Key Points

- NUPL (Net Unrealised Profit/Loss) estimates whether the Bitcoin network is sitting in net unrealised profit or net unrealised loss.

- It does this by comparing today’s market value to the prices coins last moved on-chain… a proxy for aggregate cost basis positioning.

- Rising NUPL usually means more supply is in profit, which can support trend continuation until profit-taking pressure becomes dominant.

- Falling NUPL usually means profit is shrinking or losses are spreading, which often aligns with stress phases and slower recovery conditions.

- NUPL is most useful as a cycle regime gauge… focus on zone transitions and persistence, not one-off prints.

- Use NUPL with confluence, pair it with realised price bands for cost basis, SOPR or realised profit and loss for behaviour, and dormancy or CDD for spending age.

- This guide is part of the Bitcoin on-chain series. For the full library of indicators and explainers, see the Bitcoin on-chain indicators hub.

- If any terms feel unfamiliar, use the Crypto Glossary, then return here.

Quick Answer

NUPL measures how much of Bitcoin’s circulating supply is sitting in unrealised profit versus unrealised loss, based on the last-moved price of coins on-chain. Higher readings mean more holders are in profit, which can support advances but also raises late-cycle distribution risk if selling behaviour confirms. Lower readings mean profit is scarce or losses dominate, which often aligns with stress regimes and the early stages of recovery. Use NUPL as a regime filter, then confirm with cost basis and spending behaviour before forming a view.

What Is NUPL?

NUPL estimates the net unrealised profit or loss of the circulating supply by comparing the market value of coins with the price at which they last moved on-chain. Positive values indicate the network holds net unrealised profit; negative values indicate net unrealised loss.

How Is NUPL Calculated?

- Unrealised Profit = coins currently priced above their last move price.

- Unrealised Loss = coins currently priced below their last move price.

- NUPL = (Unrealised Profit − Unrealised Loss) ÷ Market Cap.

NUPL is dimensionless and typically presented as a value between −1 and +1.

Why NUPL Matters

- Captures crowd positioning: how much of supply sits in profit versus loss.

- Frames emotional regimes during cycles without relying on headlines.

- Complements valuation tools by showing holder positioning beneath price.

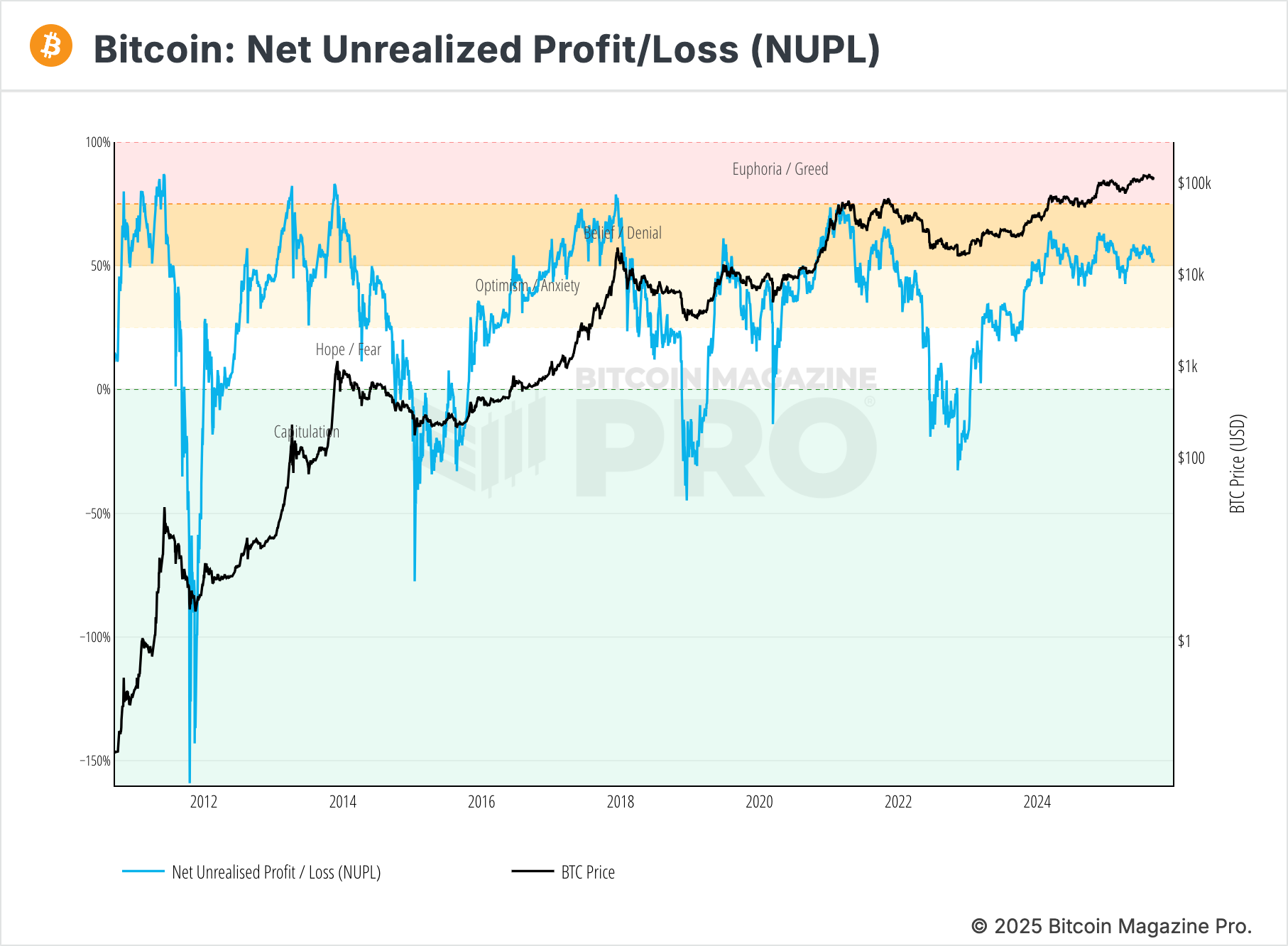

Interpreting the NUPL Zones

Conventions vary, but these zones are commonly used:

- < 0.0: capitulation and deep stress.

- 0.0–0.25: disbelief to hope; early recoveries.

- 0.25–0.5: optimism to belief; broad participation rises.

- 0.5–0.75: euphoria risk builds; distribution becomes more likely.

- > 0.75: late-cycle risk historically.

This chart displays NUPL with colour-coded zones to highlight cycle phases and turning areas.

Practical Reads

- Zone transitions: sustained moves from < 0.25 into 0.25–0.5 often signal healthier advances; sharp jumps into > 0.5 demand caution and confluence.

- Retests: pullbacks that hold within a lower zone can offer continuation; slipping zones warns of fading participation.

- Divergences: price making higher highs while NUPL stalls can hint at thinning participation; rising NUPL while price ranges can indicate quiet accumulation.

Use NUPL With Confluence

Pair NUPL with:

- Realised Price Bands (Market/LTH/STH): confirm whether participation is supported by rising cost basis.

- SOPR / Realised PnL: check if profits are being taken or absorbed.

- Dormancy/CDD: see whether older coins are driving the shift.

Common Pitfalls

- Treating a single zone as a trigger; zones migrate as liquidity evolves.

- Ignoring timeframe; weekly aggregates reduce noise versus daily flips.

- Reading NUPL in isolation without checking spending behaviour and cost-basis ladders.

A Simple Workflow You Can Reuse

- Open NUPL on a weekly chart; note the current zone and direction.

- Cross-check Market/LTH/STH Realised Price.

- Confirm with aSOPR and Realised PnL for behaviour.

- Scan Dormancy/CDD to see if older supply is participating.

- Decide: advancing participation with support, or euphoria risk with distribution.

Mini FAQs

What does NUPL tell you in simple terms?

It shows whether the network is sitting in net unrealised profit or net unrealised loss… a quick read on how comfortable holders are beneath price.

Is high NUPL always bearish?

No. High NUPL can persist during strong advances. Risk rises when NUPL is elevated and profit-taking behaviour confirms distribution.

What is the difference between NUPL and MVRV?

MVRV compares Market Cap to Realised Cap as a valuation premium. NUPL focuses on how much supply is in profit versus loss, which is more about holder positioning.

What is the difference between NUPL and SOPR?

NUPL is about unrealised positioning. SOPR is about realised outcomes when coins are actually spent, whether holders are locking in profit or loss.

Which timeframe is best for NUPL reads?

Weekly is usually enough for cycle context. Daily reads can be noisy and often do not change the regime picture.

What should NUPL be combined with for confirmation?

Use realised price bands for cost basis context, SOPR or realised profit and loss for behaviour, and dormancy or CDD to check whether older supply is participating.

If this helped you map cycle phases with more confidence, Alpha Insider members can access deeper Bitcoin on-chain analysis and commentary here.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in clear, simple terms

➡️ A private Telegram community where conviction is shared daily

Built for a calmer read of the cycle… updated week to week.

Legal And Risk Notice

This content is for education only and does not constitute financial advice. Crypto assets are volatile and you can lose money. Always do your own research and consider your risk tolerance.

Discussion