Key Points

- HODL Waves show the percentage of Bitcoin supply that last moved within each age band, from very recent to many years old.

- Realised HODL Waves weight those age bands by realised value, which helps you see where capital is concentrated, not just coins.

- RHODL is a rotation lens that compares younger realised bands to older realised bands, which can help frame cycle risk regimes.

- The most useful signal is usually the direction and persistence of shifts in age bands, not one-week spikes.

- These indicators work best as context and confirmation, paired with cost basis and profit and loss indicators such as MVRV, NUPL, SOPR, realised price bands, and realised profit and loss.

- Weekly checks are usually enough for most readers. Daily monitoring can add noise without improving the read.

- This guide is part of the Bitcoin on-chain series. For the full library of indicators and explainers, see the Bitcoin on-chain indicators hub.

- If any terms feel unfamiliar, use the Crypto Glossary, then return here.

Quick Answer

HODL Waves show how long Bitcoin has been held before it last moved on-chain. When younger age bands expand, turnover is rising and newer demand is dominating. When older age bands expand, supply is ageing and spending is muted. Realised HODL Waves add a capital-weighted view, helping you see whether the money is concentrated in younger or older cohorts. RHODL compares younger realised cohorts to older realised cohorts to help frame rotation and cycle risk, then you confirm with behaviour and flow indicators before forming a view.

What HODL Waves Actually Measure

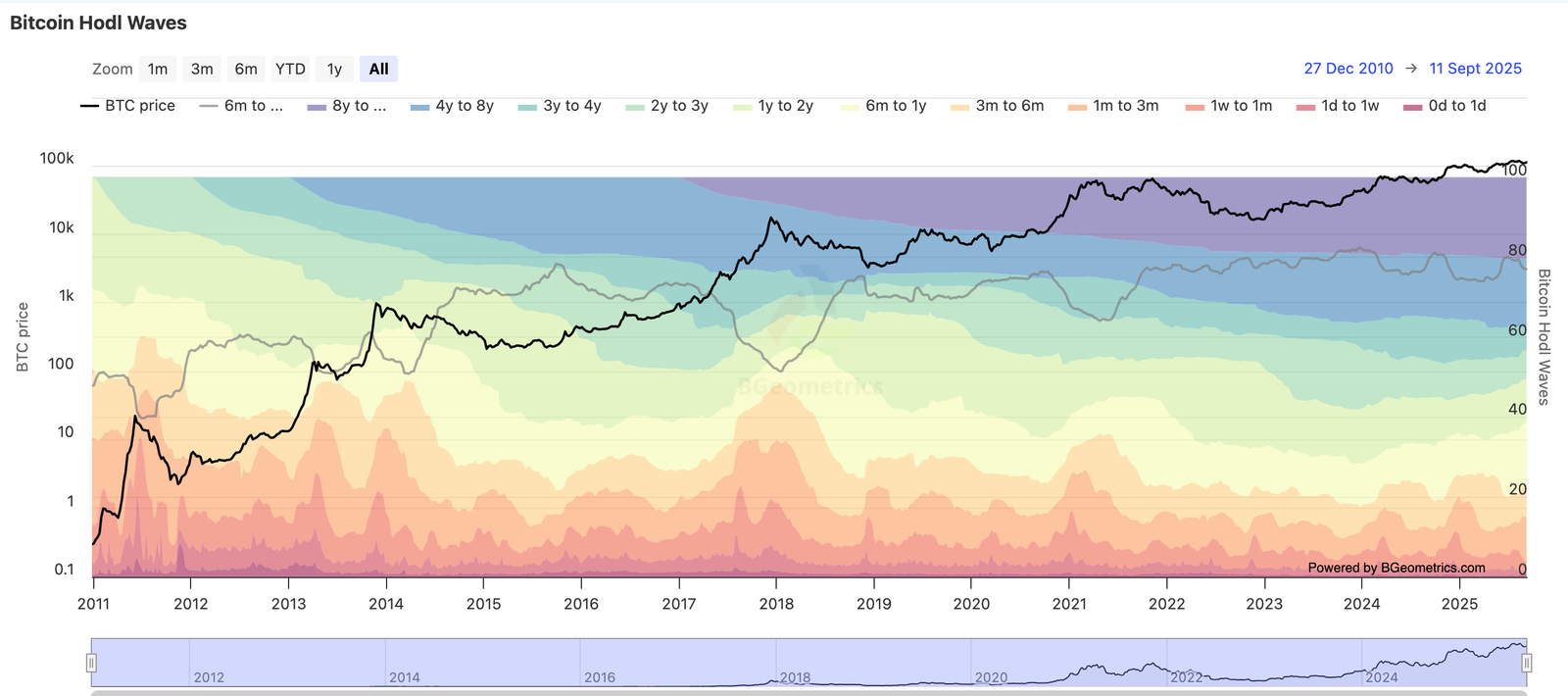

HODL Waves take the full supply of Bitcoin and group it into age bands based on the time since each coin last moved. The output is a stacked view showing what share of supply is held by coins last moved recently versus coins last moved long ago.

This is useful because Bitcoin cycles tend to rotate between two broad states:

- A turnover phase, where coins move more frequently and younger bands expand

- An ageing phase, where spending slows and older bands expand

HODL Waves do not tell you why coins moved, but they do reveal whether the network is behaving like a fast-turnover market or a slow-spending market.

How To Read HODL Waves In Practice

A simple way to read HODL Waves is to track the balance between younger bands and older bands over time.

Look for these types of shifts:

- Younger bands expanding for a sustained period often suggests rising turnover and stronger participation from newer holders.

- Older bands expanding for a sustained period often suggests supply ageing and reduced spending pressure.

- Sudden spikes in very young bands can happen during high activity periods, but the more meaningful read is whether those spikes persist and broaden.

The key is to treat HODL Waves as a behaviour backdrop. You then pair it with profit and loss indicators to see whether turnover is profit-taking, capitulation, or neutral churn.

This chart shows the share of Bitcoin supply held in each age band. Rising younger bands suggest faster turnover, while rising older bands suggest supply ageing and lower spending.

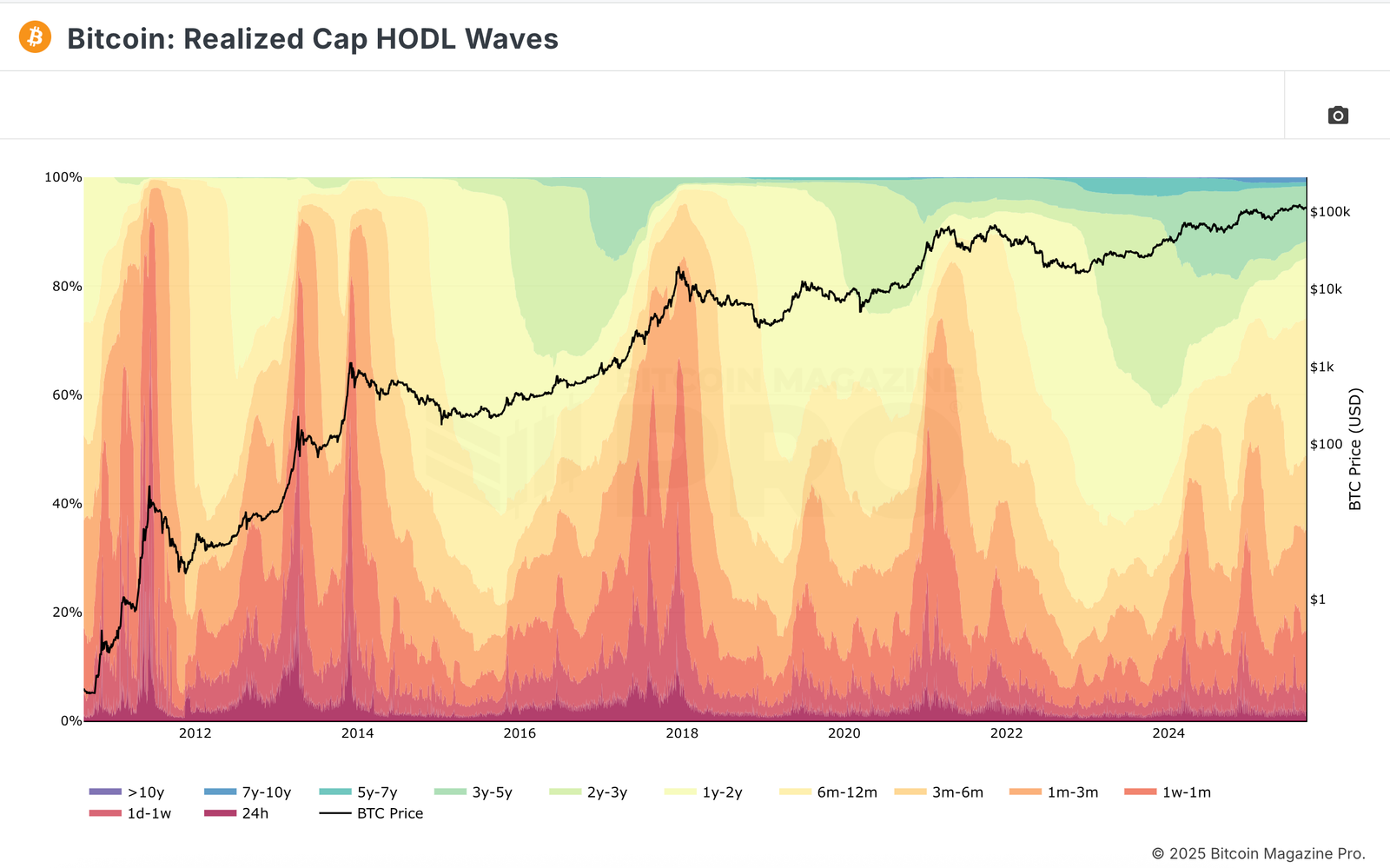

What Realised HODL Waves Add

Classic HODL Waves treat all coins equally, regardless of the price they last moved at. Realised HODL Waves weight each age band by realised value instead, which shifts the question from:

What share of coins sits in each band

to

What share of realised capital sits in each band

This matters because a small amount of supply can represent a large amount of capital if it last moved at higher prices. Realised HODL Waves are therefore a stronger capital-weighted view of cohort pressure.

A practical way to use this is to compare HODL Waves and Realised HODL Waves side by side:

- If younger bands expand in both, turnover is rising in both coin share and capital weight.

- If younger bands expand mainly in realised terms, it can suggest that newer capital has more weight than the raw supply share implies.

- If older bands hold steady or rise in realised terms, it can suggest that older capital remains anchored despite price movement.

This chart weights each age band by realised value, helping you see whether capital is concentrated in newer or older cohorts rather than only coin share.

What RHODL Means And When It Helps

RHODL is a ratio concept that compares younger realised age bands against older realised age bands. The purpose is not to predict price. The purpose is to highlight when capital is rotating heavily into younger cohorts versus when older cohorts dominate.

A clean way to use RHODL is as a confirmation layer:

- If other indicators suggest late-cycle conditions, a strong shift towards younger realised cohorts can support the idea that the market is becoming more turnover-driven.

- If other indicators suggest recovery conditions, a muted RHODL read can support the idea that turnover is still limited and ageing supply remains dominant.

RHODL works best when you do not read it in isolation. Confirm it with profit and loss behaviour, cost basis, and flow data.

A Simple Weekly Workflow

Use this checklist once per week:

- Check HODL Waves for broad ageing versus turnover changes.

- Check Realised HODL Waves to see whether capital weight matches the supply share read.

- Confirm with one cost basis tool, such as MVRV, NUPL, or realised price bands.

- Confirm with one behaviour tool, such as SOPR or realised profit and loss, to see whether spending pressure is actually rising.

This keeps the read consistent and avoids chasing daily fluctuations.

Common Traps To Avoid

- Treating one-week changes as a signal. These indicators work best as regime context and persistence tools.

- Assuming all old coin movement is distribution. Old coins can move for many reasons, so confirm with realised profit behaviour and flows.

- Ignoring cost basis. Age-band rotation is more meaningful when you know whether the market is spending above or below cost basis zones.

- Using HODL Waves as a standalone timing tool. They are strongest when used as part of a multi-indicator read.

Members On Chain Analysis

This public guide explains what HODL Waves, Realised HODL Waves, and RHODL are and how to read them.

Members on-chain analysis is the application layer, where multiple indicators are combined into one weekly view so signals are not interpreted in isolation.

Members can access the Bitcoin on-chain analysis feed here.

Mini FAQs

What are Bitcoin HODL Waves?

They show what percentage of Bitcoin supply last moved within each age band, helping you track whether supply is ageing or turning over.

What is the difference between HODL Waves and Realised HODL Waves?

HODL Waves measure coin share by age. Realised HODL Waves weight age bands by realised value, showing where capital is concentrated.

What does RHODL mean?

It is a ratio lens comparing younger realised cohorts to older realised cohorts, used to track rotation and regime context.

Do HODL Waves predict tops and bottoms?

No. They provide behaviour context. You still need confirmation from cost basis, profit and loss behaviour, and flows.

How often should these be checked?

Weekly is usually enough. Daily checks often add noise without improving the regime read.

What should be used for confirmation?

Pair with cost basis tools such as MVRV, NUPL, or realised price bands, then confirm behaviour using SOPR or realised profit and loss.

If this helped you, Alpha Insider members can access deeper Bitcoin on-chain analysis and commentary here.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in clear, simple terms

➡️ A private Telegram community where conviction is shared daily

A steadier weekly view of on-chain… with the indicators connected, not isolated.

Legal And Risk Notice

This content is for education only and does not constitute financial advice. Crypto assets are volatile and you can lose money. Always do your own research and consider your risk tolerance.

Discussion