What Are CPI, Core CPI, And PCE?

- CPI tracks the price of a fixed consumer basket paid out of pocket by households.

- Core CPI removes food and energy to cut headline noise.

- PCE covers a broader set of consumer spending measured by businesses, with weights that update more often and wider healthcare coverage.

Markets watch CPI for the pop and PCE for policy… the Fed’s target is tied to PCE.

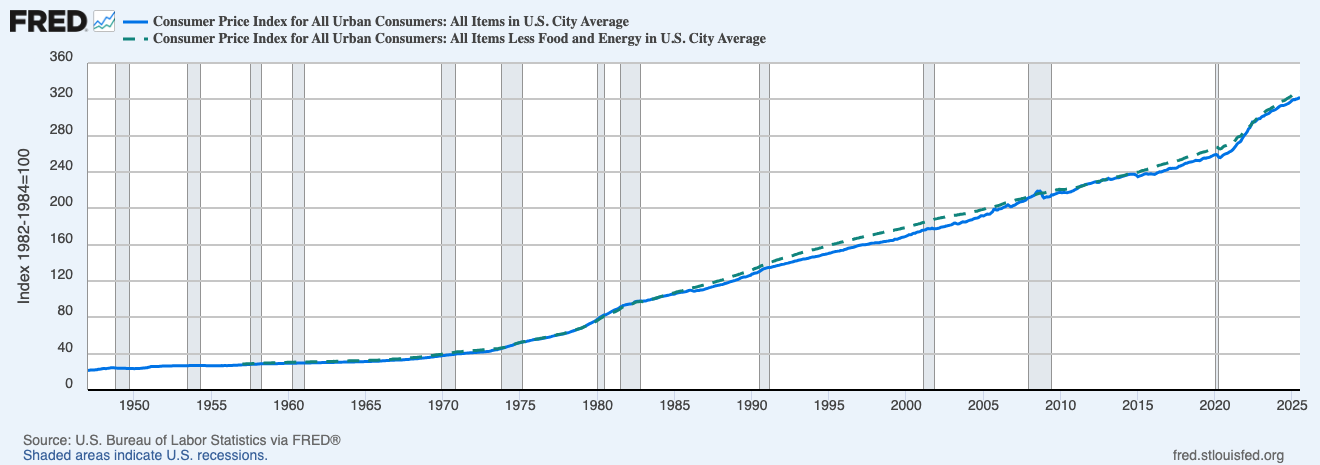

The solid line is headline CPI; the dashed line is Core CPI. Grey bands mark US recessions. The gap between the two widens during energy/food shocks and narrows when those pressures fade.

Key Differences That Move Markets

Scope

- CPI is out-of-pocket prices for urban consumers.

- PCE includes what others pay on your behalf… employer health insurance, Medicare, and more.

Weights

- CPI uses a fixed basket updated once a year.

- PCE is chain-weighted, so it adapts as people substitute between goods and services.

Healthcare weight

- PCE assigns a larger weight to healthcare than CPI, which can shift core trends.

Shelter lag

- CPI’s shelter component moves slowly and can keep core sticky even as other prices cool.

- PCE shelter tends to be a little less dominant.

Release cadence and revisions

- CPI hits earlier in the month… it moves markets first.

- PCE lands later and is revised more, which the Fed likes for policy work.

How To Read An Inflation Print

- The three numbers… MoM, YoY, and Core YoY. That’s the baseline.

- 3-month annualised… is momentum cooling or re-accelerating.

- Services vs goods… goods disinflate fast, services move slower.

- Shelter… note whether it’s still propping up core.

- Super-core services ex-shelter if you want a clean labour-sensitive read.

Why Traders Care

- Rates path… hot prints push rate-cut odds out, cool prints pull them forward.

- Yields and dollar… higher real yields and a firmer dollar can pressure crypto beta.

- Risk windows… CPI day can deliver outsized moves… plan position size and timing.

Pitfalls To Avoid

- Base effects… YoY can look better or worse depending on last year’s base. Always check 3-month annualised.

- Seasonals… January and summer months can be noisy.

- Shelter inertia… CPI core can stay sticky even as new-lease rents cool.

- Overreacting to a single print… look for persistence across two or three reports.

A Simple Pre- and Post-Print Workflow

Before the print

- Note consensus for headline and core.

- Map the reaction path: if MoM runs hot… which levels or zones matter on DXY, 10-year yields, and BTC.

After the print

- Check MoM and 3-month annualised first… then YoY.

- Scan services vs goods… is shelter doing the heavy lifting.

- Flip to PCE at month-end to see if policy-relevant momentum agrees.

FAQ

Why does the Fed prefer PCE.

Broader coverage, chain weights, and cleaner healthcare treatment give a better policy lens.

Is Core always more important than headline.

For trends, yes. For near-term market impact, food and energy shocks in headline can still swing pricing.

Can CPI and PCE disagree.

Yes. Different baskets and weights. When they diverge, expect choppy rates pricing until the next round settles it.

If this helped you read inflation without the noise, join Alpha Insider for Macro Heat dashboards, calendar previews for the next prints, and a weekly positioning watchlist. Fewer mistakes, cleaner execution, more conviction.

The Markets Unplugged members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports (inflation, yields, liquidity, dollar)

It’s the full playbook.

Discussion