Key points

- Binance has moved to a dual leadership model, with co-founder Yi He joining former regulator Richard Teng as co-CEO to pair product vision with regulatory credibility.

- The shift continues Binance’s transition away from the CZ era, aiming to reassure regulators, partners and users that governance, compliance and internal controls are being strengthened.

- For Bitcoin holders, nothing about day-to-day custody changes overnight, but the exchange’s ability to manage regulatory pressure and operational risk now rests on this shared leadership.

- Sensible risk management still means limiting how much Bitcoin you keep on any exchange, using self custody for longer-term holdings and monitoring regulatory moves that affect Binance in your region.

Introduction

Binance has just announced a new dual leadership structure. Co-founder Yi He has been appointed co-CEO alongside Richard Teng, who took over as chief executive after Changpeng Zhao (CZ) stepped down in 2023.

For everyday users the obvious question is simple… what does this change actually mean for Bitcoin and other assets held on the exchange?

This guide walks through who Yi He is, why Binance has made this move now, and the practical implications for anyone keeping Bitcoin on Binance in 2025.

Who Is Yi He?

Yi He is a Chinese business executive and one of Binance’s original co-founders. Before moving into crypto she worked in media, including as a TV travel show host, and later joined the industry via OKCoin.

Key points about her background:

- Helped launch Binance in 2017 alongside CZ and has been part of the senior team since the start.

- Previously served as chief customer service / marketing lead and has overseen user growth, branding and product launches.

- Heads YZi Labs (formerly Binance Labs), the venture arm that invests in blockchain projects.

- Has long described herself as a holder of BNB and a champion of Binance’s user-first culture.

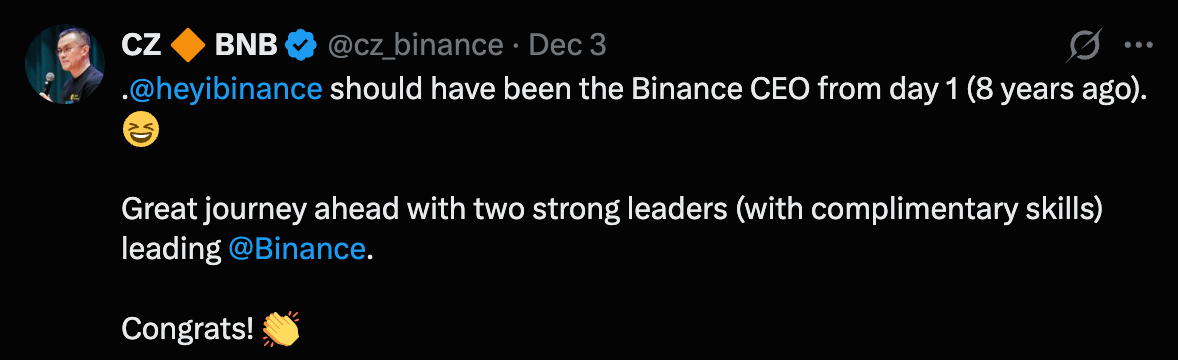

Leadership Update:

— Binance (@binance) December 3, 2025

We are delighted to welcome Binance co-founder @heyibinance into her new role as Co-CEO.

Yi has always played an important role, shaping our culture, driving innovation, and championing a user-first approach across our entire ecosystem.

Her leadership has… pic.twitter.com/CqsuTkb0gc

In other words, Binance has elevated an internal founder figure who has both deep product history and public visibility inside the ecosystem.

How Did Binance Get To A Dual CEO Structure?

To understand this leadership shift it helps to remember the last few years of regulatory pressure on Binance.

Reuters and other outlets have documented how, during the CZ era, Binance grew rapidly while keeping a light footprint with regulators. Investigations highlighted issues such as:

- Weak money-laundering checks and tension between public promises of strong compliance and internal practices.

- Strategies to limit scrutiny from US and UK regulators, including complex corporate structures and at least one backdated document for a UK unit.

- Concerns over commingling of customer funds with company revenue in 2020 and 2021.

By 2023 Binance faced investigations from multiple agencies. CZ ultimately pleaded guilty in the United States to failing to maintain adequate anti-money-laundering controls, agreed to step down as CEO and paid a large fine.

Richard Teng, a former regulator who had joined Binance after leading Abu Dhabi Global Market’s financial services authority, then took over as CEO with a clear brief to strengthen compliance and rebuild relationships with regulators.

The new co-CEO model with Yi He sits on top of this transition.

What Exactly Has Changed At The Top Of Binance?

The current structure looks like this:

- Richard Teng - Co-CEO

Focused on regulation, licensing, global policy engagement and the overall corporate control framework. His background is in traditional financial supervision and exchange regulation. - Yi He - Co-CEO

Focused on user growth, product, branding, customer experience and strategic investments, while remaining a central voice inside the company’s culture.

Binance’s official statements present this as a way to combine regulatory credibility with founder-driven product leadership as the platform pushes toward hundreds of millions of users globally.

For users, the headline is that Binance is no longer run by a single dominant founder. Power is now formally split between a regulatory-focused executive and a long-time founder who knows the product and community.

Why Appoint Yi He As Co-CEO Now?

Several factors likely make this timing attractive for Binance:

- Regulatory reset after the CZ era

Following enforcement actions and the earlier run on Binance triggered by reporting on compliance gaps, the company has been pushing a more transparent image. Elevating Yi He signals continuity of the original vision without placing CZ back at the centre.

- Operational scale and regional expansion

Binance is operating across dozens of jurisdictions, each with their own licensing regimes. Splitting responsibilities between two co-CEOs can help manage both regional growth and complex compliance pipelines. - Investor and partner reassurance

External partners often want to see clear governance. Naming a co-founder with a long track record inside the firm may reassure stakeholders that there is strong internal ownership of long-term strategy, not just a caretaker CEO.

None of this removes past controversies, but it explains why Binance is presenting this as a natural evolution rather than a crisis move.

What Does This Mean For Your Bitcoin On Binance?

The key question for users is not the title on a press release…it is practical risk.

A simplified way to think about it:

- Regulatory risk

Teng’s regulatory background and the company’s public messaging suggest continued focus on licences, KYC and anti-money-laundering controls. If successful, that should reduce the chance of sudden jurisdiction-level bans or extreme enforcement shocks. It does not eliminate the risk, especially in markets where regulators remain sceptical of large offshore exchanges. - Operational and governance risk

Formalising dual leadership can help spread responsibilities and improve decision-making. It may also reduce dependence on any single individual, which is good from a key-person risk perspective. However, users are still exposed to the execution quality of Binance’s internal systems, risk controls and custody arrangements. - User experience and product direction

Yi He’s focus on customer experience and ecosystem growth may translate into more retail-friendly features, educational content and regional campaigns. From a Bitcoin user’s standpoint this is mostly upside, provided security remains prioritised.

From a pure custody perspective nothing material changes overnight: your Bitcoin on Binance remains an exchange liability matched by whatever assets the company holds in its wallets and reserves. Leadership changes are ultimately about the probability of that liability being honoured smoothly in future.

How To Manage Your Own Bitcoin Risk On Binance

Leadership shifts are a useful reminder to review personal risk, not a reason for panic by themselves. A conservative framework might include:

- Limit how much you keep on any exchange

Exchanges are convenient for trading and conversions, not long-term cold storage. Consider keeping only the Bitcoin and other assets you actively use on Binance, with the majority held in self custody. - Use self custody where appropriate

For long-term holdings, a well-secured hardware wallet or other self-custody solution can reduce counterparty risk, provided you are confident with seed phrase management and backups. - Monitor regulatory developments in your region

If your local regulator tightens rules on Binance or similar platforms, that may affect your ability to deposit, withdraw or trade. Staying informed helps you act early rather than react under pressure. - Understand proof-of-reserves and its limits

Where Binance provides proof-of-reserves information, treat it as one piece of evidence, not a guarantee. Always recognise that any centralised platform carries some level of opacity. - Plan for stress scenarios

Think through what you would do if withdrawals were temporarily delayed, if your jurisdiction restricted access, or if you needed to move funds quickly. Having a plan in advance reduces emotional decision-making.

New leadership can improve the odds of robust governance and compliance, but it does not change the basic principle that Bitcoin in self custody behaves differently from Bitcoin held with a third party.

Key Takeaways For Bitcoin Holders

- Binance now operates under a dual leadership structure, with co-founder Yi He and former regulator Richard Teng sharing the CEO role.

- The move continues a multi-year transition away from the CZ era, shaped by regulatory investigations and enforcement actions worldwide.

- For users, the practical impact is mainly about governance, regulatory posture and product direction rather than immediate changes to how Bitcoin is held on the platform.

- Sensible risk management still means avoiding over-reliance on any single exchange, using self custody for long-term holdings and staying alert to regulatory news in your region.

Leadership headlines are important context… but your personal security still starts with how you choose to hold and move your Bitcoin.

If This Helped You…The Markets Unplugged members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

Alpha Insider is currently 25 percent off… members get the full playbook, not just headlines.

Legal & Risk Notice

This article is for educational information only and does not constitute investment, trading, legal or tax advice. Bitcoin and other digital assets are volatile and high risk. Always do your own research, consider your personal circumstances, and, where appropriate, consult a qualified professional before making financial decisions or using any exchange, wallet or platform.

Discussion