Key Points

- MVRV Ratio compares Bitcoin’s Market Cap to its Realised Cap… a simple way to see how far price is trading above or below aggregate cost basis.

- Market Cap reflects today’s price. Realised Cap prices each coin at the last time it moved on-chain, then sums that across the network.

- When MVRV rises, price is stretching ahead of cost basis. When it falls, price is compressing back toward what the network paid.

- MVRV is most useful for cycle context and risk framing… not for calling exact tops or bottoms.

- The cleanest reads come from trends and regimes, not single-day spikes… weekly views are usually enough.

- MVRV works best with confirmation from behaviour and flows, especially SOPR, realised profit and loss, realised price bands, and spending-age tools like CDD or dormancy.

- This guide is part of the Bitcoin on-chain series. For the full library of indicators and explainers, see the Bitcoin on-chain indicators hub.

- If any terms feel unfamiliar, use the Crypto Glossary, then return here.

Quick Answer

MVRV Ratio measures how expensive Bitcoin is relative to the network’s realised cost basis, by dividing Market Cap by Realised Cap. Values near 1.0 imply price is close to aggregate cost basis. Higher values imply a growing premium, which can raise mean-reversion risk if spending and flows confirm distribution. Lower values imply a compressed premium, which has often aligned with better long-horizon risk-reward when selling pressure fades. Use it as a valuation context layer, then confirm with behaviour indicators before forming a view.

What Is the MVRV Ratio?

The MVRV Ratio compares Bitcoin’s market value with its realised value. Market value is price multiplied by circulating supply. Realised value prices each coin at the last time it moved on-chain and sums that cost basis across the network. MVRV = Market Cap ÷ Realised Cap.

When MVRV rises, price is moving ahead of aggregate cost basis. When it falls, price is converging back toward what holders paid.

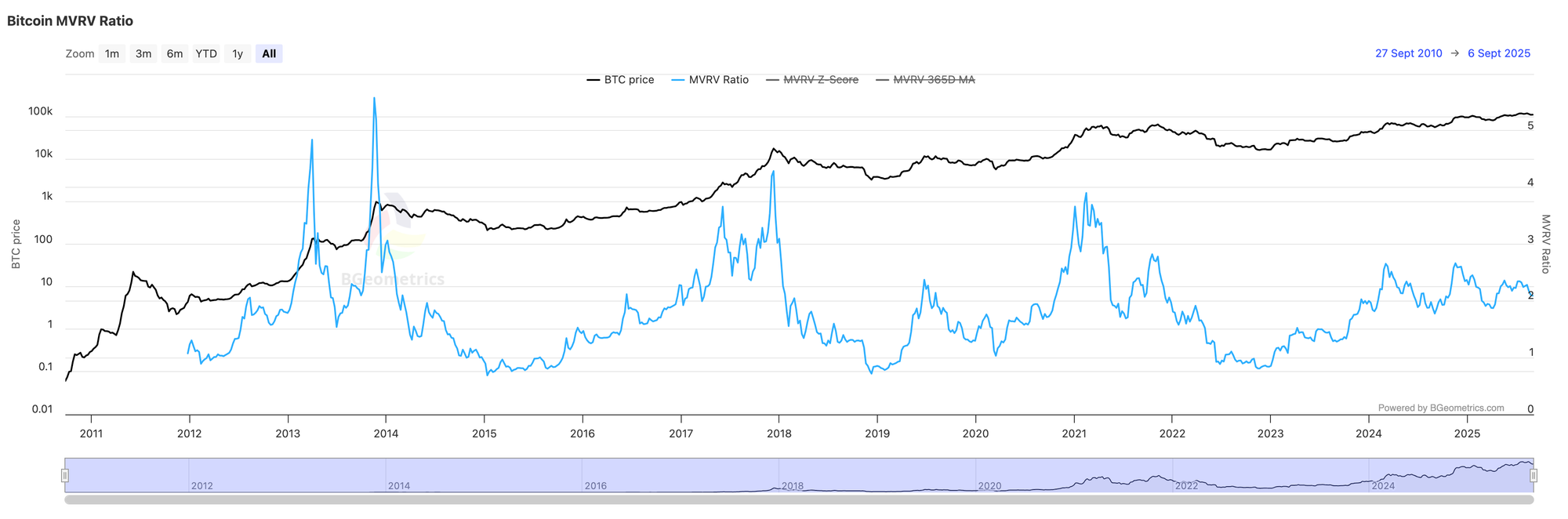

This chart shows the MVRV Ratio across cycles and helps contextualise typical risk zones.

How Is MVRV Calculated?

- Market cap = current BTC price × circulating supply.

- Realised cap = sum of each coin’s last transacted price × coin amount.

- MVRV Ratio = Market cap ÷ Realised cap.

This produces a dimensionless number. Values near 1.0 imply price close to the network’s average cost basis. Higher values imply a growing premium over that base.

Why MVRV Matters

- Valuation anchor across cycles.

- Separates fast price moves from slower shifts in realised value.

- Frames risk. Extreme premiums raise mean-reversion risk. Depressed premiums often align with value zones.

Typical Ranges and Risk Bands

Use these as guides, not triggers, and pair them with other evidence:

- ≤ 1.0: price at or below aggregate cost basis.

- 1.0–2.0: constructive expansion with manageable premium.

- 2.0–3.5: elevated premium. Monitor confluence.

- ≥ 3.5–5.0: historically late-phase risk in strong cycles.

This chart normalises the gap between market and realised values to highlight statistical extremes.

Useful Variations You’ll See

- MVRV Z-Score normalises the gap between market and realised caps by the standard deviation of market cap to highlight statistical extremes.

- STH vs LTH profitability lenses show which cohort bears distribution pressure.

- Percentile or banded views place today’s reading within historical ranges.

How To Use MVRV In Practice

Build confluence, not single-indicator calls

Combine MVRV with realised price bands (Market, LTH, STH), SOPR, dormancy or CDD, and supply metrics. Aim for alignment across valuation, spending behaviour, and supply rotation.

Focus on the trend in premium

A rising MVRV that remains within mid-cycle zones often accompanies healthy advances. Sharp spikes into extreme zones that reverse quickly are a warning.

Watch for divergences

Higher highs in price while MVRV rolls over can hint at weakening realised value support. The opposite can flag quiet accumulation beneath price.

Match timeframe to intent

Daily MVRV can be noisy. For position trades, use weekly or monthly aggregates and check distance from realised price bands.

Respect regime shifts

As liquidity and participant mix evolve, historical extremes migrate. Prefer percentiles over fixed cut-offs when conditions change.

Common Pitfalls

- Treating any threshold as absolute.

- Ignoring the trend in realised cap. A steady rise can sustain premium longer.

- Skipping cohort context. STH euphoria differs from LTH distribution.

A Simple Workflow You Can Reuse

- Open MVRV on a weekly chart.

- Reference MVRV Z-Score for statistical context.

- Compare with Market, LTH, and STH realised price bands.

- Cross-check SOPR to see if profits are being taken or held.

- Scan dormancy or CDD for old-coin movement.

- Decide: sustained premium with support, or stretched premium with distribution risk.

Mini FAQs

What does MVRV mean in simple terms?

It shows whether Bitcoin is trading at a premium or discount to the network’s realised cost basis.

Is MVRV the same as MVRV Z-Score?

No. MVRV is the raw ratio. Z-Score normalises the Market Cap vs Realised Cap gap to highlight statistically unusual extremes.

Does a high MVRV always mean a top is near?

No. Premium can persist while realised cap rises. Risk increases when MVRV is elevated and other indicators confirm distribution.

What should be used to confirm MVRV signals?

SOPR or realised profit and loss for behaviour, realised price bands for cost basis context, and exchange netflows or spending-age tools for distribution pressure.

Why can MVRV stay high for longer in some cycles?

If demand is persistent and realised cap keeps climbing, the network can sustain a higher premium for longer than people expect.

What timeframe is best for MVRV reads?

Weekly for cycle context. Daily is noisier and often does not change the regime read.

If this helped you read valuation without guesswork, Alpha Insider members can access deeper Bitcoin on-chain analysis and commentary here.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in clear, simple terms

➡️ A private Telegram community where conviction is shared daily

A steadier view… one week at a time.

Legal And Risk Notice

This content is for education only and does not constitute financial advice. Crypto assets are volatile and you can lose money. Always do your own research and consider your risk tolerance.

Discussion