What Is PCE… and how does it differ from CPI?

- PCE (Personal Consumption Expenditures price index) tracks the prices of what people consume, built from business surveys and national accounts.

- It’s chain-weighted, so the basket adjusts as consumers substitute between items… fewer distortions.

- CPI is a fixed basket of out-of-pocket prices for urban consumers.

- The Fed’s 2% target is framed on PCE, not CPI.

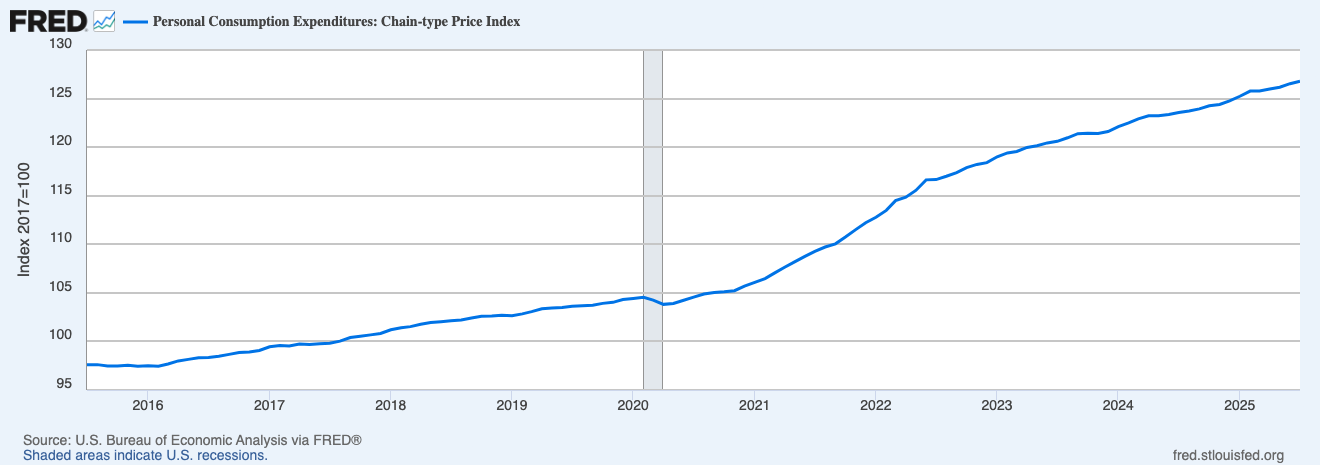

A clean look at the post-pandemic surge, the 2022 peak in momentum, and the slower step-down since.

How PCE Is Built (and why policy prefers it)

- Broader coverage: includes what’s paid for households (employer insurance, Medicare).

- Re-weighting: chain weights reflect real-time substitution… less chance of a stale basket driving the story.

- Services tilt: healthcare and services carry more weight versus CPI, which matters for a labour-heavy economy.

- Revisions: monthly updates align with the national accounts; the Fed likes the sturdier backbone for policy work.

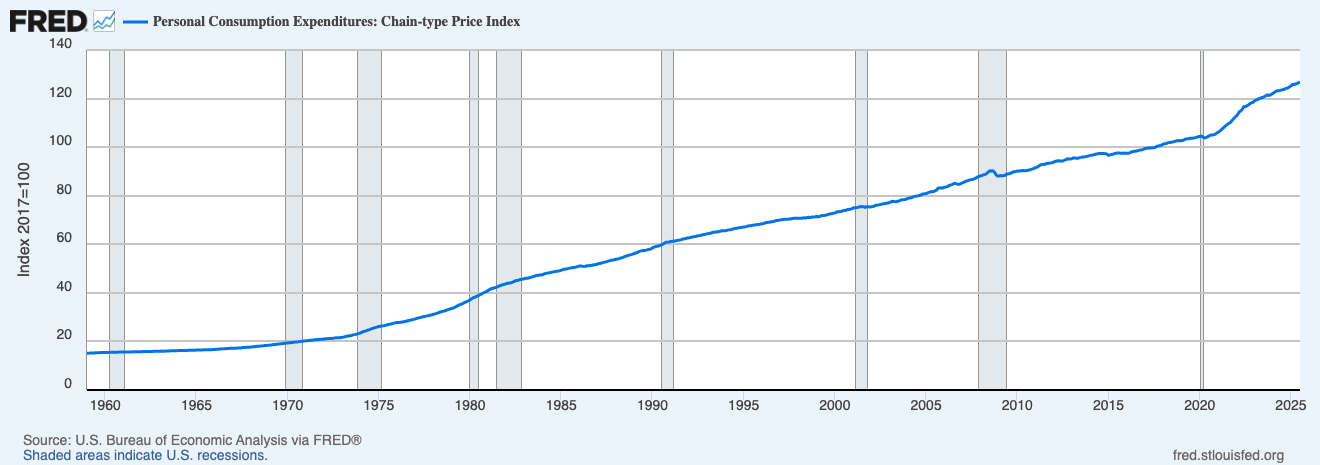

Long history shows how rare true disinflationary episodes are, and how recessions (grey bands) interact with inflation momentum.

Headline vs Core PCE… which one cuts through?

- Headline PCE includes food and energy.

- Core PCE strips them out to show underlying trend.

- Traders game the headline print, but policy leans on core. If the two disagree, watch the 3-month annualised core to judge momentum.

Reading a PCE Release… step by step

- MoM and Core MoM first… then YoY. Momentum tells the truth.

- 3-month annualised… cooling, flat, or re-accelerating.

- Goods vs services… goods disinflate fast; services move with wages.

- Super-core services ex-shelter if you want the labour-sensitive pulse.

- Cross-check CPI vs PCE… if CPI ran hot but PCE didn’t, the Fed tone usually follows PCE.

Watch-outs

- Base effects: YoY can look “better” just because last year’s comp was high… always check the 3-month run rate.

- Shelter lag: even in PCE, housing services cool slowly; don’t overreact to a sticky month.

- Single-print traps: one surprise doesn’t make a regime… look for two or three consistent prints.

- Basket differences: CPI and PCE can diverge for months due to weights… price action gets choppy when they do.

A Quick Pre-/Post-Print Workflow

Before the print

- Note consensus for headline/core; map scenarios for DXY, 10-year yields, BTC.

After the print

- Read MoM + 3-month annualised… then YoY.

- Split goods vs services, glance at super-core.

- Update the policy lens: does this shift cut odds or timing on the next move.

Mini FAQs

Why does the Fed target PCE instead of CPI?

Broader coverage, chain weights, and better services/healthcare treatment give a cleaner policy anchor.

Is core always more important?

For trend, yes. Headline shocks still swing markets on release day, but policy reaction follows core momentum.

Can PCE fall while CPI rises?

Yes… different weights and sources. When they diverge, expect messy rates pricing until the next round.

If this helped you read inflation without noise, join Alpha Insider for Macro Heat dashboards, calendar previews for the next prints, and a weekly positioning watchlist. Fewer mistakes, cleaner execution, more conviction.

The Markets Unplugged members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports (inflation, yields, liquidity, dollar)

It’s the full playbook.

Discussion