What Are RRP And Bank Reserves?

- RRP is the Fed’s overnight reverse repo facility… money funds park cash against Treasuries and earn the RRP rate.

- Bank reserves are deposits that banks hold at the Fed… the raw fuel for settlement and interbank liquidity.

Cash can slosh between RRP, bank reserves, and the Treasury General Account (TGA) depending on bill issuance, policy, and money-market incentives.

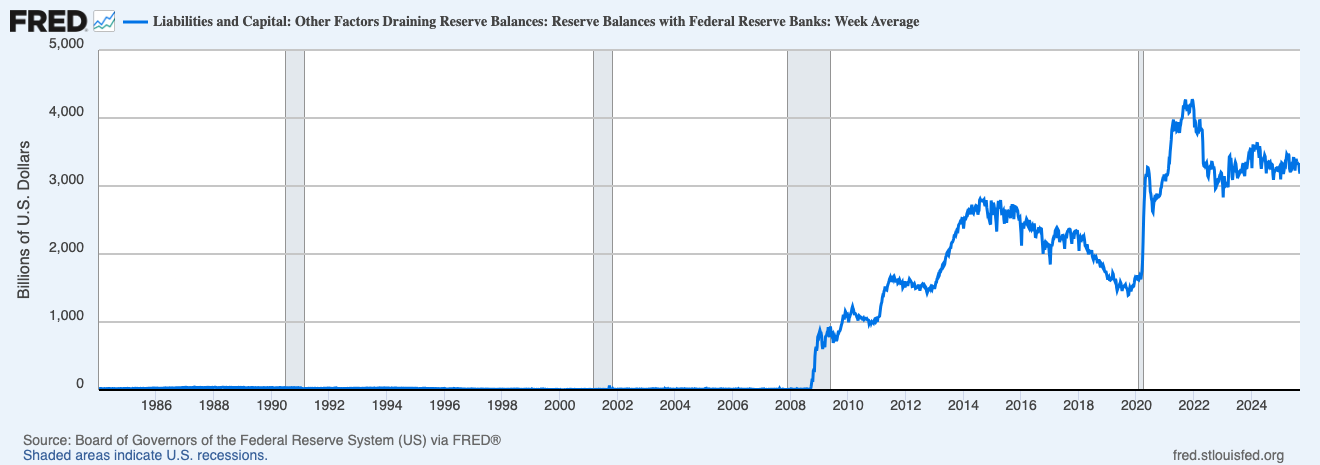

This long history shows the post-GFC step-change, the QE/QT waves, and today’s still-ample reserve regime compared with pre-2008.

Why This Pair Drives Liquidity

- When RRP drains and reserves rise, cash is leaving the parking lot and re-entering the banking system… market-friendly.

- When RRP builds or reserves fall, conditions tighten… higher front-end yields soak up cash.

- Issuance mix matters… more T-bills can pull cash out of RRP, while heavy coupon supply can lift long yields and offset some of the relief.

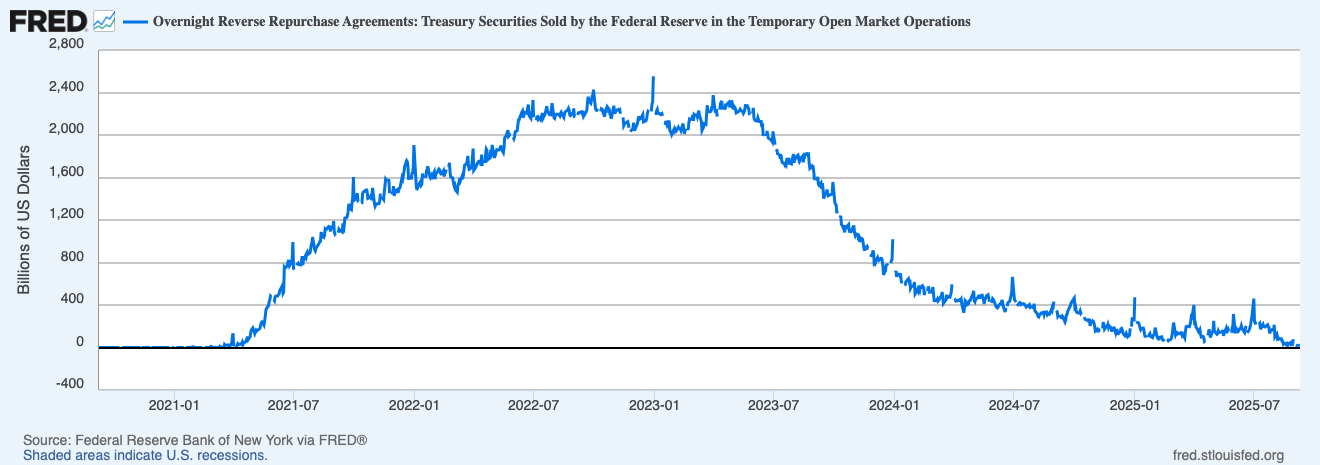

This chart shows the surge during the hiking cycle and the step-down as bills and rate cuts pulled cash out of the facility.

Reading Both Together

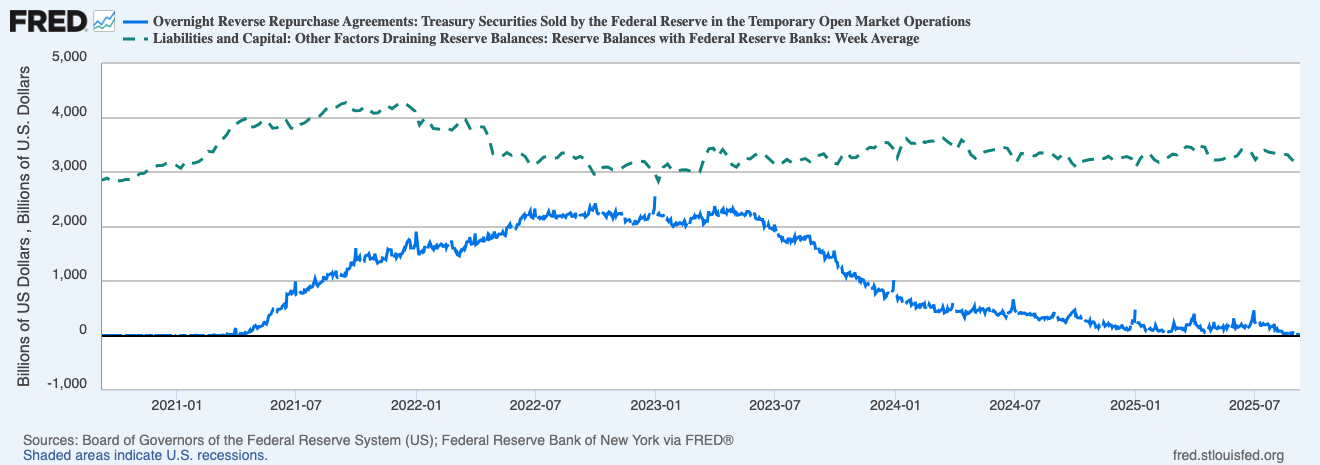

This overlay makes the trade-off clear… RRP down with reserves steady to higher is liquidity easing; RRP sticky with soft reserves is a headwind.

Practical Reads

- RRP grinding toward zero with firm reserves… easier backdrop for beta, friendlier for basis trades and market-making.

- Reserves slipping while RRP stays low… watch TGA rebuilds and QT pace; risk can feel light-air days.

- Fast RRP drops around bill waves… short squeezes in funding can pop, but check if reserves actually rise before calling it a regime shift.

- SOFR vs EFFR… small gaps or month-end bumps are plumbing noise; persistent gaps flag stress.

Watch-outs

- Month-end and quarter-end… balance-sheet windows can nudge SOFR and RRP temporarily.

- Debt-ceiling and TGA rebuilds… Treasury cash calls can drain reserves even as RRP sits quiet.

- ON RRP rate changes… tweak the incentive for money funds… watch the facility the day after FOMC.

- Optics vs effect… a low RRP is good, but if reserves aren’t rising, the system may still feel tight.

A Simple Workflow You Can Reuse

- Open RRP and Reserves… direction and persistence first.

- Check TGA (WTREGEN) and Fed balance sheet (WALCL) to size the impulse.

- Cross-check SOFR, DXY, and 10-year real yields… is easier funding reaching the tape.

- For crypto… compare perp funding and basis to cash yields… if carry doesn’t clear the hurdle, size down.

- Into big issuance weeks… expect bumps, keep risk tight, reassess after settlement.

Mini FAQs

Can liquidity improve during a policy pause.

Yes… if RRP drains and reserves rise, conditions can ease even with a flat policy rate.

Why does RRP exist at all.

It gives money funds a safe overnight home, setting a floor under front-end rates and helping the Fed control policy transmission.

Is a low RRP always bullish.

It helps, but you want rising reserves with it… that’s the cleaner tell for easier conditions.

If this helped you read the quiet liquidity dials properly, join Alpha Insider for Macro Heat dashboards, calendar previews for key prints, and a weekly positioning watchlist. Fewer mistakes, cleaner execution, more conviction.

The Markets Unplugged members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports

Sorted… now execute.

Discussion