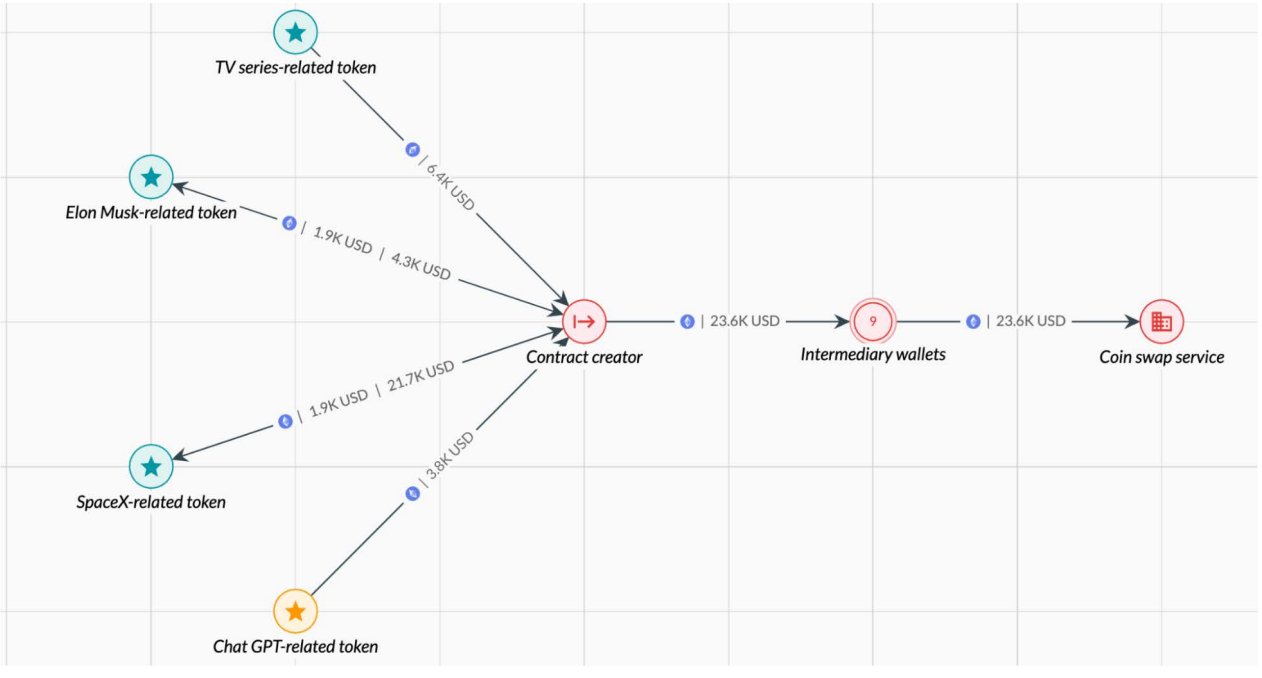

Rug Pull Losses During The Memecoin Boom: Source Elliptic

This Elliptic Investigator graph shows a single contract creator launching several themed tokens that reference celebrities, brands and popular culture. Investor funds from each token flow back to the same contract creator, then through intermediary wallets into a coin swap service, illustrating how one scammer can recycle the same exit scam pattern across multiple launches.

A Simple Five Step Checklist To Spot A Rug Pull Before You Buy

You do not need to be a developer to reduce your risk. Before you buy any new token, take a few minutes to run through these five steps.

Step 1: Check The Project Basics

Start with the simple questions:

- Is there a clear, honest explanation of what the project does, written in plain language?

- Do they explain why a token is needed, or is it just bolted on to attract speculation?

- Can you find verifiable information about the team, or is everything anonymous and recycled stock photos?

Some legitimate projects are launched by anonymous teams, especially in DeFi, but when anonymity combines with unrealistic promises, no clear business model and heavy pressure to buy quickly, your risk increases sharply.

Look for:

- A website with a clear roadmap, documentation and links to active code repositories.

- Social channels that discuss real development progress rather than only price targets.

- Independent coverage from reputable analysts or communities, not just paid “partnership” posts.

If you cannot answer basic questions about what the project does and how it plans to deliver value, you should not move on to step two.

Step 2: Look At Token Distribution And Holders

Next, examine who actually holds the token:

- Use a block explorer to see the largest wallets.

- Check what percentage of the supply is in the top ten addresses.

- Look for obvious team or deployer wallets that have not locked or vested their holdings.

Red flags include:

- One or two wallets holding most of the supply, especially if those wallets are labelled as the creator or deployer.

- No evidence of locked liquidity or time based vesting for team tokens.

- A pattern of new wallets receiving large allocations with no clear explanation.

Many chains now have community tools or dashboards that show holder concentration for popular tokens. If the token you are considering does not, you can still manually inspect the top holders and ask whether that distribution feels safe.

Step 3: Scan The Smart Contract For Obvious Traps

You do not need to read Solidity or Rust to spot basic contract risks. Use reputable scanners to get an initial assessment:

- Contract risk scoring tools that flag common problems such as minting permissions, trading restrictions and ownership control.

- Honeypot detectors that simulate a buy and sell to check whether you would actually be able to exit the position.

These tools can highlight:

- Functions that allow the owner to block selling or set very high transaction taxes.

- Code that lets the creator mint new tokens at will, diluting existing holders.

- Contracts where ownership has not been renounced or transferred to a multisig, so a single person can change critical parameters.

Remember that scanners are never perfect. A contract might pass an automated check and still be dangerous, or a new exploit method might not yet be in their rule set. Treat scanner results as a first line filter, not a guarantee of safety.

Step 4: Check Liquidity, Volume And Where The Token Trades

Rug pulls often rely on thin, easily controlled markets.

Before you buy:

- Look at the size of the liquidity pool on the main decentralised exchange where the token trades.

- Compare daily trading volume with the size of the pool.

- Check whether the liquidity provider tokens are locked, burned or held by a trusted third party.

Red flags:

- Liquidity is tiny compared with the fully diluted valuation suggested by the project.

- Liquidity has not been locked for a meaningful period.

- Most of the trading is happening in very short bursts rather than steady activity through the day.

Also pay attention to where the token is listed. A project listed only on obscure, unregulated venues, with no established exchanges showing interest, deserves extra caution.

Step 5: Analyse The Marketing And The Promises

Finally, step back and look at how the project behaves.

Warning signs include:

- Guaranteed returns, fixed daily yields or “risk free” language.

- Heavy focus on price targets and “next hundred times” claims rather than product or technology.

- Aggressive referral or affiliate schemes where rewards depend on recruiting more buyers.

- Pressure to act immediately because of a limited window, combined with vague documentation.

Many 2024 to 2025 rug pulls piggybacked on political trends, celebrity narratives or memecoin culture to drive rapid inflows before disappearing.

If a token relies on hype, trend riding and constant urgency rather than clear value, treat it as a short term trade at best and size your risk accordingly.

Common Rug Pull Patterns To Recognise In 2024 To 2026

While every scam is slightly different, most modern rug pulls fall into a few familiar patterns:

- Classic DeFi Liquidity Rug

The team launches a token, seeds an automated market maker pool, markets hard, then drains the liquidity once enough buyers arrive. - Honeypot Token

The code allows anyone to buy but only the creator can sell. Buyers watch the price move but cannot exit, and their funds are effectively trapped. - Memecoin Pump And Drain

A token is launched on a popular chain with a viral theme. The creator uses mechanics that front run demand, then exits into the liquidity peak, leaving new buyers holding rapidly falling bags. - Yield Farm That Vanishes

The project promises very high yields in its own token or a synthetic asset. Once enough value is locked, the developers exploit a backdoor or governance control to seize user funds. - Hybrid Social Engineering Scams

Criminals impersonate legitimate projects, exchanges or even regulators, tricking victims into moving funds into “verification” wallets that are then emptied.

Once you have seen these patterns a few times, they become easier to recognise, even when wrapped in new branding.

How To Avoid Rug Pulls When Rotating Out Of Bitcoin

For many people the journey starts with Bitcoin. The danger comes when you recycle those gains into highly speculative altcoins without adjusting your risk controls.

A few practical rules:

- Treat speculative tokens as a separate pot from your long term Bitcoin holdings. Decide upfront how much you can afford to lose in that pot.

- Do not assume that a token is safe because a friend, influencer or community chat recommends it. Run your own five step checklist every time.

- Favour projects where you understand the value proposition and the role of the token, rather than chasing every trending ticker.

- Prefer gradual position building over one large buy. Small initial amounts give you time to test liquidity, slippage and contract behaviour.

Think of rug pull defence as part of protecting your Bitcoin. The less you leak through scams and rushed decisions, the more of your long term capital stays in the market for the next cycle.

A Simple Workflow Before You Buy Any New Token

Here is a quick routine you can follow each time you consider a new coin:

- Read the website and documentation once, without any money involved. Note anything you do not understand.

- Check holder distribution and liquidity in a block explorer and at least one independent dashboard if available.

- Run a contract scan and honeypot check, and read the summary carefully.

- Look at trading history over several days, not just the last hour.

- Pause before committing. If the trade only feels attractive when you are rushing, it is probably not worth it.

If you want a more technical workflow covering honeypots, tax functions and deeper smart contract logic, you can pair this Basics guide with a more advanced rug pulls and honeypots article and the broader guide on top crypto scams.

Mini FAQs

How Do I Know If A Coin Is A Rug Pull?

You can never be completely certain, but you can stack the odds in your favour. Look for concentrated ownership, unlocked liquidity, opaque or unaudited contracts, hype driven marketing and unrealistic promises. Use scanners and block explorers to cross check what the team claims.

What Is A Rug Pull In Crypto And How Does It Happen?

A rug pull is when a project’s creators suddenly remove liquidity or use hidden code to seize user funds, after attracting investment through a token sale, DeFi pool or yield farm. It usually involves draining a liquidity pool or abusing special permissions coded into the smart contract.

Can Bitcoin Itself Be A Rug Pull?

Bitcoin does not fit the standard rug pull pattern. It has a transparent, open source protocol, a long history, and no central team that can suddenly drain a liquidity pool or change core rules for personal gain. However, scams can still be built around fake Bitcoin investment schemes that misuse the name.

How Do I Avoid DeFi Rug Pulls Altogether?

The strictest option is to avoid unaudited, unauthorised DeFi projects completely and use only well known platforms with a strong security record. If you do want exposure to newer protocols, start with very small amounts, use all the checks outlined in this guide, and follow reputable security researchers and regulators for new warnings.

If This Helped You Protect Your Bitcoin And Altcoins

This guide is part of the Crypto Basics series on The Markets Unplugged, designed to help you navigate crypto without drowning in jargon.

If you want deeper support on when to take risk, when to step back and how to plan entries before the crowd moves, consider joining Alpha Insider.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports

If you are serious about staying in the game long enough to benefit from the next cycle, combining solid scam defences with structured timing and clear levels can make a meaningful difference. This is not noise... it is the full playbook.

Discussion