Introduction

Dollar Cost Averaging, or DCA, is one of the first strategies most people hear about when they arrive in crypto… but very few take the next step and actually plan their entries, exits and profit targets in a structured way.

At Markets Unplugged we see the same pattern every cycle. People DCA into Bitcoin or an altcoin whenever they remember, exit on emotion, then only afterwards realise they never had a simple set of levels or a clear return target. The result is stress, regret and inconsistent results.

This guide explains how to use our free Crypto DCA Calculator to turn DCA from a vague idea into a concrete plan you can test, adjust and review. You can open the tool in another tab here while you read:

https://www.themarketsunplugged.com/free-dca-calculator/

If any of the terminology in this guide is new, keep our crypto glossary of key terms and definitions for beginners open in another tab while you read. It will help you with any Bitcoin or crypto slang you have not seen before.

Key Points

- Dollar Cost Averaging is about time and risk, not a magic profit button. It smooths your entries into Bitcoin and altcoins but does not remove drawdowns or decision making.

- A proper crypto DCA calculator helps you map both sides of the plan… how you will scale in and how you will scale out, along with total cost, expected returns and risk size.

- The free DCA Calculator on The Markets Unplugged works with any coin and currency, lets you set multiple DCA in and DCA out levels, and exports results to CSV so you can journal and refine.

- DCA plans are strongest when they combine numbers with timing… for us that means mapping DCA levels against Kairos timing windows and simple price action, not trading every wiggle.

- Free tools are for building your own plan. When you want pre mapped DCA levels across many coins, including more than forty altcoins, you can step up to members only tools such as DCA Targets and Alpha Insider.

What Is Dollar Cost Averaging In Crypto?

Dollar Cost Averaging is a simple way to spread your buys over time instead of trying to choose one perfect entry. You decide how much you want to invest in Bitcoin or a particular altcoin, then commit to adding regularly or at pre defined price levels.

In traditional investing this often means a fixed amount each month. In crypto, with higher volatility and big cycles, DCA is usually more flexible. You might step in more aggressively during deep pullbacks, slow down near local highs, or tie your plan to on chain and macro context.

What DCA does well:

- Reduces the pressure to “time the bottom” with one trade.

- Encourages a consistent saving habit into a chosen asset.

- Makes it easier to function emotionally during drawdowns, because you have a plan.

What DCA does not do:

- It does not guarantee profits.

- It does not tell you when to exit or how to size positions.

- It does not protect you from picking weak or failing projects.

That is why a calculator and a written plan matter. They turn DCA from “I will just buy whenever” into “I know which levels and which amounts I am committing to, and I know what result I am aiming for”.

Why Use A Crypto DCA Calculator Instead Of Guessing?

Many people treat DCA as something you do in your head. They remember roughly what they spent, have a vague idea of average price, and then try to decide on the fly when to take profit. That works in quiet markets, but it breaks down when volatility spikes.

A dedicated crypto DCA calculator helps you:

- See your true average entry price for Bitcoin or any altcoin, not a guess.

- Map specific DCA in levels instead of random buys.

- Map specific DCA out or trim levels so you do not have to invent exits mid move.

- Understand your maximum risk in both capital and percentage terms.

- Preview different scenarios… for example, how results change if your highest target is hit versus only the first two.

The free DCA Calculator on The Markets Unplugged is built specifically for this kind of planning. It is not a marketing funnel for an exchange, it is a neutral tool that lets you plug in your own levels and see the numbers clearly before committing.

The tool lets you select any coin and currency, enter a set of DCA in and DCA out levels, and instantly see your total cost, average price and potential profit before you risk capital.

How To Use The Free Crypto DCA Calculator

You can use the DCA Calculator for Bitcoin, Ethereum or any altcoin. The process is the same each time.

Step 1: Choose Your Coin And Currency

Open the tool here:

https://www.themarketsunplugged.com/free-dca-calculator/

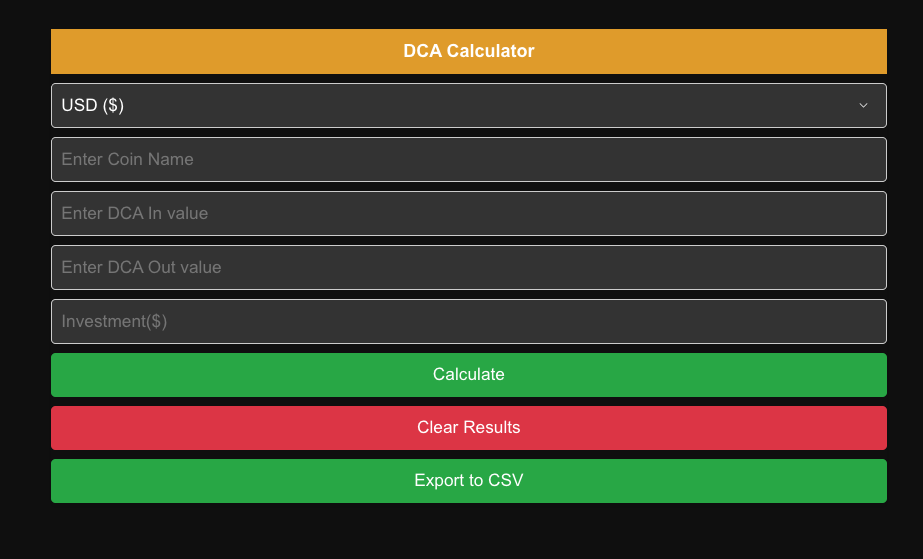

At the top:

- Choose the fiat currency you want to work with, for example USD ($).

- Type the name or ticker of the coin you are planning to DCA into, here FET.

At this stage the price and investment boxes are still empty. All you have done is tell the calculator which market you are planning for.

The calculator is set to USD and FET, but the DCA In, DCA Out and Investment fields are still blank. This is your clean starting point before you define any levels or risk.

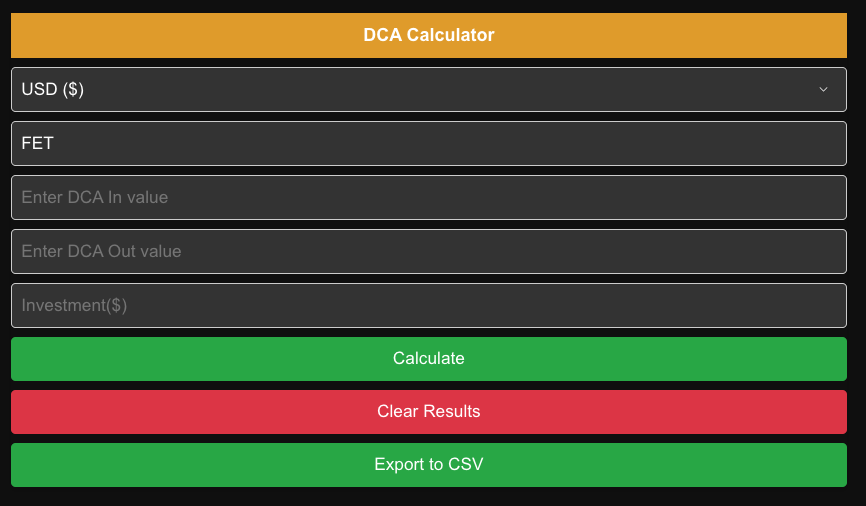

Step 2: Enter Your DCA In Level

Next, decide the price where you are comfortable starting to build the position.

For this example, we choose 0.13 as the DCA In level for FET and enter it into the DCA In field. The DCA Out and Investment fields remain empty for now… this step is only about defining the entry level you are anchoring the plan around.

The DCA In field now shows 0.13, while DCA Out and Investment still show placeholder text. You have committed to a starting entry level, but not yet to a target or position size.

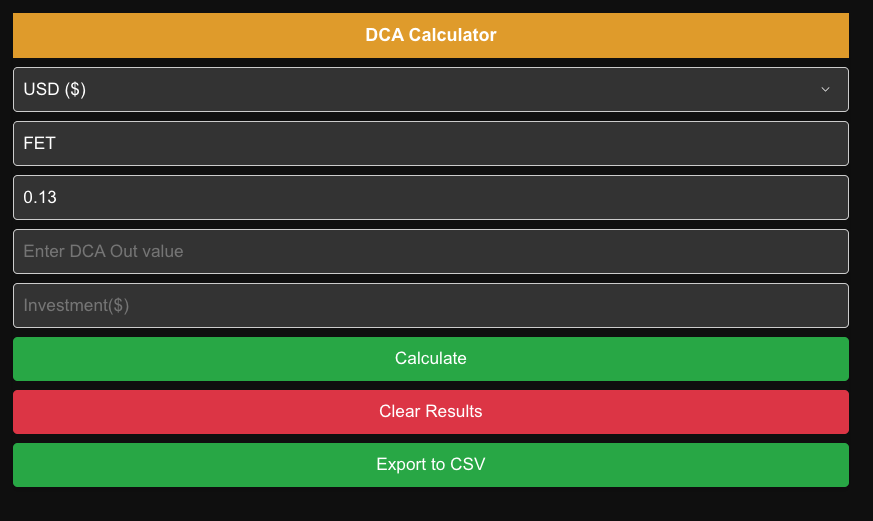

Step 3: Add Your DCA Out Target

Now add a DCA Out level, the price where you plan to start taking profit or trimming the position.

In this example we enter 2.0 as the DCA Out value. With 0.13 as a DCA In and 2.0 as a DCA Out, you can already see the type of move you are planning for before you commit any capital.

When you design your own plans, it helps to:

- Choose sensible targets based on prior levels, conservative multiples and the wider cycle.

- Think about where your thesis would clearly be wrong… an invalidation zone where you would stop adding instead of averaging down forever.

Both price fields are now filled: 0.13 for DCA In and 2.0 for DCA Out. The Investment field is still empty, so you can review the logic of the move before deciding how much capital to allocate.

For most readers these levels will come from simple horizontal levels, prior ranges and fib retracements on their own charts. For Alpha Insider members, the DCA Targets page takes this further… over forty altcoins have DCA in, DCA out and invalidation zones pre mapped from technical analysis and fib levels, so the planning work starts from a researched template rather than a blank screen.

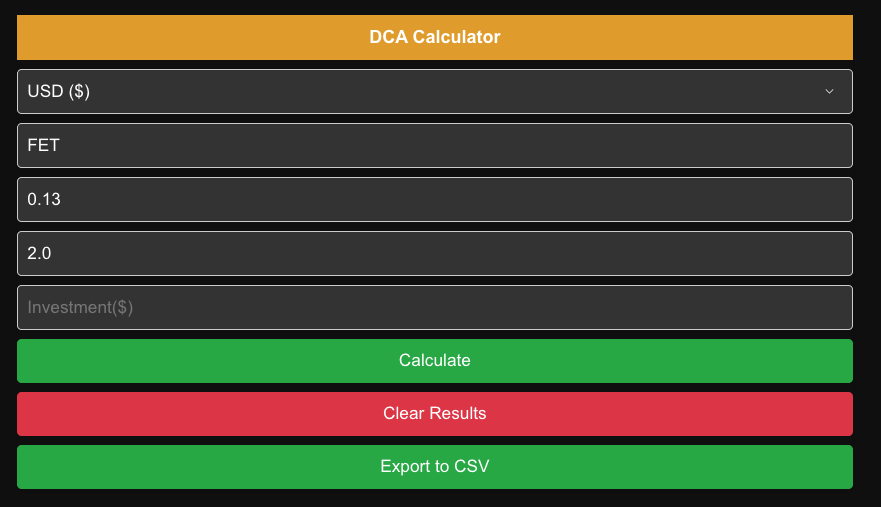

Step 4: Enter Your Total Investment

With entry and exit levels in place, decide how much capital you are willing to put to work in this plan.

Here we set 1,000 in the Investment($) field, meaning we are prepared to allocate one thousand dollars to this FET DCA idea if the level is reached. This completes the basic inputs: coin, DCA In, DCA Out and risk size.

The calculator now shows DCA In at 0.13, DCA Out at 2.0 and an Investment of 1,000. At this point you have a fully defined scenario: asset, prices and total risk.

Step 5: Calculate And Review The Results

Click Calculate to let the tool run the numbers.

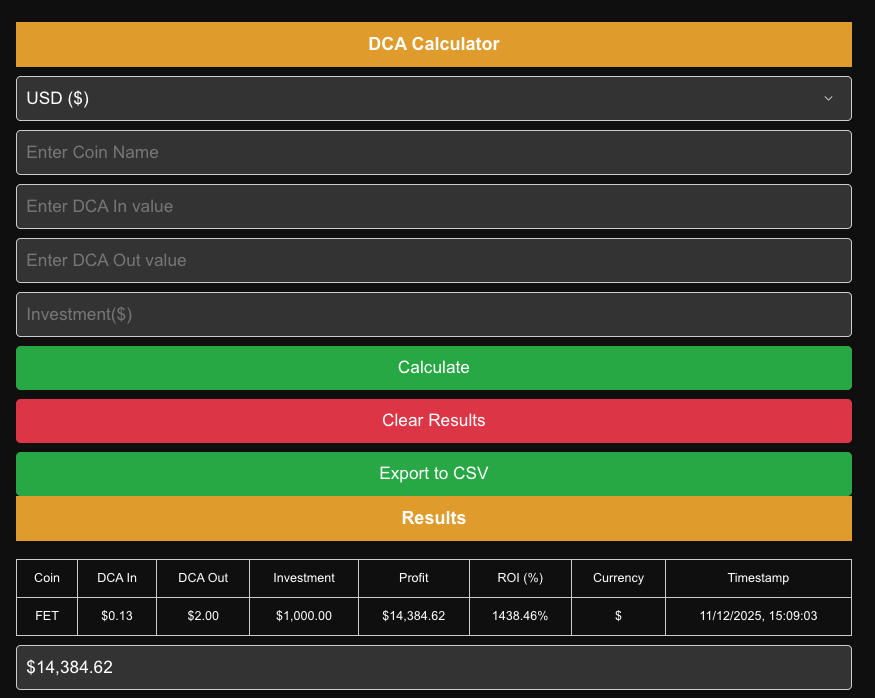

For this FET example, the results table shows:

- Coin: FET

- DCA In: 0.13

- DCA Out: 2.00

- Investment: $1,000.00

- Profit: $14,384.62

- ROI: 1,438.46%

The summary bar at the bottom repeats the total profit so you can sanity check whether the potential return and the amount at risk match your expectations and your thesis.

The results table shows how a $1,000 allocation at 0.13 with a 2.0 target would behave if the plan plays out, including total profit, ROI and a timestamp so you can log exactly when you built the scenario.

Step 6: Export Or Reset For The Next Plan

When you are happy with the setup you can:

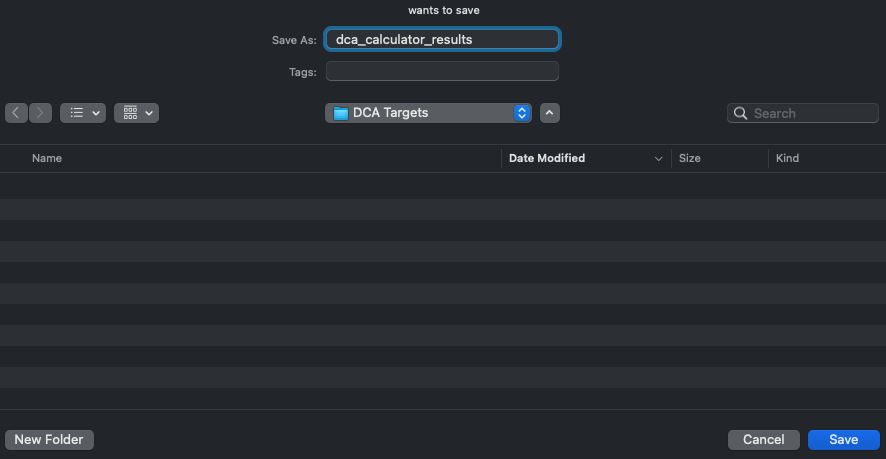

- Use Export To CSV to save the plan into your journal so you can review it later against what actually happened in the market.

- Hit Clear Results to reset the inputs and test a different coin, different levels or a different risk size.

Over time you can build a small library of DCA plans for Bitcoin and various altcoins, compare them, and refine your approach instead of relying on memory or on-the-fly decisions.

The Export To CSV and Clear Results buttons let you either save the current DCA plan for record keeping or wipe the slate clean and explore another scenario without confusion between runs.

Example DCA Plans For Bitcoin, Altcoins And Memecoins

To make this concrete, here are three simple examples of how different traders might use the calculator.

Example 1: Long Horizon Bitcoin DCA Plan

A conservative investor wants to build a position in Bitcoin over the next 18 to 24 months. They:

- Allocate a fixed amount each month as a base.

- Add extra buys if price revisits larger support areas.

- Plan modest profit trims near conservative cycle targets.

The calculator helps them see:

- Their approximate average price if all levels fill.

- How much capital they would genuinely have at work if a deep pullback occurred.

- The kind of percentage return they might book if they trim steadily instead of holding everything for a single top.

Example 2: Altcoin Rotation DCA Plan

A more active participant wants exposure to a high conviction altcoin during an altseason window.

They:

- Keep overall risk size smaller than their Bitcoin plan.

- Set staggered DCA in levels during weakness or consolidation.

- Map multiple targets higher up the chart where they will trim 10 to 20 percent each time.

The calculator helps them avoid the common mistakes of:

- Over committing too early in the move.

- Forgetting to take profit until the entire move has already reversed.

- Underestimating how much they have at risk when stacking entries.

For readers building their own plans, the free DCA Calculator is the place to test different level combinations until the risk and reward feel sensible. Alpha Insider members can start from the DCA Targets page instead, where those DCA in, DCA out and invalidation zones are already laid out for each covered altcoin, then fine tune them in the calculator if they want to stress test scenarios.

Example 3: Speculative Memecoin DCA Plan

A speculative trader accepts that meme coins are high risk and treats them accordingly.

They:

- Cap exposure at a small fraction of their overall crypto stack.

- Use a very tight DCA in plan, often only one or two entries.

- Set aggressive DCA out levels that quickly remove initial capital and then some.

The calculator makes it clear:

- Exactly how much money they are willing to lose if the project fails.

- How quickly they can get to “house money” if the trade works.

- Whether the potential return justifies playing in that part of the market at all.

In all three cases, the key is the same… the numbers are written down, the plan is visible, and decisions are made before emotion takes over.

Using DCA With Timing And Risk Management

DCA does not replace timing, it works alongside it.

At Markets Unplugged we use KAIROS, our in house timing framework, to map windows where highs and lows tend to cluster over a cycle. We then align DCA plans with those windows rather than treating time as random.

In practice, that might mean:

- Favouring DCA in during low windows for Bitcoin and Ethereum rather than chasing parabolic moves into known high windows.

- Being more willing to trim altcoin positions into strength when Kairos flags a relevant high window for dominance or a particular sector.

- Leaving room in your DCA plan for uncertainty… you rarely know ahead of time which exact level will be the low or high.

Whatever approach you take, the key is to pair each DCA plan with a realistic invalidation. In our own frameworks that usually means a price or time zone where the thesis has clearly failed, even if the asset is still alive on paper. Members see those zones built into the DCA Targets and timing notes; free users can achieve something similar by being honest on the chart about where they would stop adding and re-evaluate.

The free DCA Calculator lets you test these ideas. You can build one plan for a conservative scenario, another for a more aggressive scenario, and use Kairos and simple technical levels to decide which one to favour as the cycle unfolds.

Common DCA Mistakes To Avoid

A calculator will not fix behaviour on its own. These are mistakes we see often:

- Running a DCA plan with no invalidation.

Continuing to add at every lower level without ever defining where the thesis is broken, which can turn a reasonable position into an open ended liability. - DCA without an exit plan.

Buying steadily but never deciding when to take profit, then watching an entire move reverse. - DCA into low quality or misunderstood assets.

A neat plan does not save you from flawed fundamentals, weak liquidity or poor risk. - Ignoring total risk size.

Adding “just a little more” at each level until the position becomes far larger than intended. - Changing the plan mid flight without review.

Constantly adding new levels or moving targets without writing down why.

Writing a DCA plan into the calculator, exporting it, and reviewing it weekly is often enough to avoid most of these. The discipline comes from seeing your own numbers instead of treating them as abstract ideas.

Mini FAQs

Is DCA always the best strategy for crypto?

No. DCA is a useful base strategy for Bitcoin and stronger altcoins, but it becomes far less effective if you are buying at random prices with no technical levels in mind. A DCA plan that ignores obvious support, resistance and prior ranges is just guessing in smaller pieces. In Alpha Insider we anchor DCA in and DCA out plans to clear levels on the chart so members are not averaging into noise.

Can I misuse a DCA calculator?

Yes. A calculator is only as good as the entries and exits you feed into it. If your DCA in and DCA out levels are not grounded in basic technical analysis, realistic targets and a clear invalidation, the output will look neat but the plan itself will be weak. That is why our DCA Targets page gives members pre mapped zones for more than forty altcoins, built from TA and fib levels, which they can then plug into the calculator.

How often should I update my DCA plan?

You do not need to change your plan every week. It is usually better to review it when a key level has been reached, when your thesis changes, or when the chart structure has clearly shifted. If your original DCA levels came from solid technical areas, they should not need constant tinkering.

Does DCA make sense for very small speculative coins?

Only if your risk size is genuinely small and you accept that you may lose most or all of that allocation. For many traders DCA is better reserved for assets with deeper liquidity and clearer technical structure. Even then, using TA based DCA in and out zones and an explicit invalidation is what turns a speculative idea into a controlled plan.

If this guide and the free DCA Calculator help you feel more in control of your Bitcoin and altcoin plans, the natural next step is to see how we use the same approach in live markets.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports

This is where the free tools and the paid tools join up… you build confidence with the calculator, then use member level timing and DCA targets to align that plan with what the market is actually doing.

This isn’t noise… it’s the full playbook.

Legal And Risk Notice

Nothing in this article or in the DCA Calculator is financial, investment or trading advice. It is educational information only, based on historical market behaviour and internal frameworks used by The Markets Unplugged. Cryptoassets are highly volatile and you can lose all the capital you commit. Always do your own research, size positions responsibly, and consult a qualified professional if you are unsure whether any strategy is appropriate for your circumstances.

Discussion