Key Points

- HODLer Net Position Change is an on-chain estimate of whether long-term holders are adding to balances or distributing over time.

- Sustained readings above zero often suggest an accumulation regime and a tighter float.

- Sustained readings below zero often suggest distribution that can cap rallies.

- The edge is direction and persistence, not a single print.

- Confirm with venue and behaviour context, especially exchange netflows, spending-age tools (CDD or VDD), and profit and loss behaviour (SOPR or Realised PnL Ratio).

- Weekly checks are usually enough for most readers.

- This guide is part of the Bitcoin on-chain series. For the full library of indicators and explainers, see the Bitcoin on-chain indicators hub.

- If any terms feel unfamiliar, use the Crypto Glossary, then return here.

Quick Answer

HODLer Net Position Change estimates whether long-term holders are accumulating or distributing over a rolling window. Positive values suggest HODLers are adding to balances. Negative values suggest they are distributing. Treat it as behavioural context, then confirm with exchange flows and profit and loss behaviour to avoid reading it in isolation.

What Is HODLer Net Position Change

This metric tracks whether wallets classed as long-term holders are, on net, increasing their balance or reducing it across a rolling window.

- Positive readings mean HODLer balances are growing.

- Negative readings mean HODLers are distributing.

The clean question it answers is simple. Are slow wallets adding, or lightening up.

How It Is Built

Data providers define a HODLer cohort using coin age and spend behaviour. Each day they estimate how the cohort’s aggregate balance changes, typically filtering out miner flows, exchange wallets, and short-term churn.

The output is a smoothed series that helps you judge whether long-term entities are accumulating or distributing over the week.

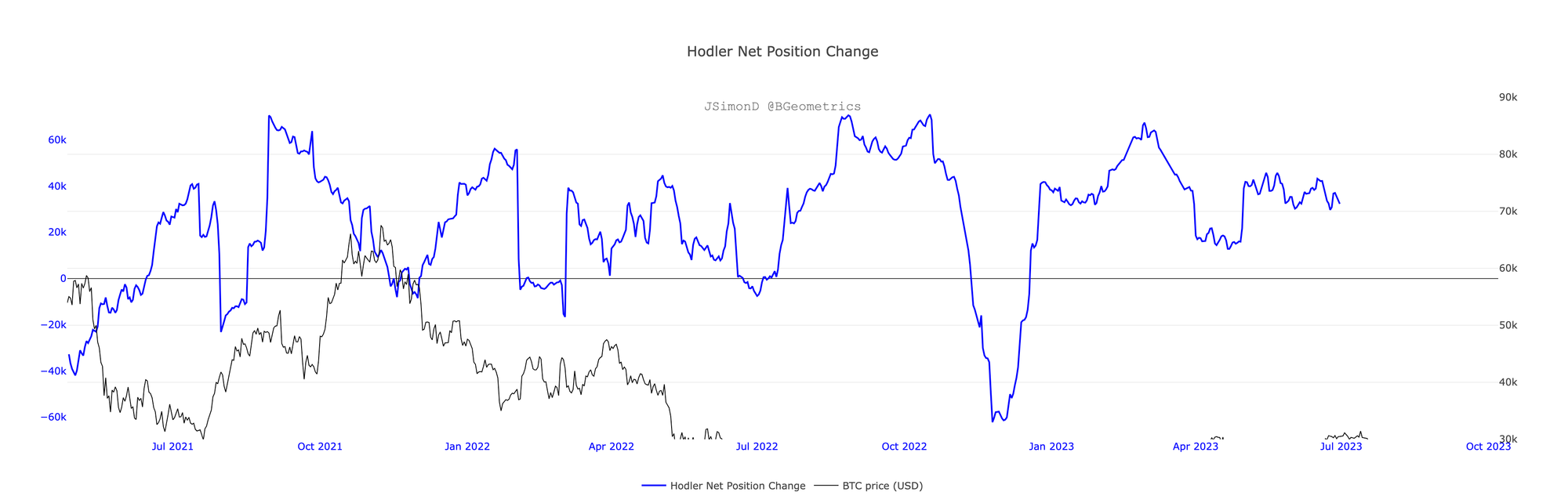

Blue above zero shows net accumulation by HODLers… blue below zero flags net distribution. The longer the stay above or below zero, the more meaningful the regime.

Why It Matters

Long-term wallets influence available float. When they accumulate, less supply tends to sit on venues.

When they distribute into strength, rallies can turn into exit liquidity.

During deep drawdowns, a sustained flip back to positive readings can be an early sign that weak hands have been flushed and longer-term entities are adding again.

Practical Guide Rails

Use these as guide rails, not gospel.

- Sustained above zero for weeks

Often signals an accumulation regime. Pullbacks can be healthier when float is tightening. - Sustained below zero into strength

Often signals distribution on rallies. Risk conditions can deteriorate if price acceptance weakens. - Fast one-day swings

Often noise from re-tags, custody changes, or one-off treasury movements. Look for follow-through. - Repeated crosses around zero

Usually calls for patience. Let the weekly cadence confirm the direction.

Common Traps To Avoid

- Do not assume all distribution is bearish. Some supply can move into ETFs or custodian wrappers without hitting spot books.

- Do not ignore venue flows. Net accumulation with heavy exchange inflows can still mean sell pressure exists elsewhere.

- Do not over-fit levels. The edge sits in direction and persistence, not a magic number.

Pair It With Other Dials For Confluence

Exchange Netflows

- Accumulation plus outflows often means tighter float.

- Distribution plus inflows often signals stress.

CDD, VDD, And HODL Waves

These help confirm which age bands are moving when the HODLer cohort changes stance.

Realised PnL Ratio And SOPR

These help confirm whether profit-taking is being accepted during distribution, or whether selling pressure is overwhelming bids.

Mayer Multiple And The 200-Day

These help frame stretch and mean reversion, so your read is not purely emotional during fast moves.

A Weekly Workflow You Can Reuse

- Mark the weekly average of HODLer Net Position Change as positive, negative, or flat.

- Check exchange netflows and reserves. Are coins heading to venues or leaving them.

- Cross-check SOPR or Realised PnL Ratio and CDD or VDD to judge acceptance and who is spending.

- Act on persistence. Three similar weekly reads build confidence. One bar does not.

- Review on a fixed day each week, so you reduce headline-driven decision making.

Mini FAQs

What does HODLer Net Position Change tell you in simple terms?

It estimates whether long-term holders are adding to their balances or reducing them over time.

Does positive HODLer Net Position Change guarantee higher prices?

No. It can improve the backdrop by tightening float, but price still needs demand and acceptance.

Why do different data providers show different numbers?

Cohort definitions and entity tagging vary. Direction and persistence usually matter more than the exact level.

Can this be used intraday?

Not really. It is designed as a slower behavioural dial. Weekly cadence is the point.

What should confirm a HODLer Net Position Change read?

Use exchange netflows and reserves for venue pressure, CDD or VDD for spending age, and SOPR or Realised PnL Ratio for profit-taking versus stress.

How often should this be checked?

Weekly is usually enough. Daily checks can overreact to one-off events and reclassifications.

If this helped you track accumulation and distribution with more confidence, Alpha Insider members can access deeper Bitcoin on-chain analysis and commentary here.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

Built for steadier context… with indicators read together, not in isolation.

Legal & Risk Notice

This guide is for education only… not financial, investment, legal, accounting, or tax advice. Nothing here is a recommendation to buy, sell, or use any product or service. Cryptoassets are high risk… prices can go to zero… only use amounts you can afford to lose. Availability and legality vary by country… check your local rules before acting. You are responsible for your own decisions.

Discussion