Key Points

- Bitcoin Liveliness is a 0 to 1 behaviour gauge built from coin-days created versus coin-days destroyed.

- Rising Liveliness often suggests older supply is being spent, which can increase distribution risk if it persists.

- Falling Liveliness often suggests saving dominates, which can tighten available supply and support healthier trend conditions.

- The cleanest read is the slope of a 30 to 90-day average, not one-day spikes.

- Liveliness works best with confirmation. Pair it with CDD or VDD Multiple for age, SOPR or Realised PnL Ratio for profit-taking, and exchange netflows for venue pressure.

- Weekly checks are usually enough for most readers… daily monitoring can add noise without improving the regime read.

- This guide is part of the Bitcoin on-chain series. For the full library of indicators and explainers, see the Bitcoin on-chain indicators hub.

- If any terms feel unfamiliar, use the Crypto Glossary, then return here.

Quick Answer

Bitcoin Liveliness measures whether older coins are being spent or left to age. When Liveliness trends higher, coin-days are being destroyed more aggressively, which often means older supply is moving and spending pressure is rising. When Liveliness trends lower, coin-days are accumulating, which usually means holders are saving and supply is ageing in place. Treat it as a behaviour dial, then confirm with age tools and profit and loss indicators before forming a view.

What Is Bitcoin Liveliness

Liveliness reflects the balance between coin-days being destroyed and coin-days being created over time. It is best treated as a behavioural dial that answers one question.

Are older coins being spent more, or are they ageing in place.

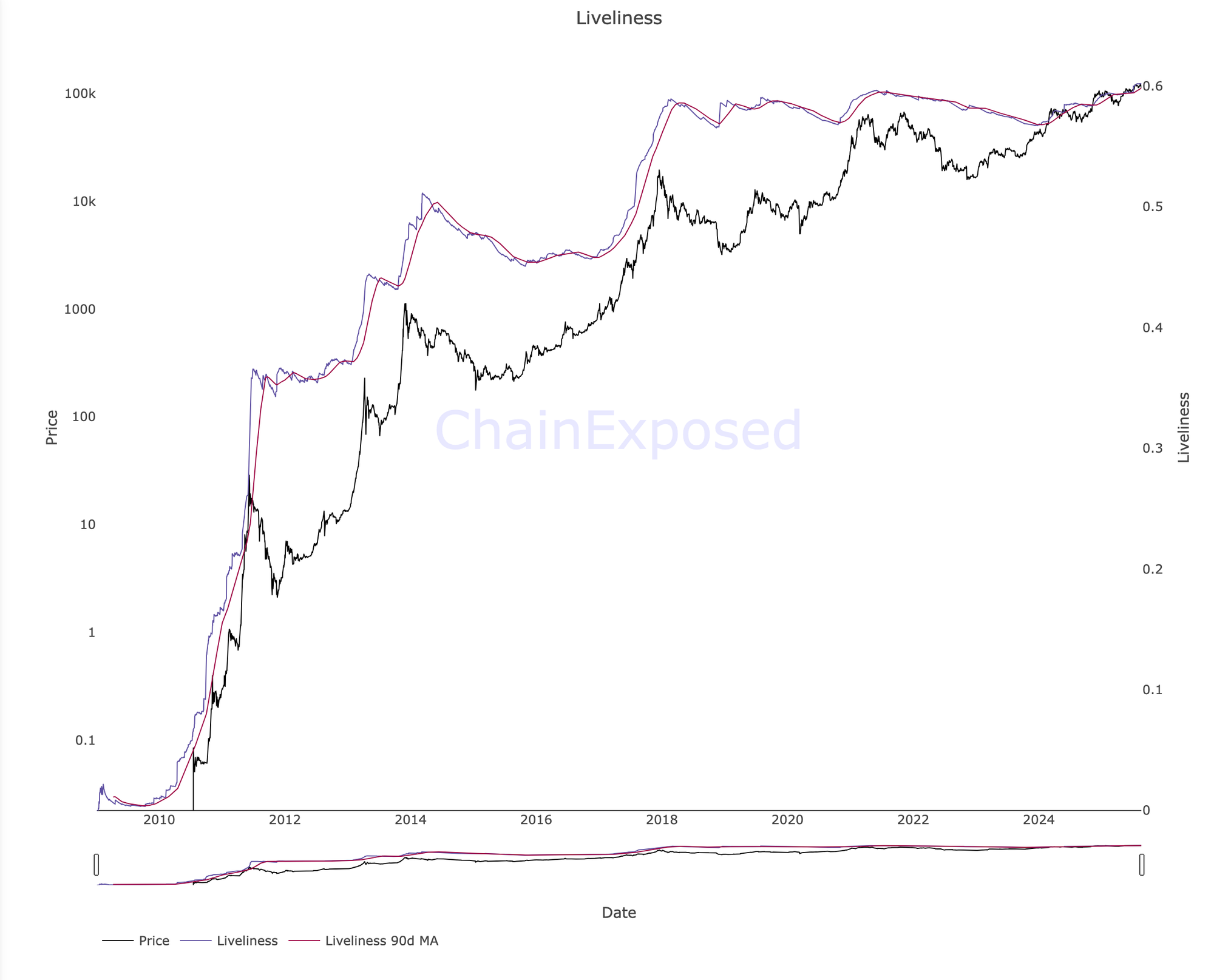

The purple line is Liveliness with a 90-day average against price on a log scale. Rising slopes show net spending of older coins… falling slopes show net saving and ageing.

How It Is Constructed Without The Maths Headache

- Every UTXO accumulates coin-days while it remains unmoved.

- When that UTXO is spent, those accumulated coin-days are destroyed.

- Liveliness compares destroyed coin-days to created coin-days across history.

- A higher ratio means more spending of older supply relative to saving.

You do not need the formula. Track direction and persistence.

What Rising Vs Falling Liveliness Really Means

Rising Liveliness

- Ageing supply is being spent.

- Expect distribution windows, treasury moves, or rotation.

- Treat as meaningful only if the 30 to 90-day average also turns up.

Flat To Falling Liveliness

- Holders are saving and coin-days stack up.

- Available float can tighten on venues.

- Price rallies with falling Liveliness often travel better than rallies with Liveliness accelerating upward.

Sharp Spikes

- Often event-driven spends.

- Treat as noise unless the moving average confirms a regime shift.

Practical Guide Rails

Use these as guide rails, not gospel.

- Use a 30-day or 90-day moving average for regime.

- Slope up suggests spending bias.

- Slope down suggests saving bias.

- Pair rising Liveliness with exchange net inflows to spot sell pressure building.

- Pair falling Liveliness with exchange outflows for healthier trend conditions.

- A rally with falling Liveliness is often cleaner than a rally where Liveliness rises sharply.

Common Traps To Avoid

- One-day bursts can be exchange housekeeping or entity re-tags. Wait for follow-through.

- Do not assume rising equals bearish. It can also reflect benign rotation or miners funding operations. Confluence matters.

- Do not ignore age. Pair with CDD or VDD Multiple to see which age bands are moving, not just that spending occurred.

Pair Liveliness with these dials

- Pair Liveliness With These Dials

- CDD or VDD Multiple to confirm whether older coins drove the move.

- SOPR or Realised PnL Ratio to see if profit-taking is being accepted while Liveliness rises.

- HODL Waves to see whether younger bands swell as older coins distribute.

- Exchange reserves and netflows to connect saving versus spending to venue liquidity.

A Weekly Workflow You Can Reuse

- Log the 90-day Liveliness slope as up, down, or flat.

- Check CDD or VDD to see whether the move is older supply-led.

- Cross-check exchange netflows and reserves for venue pressure.

- If Liveliness is rising and there is an inflow streak and Realised PnL Ratio is above 1.0, treat risk as higher and avoid chasing weak breakouts.

- If Liveliness is falling and there is an outflow streak, favour dips that hold key levels.

Review weekly. Persistence matters more than headlines.

Mini FAQs

Is there a single Liveliness level that matters most?

No. Direction and persistence matter more than any single level. Use the slope of a 30 to 90-day average for a cleaner regime read.

Does rising Liveliness always mean bearish?

No. It can reflect rotation or treasury activity. Risk rises when Liveliness trends up and other indicators confirm distribution, such as exchange inflows and profit-taking behaviour.

Can large holders distort Liveliness?

Large spends will move it, but that is the point. Confirm with CDD or VDD Multiple to see whether older supply drove the change.

Does Liveliness time exact tops or bottoms?

No. It is a context tool. Use it to frame spending versus saving, then confirm with cost basis, profit and loss, and flows.

What should confirm a Liveliness read?

CDD or VDD Multiple for age, SOPR or Realised PnL Ratio for behaviour, and exchange netflows or reserves to connect the read to venue liquidity.

How often should Liveliness be checked?

Weekly is usually enough. Daily checks can overreact to event-driven spikes.

If this helped you read Bitcoin saving vs spending without guesswork, join Alpha Insider for weekly timing windows, dashboards, and member videos. Fewer mistakes… cleaner execution… more conviction.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

This isn’t noise… it’s the full playbook.

Legal & Risk Notice

This guide is for education only… not financial, investment, legal, accounting, or tax advice. Nothing here is a recommendation to buy, sell, or use any product or service. Cryptoassets are high risk… prices can go to zero… only use amounts you can afford to lose. Availability and legality vary by country… check your local rules before acting. You are responsible for your own decisions.

Discussion