Key Points

- BBB OAS is the option-adjusted spread of BBB-rated corporate bonds over Treasuries, it is the “borderline” part of credit.

- BBB spreads can provide an earlier, cleaner tightening signal than high yield, because they move with less noise.

- The trend and persistence matter more than any one-day spike, use the weekly lens.

- Pair BBB OAS with DXY and 10-year real yields to confirm whether conditions are tightening or easing.

- If you want quick definitions for terms used here, see the Crypto Glossary.

- For more macro dials like this, use the Macro For Beginners hub.

Quick Answer

The BBB spread (BBB OAS) measures how much extra yield investors demand to own BBB-rated corporate debt versus US Treasuries, after adjusting for bond options. Because BBB sits right above junk status, a sustained widening often signals rising downgrade and refinancing risk, plus tighter financial conditions. A sustained tightening usually signals easier conditions and improving risk appetite.

BBB OAS matters because it is the credit “hinge” between safe and stressed. When BBB spreads widen and stay wide, financing gets pricier, downgrade risk rises, and liquidity can thin. When BBB spreads tighten and stay tight, conditions are easing and risk appetite tends to improve. For a cleaner read, track BBB OAS alongside high-yield OAS, then confirm with the dollar (DXY) and 10-year real yields.

What Is The BBB Spread?

BBB OAS is the option-adjusted spread of BBB-rated corporate bonds over Treasuries.

- BBB OAS: the extra yield BBB corporates pay versus Treasuries, adjusted for embedded options.

- Why it matters: BBB is the last rung of investment grade, so it is where downgrade risk starts to bite.

- What widening implies: investors demand more compensation for downgrade and default risk, refinancing gets more expensive.

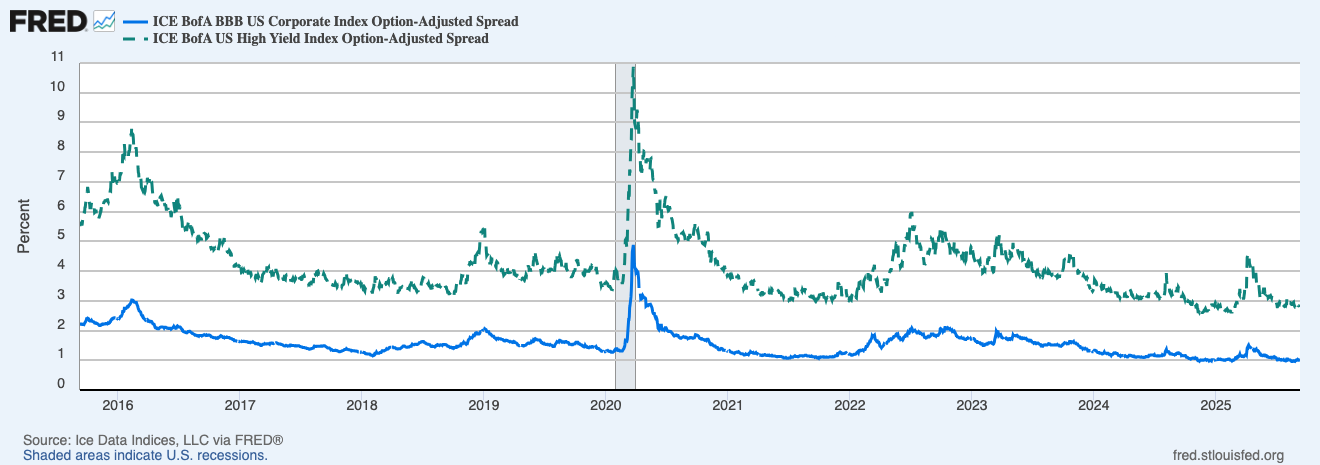

This chart shows how BBB spreads behave across regimes, calm periods tend to sit lower, risk phases lift and persist, crisis spikes jump sharply. Focus on slope and follow-through, not the single print.

Why The BBB Line Matters

- Downgrade Spiral Risk: many funds cannot hold sub-investment-grade debt, so downgrades can trigger forced selling and thinner liquidity.

- Financing Channel: BBB is a workhorse tier for corporate borrowing, wider spreads raise coupons at rollover, which can pressure capex, hiring, and buybacks.

- Macro Tell: BBB often responds to real yields, dollar strength, and bank lending standards with less noise than high yield, it can flag tightening earlier.

High yield swings harder when panic hits, BBB often turns earlier when conditions quietly tighten. The overlay helps you see whether stress is isolated or becoming broad.

Practical Thresholds

Use these as guide rails, not gospel.

- 100 to 150 bps: easier conditions, refinancing tends to flow, carry tends to work.

- 160 to 200 bps with persistence: tightening under the hood, risk tolerance often falls.

- Above 220 to 250 bps and rising: downgrade risk rising, tighter conditions tend to spill into risk assets.

- The main rule: prioritise direction and persistence over a single reading.

How To Read Moves In Context

- BBB Up While High Yield Flat: quiet tightening, equities and crypto can lag the credit signal.

- BBB Up With High Yield Up: broader de-risking, conditions tightening across quality tiers.

- BBB Steady While High Yield Falls: improving risk tone, stress is easing at the margin.

- Energy Noise: oil spikes can widen high-yield energy without a system shift, BBB can help filter that.

Watch Outs

- Month-End Effects: index changes and large new issuance can nudge spreads for a session.

- Post FOMC Whipsaws: spreads can snap and fade, look for follow-through over the next couple of sessions.

- Single-Name Headlines: ETF headlines distort sentiment, the index trend is your anchor.

A Simple Workflow You Can Reuse

- Set The Window: keep BBB OAS on a 5 to 10 year view, mark 150, 200, and 250 bps as context lines.

- Add The Overlay: compare BBB OAS with high-yield OAS, check whether the quality gap is widening or compressing.

- Confirm The Macro Mix: cross-check DXY and 10-year real yields, if both tighten alongside BBB, the signal strengthens.

- Translate To Risk Appetite: BBB widening usually aligns with tighter conditions for risk assets, BBB tightening usually aligns with easing conditions.

- Review Weekly: persistence beats headlines.

Mini FAQs

What Does OAS Adjust For?

OAS adjusts for embedded bond options and curve effects, so you get a cleaner risk spread over Treasuries.

Do Levels Or Changes Matter More?

The turn with persistence matters most. Levels help with context, the trend sets the risk tone.

Why Not Just Watch High Yield?

High yield is noisier. BBB often signals broad tightening earlier and with fewer false alarms.

If this helped you read the credit line that actually moves the economy, Alpha Insider is where Macro Heat dials and repeatable workflows get pulled into one playbook.

Alpha Insider members also get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports

Legal And Risk Notice

This content is for educational purposes only and is not financial advice. Markets are volatile and you can lose money. Do your own research and consider your risk tolerance before making financial decisions.

Discussion