Key Points

- CTAs (managed futures) are systematic funds that trade futures across rates, FX, equities, and commodities using trend rules.

- Their flow is slow and persistent, which can extend moves even when fast money fades.

- Rates trends often lead the rotation, then the dollar and equities, and finally crypto beta.

- Track trend performance, concentration, and correlation to equities, then confirm with volatility (VIX or MOVE).

- For related guides, use the Macro For Beginners hub here.

- If you want quick definitions for terms like futures, volatility, DXY, and real yields, see the Crypto Glossary here.

Quick Answer

CTAs are systematic managers, usually called managed futures, who trade rules-based trend signals across major futures markets. A trend model typically goes long what is rising and shorts what is falling, then sizes positions based on volatility. Because CTA portfolios adjust gradually and often hold positions for weeks to months, their buying and selling can add persistence to big macro themes.

CTAs matter because they are large, diversified, and reactive in a predictable way. When trends persist, their models keep adding, which supports the dominant move. When trends break and volatility rises, they cut risk, which can accelerate reversals. Tracking CTA trend performance, concentration, and correlation gives you a clean “slow money” read for the macro tape.

What Is A CTA, And What Is A Trend Model?

CTA (Commodity Trading Advisor): a systematic manager that trades futures across rates, FX, equities, and commodities.

Trend model: a rules-based approach that buys strength and sells weakness, usually via moving averages, breakouts, or similar price filters.

The important point is not the label, it is the behaviour. These strategies tend to scale in and scale out, so flows cluster over time.

How Trend Models Enter And Exit

Most CTA trend sleeves follow the same three building blocks:

- Signal: a moving average cross, breakout, or similar price filter.

- Sizing: target volatility across markets, if volatility rises they cut size, if volatility compresses they add.

- Stop And De-Risk: a trend break, or volatility expansion that invalidates the signal.

That creates persistence. Entries cluster, exits cluster, and that flow can keep a move going longer than the headlines justify.

The Two Tells To Track Each Week

- Performance And Concentration: are trend strategies grinding up, and are positions clustered around one macro theme.

- Correlation To Equities: when CTAs are long bonds and short USD, correlation to stocks can flip, which matters for hedging and risk mix.

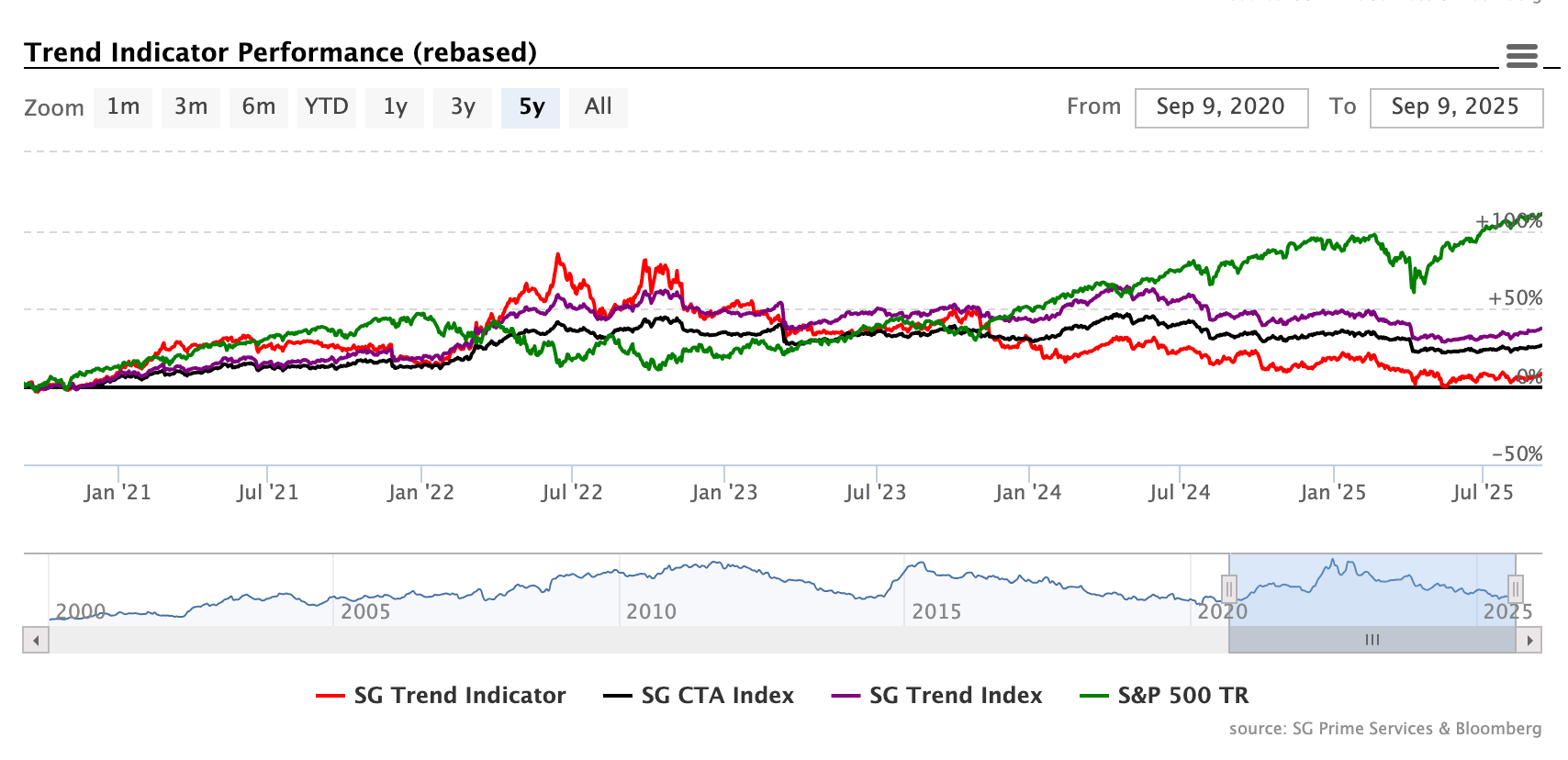

This chart helps you see when trend strategies are compounding versus whipsawing. The most useful periods are the steady grinds, because that is when flows tend to stay aligned.

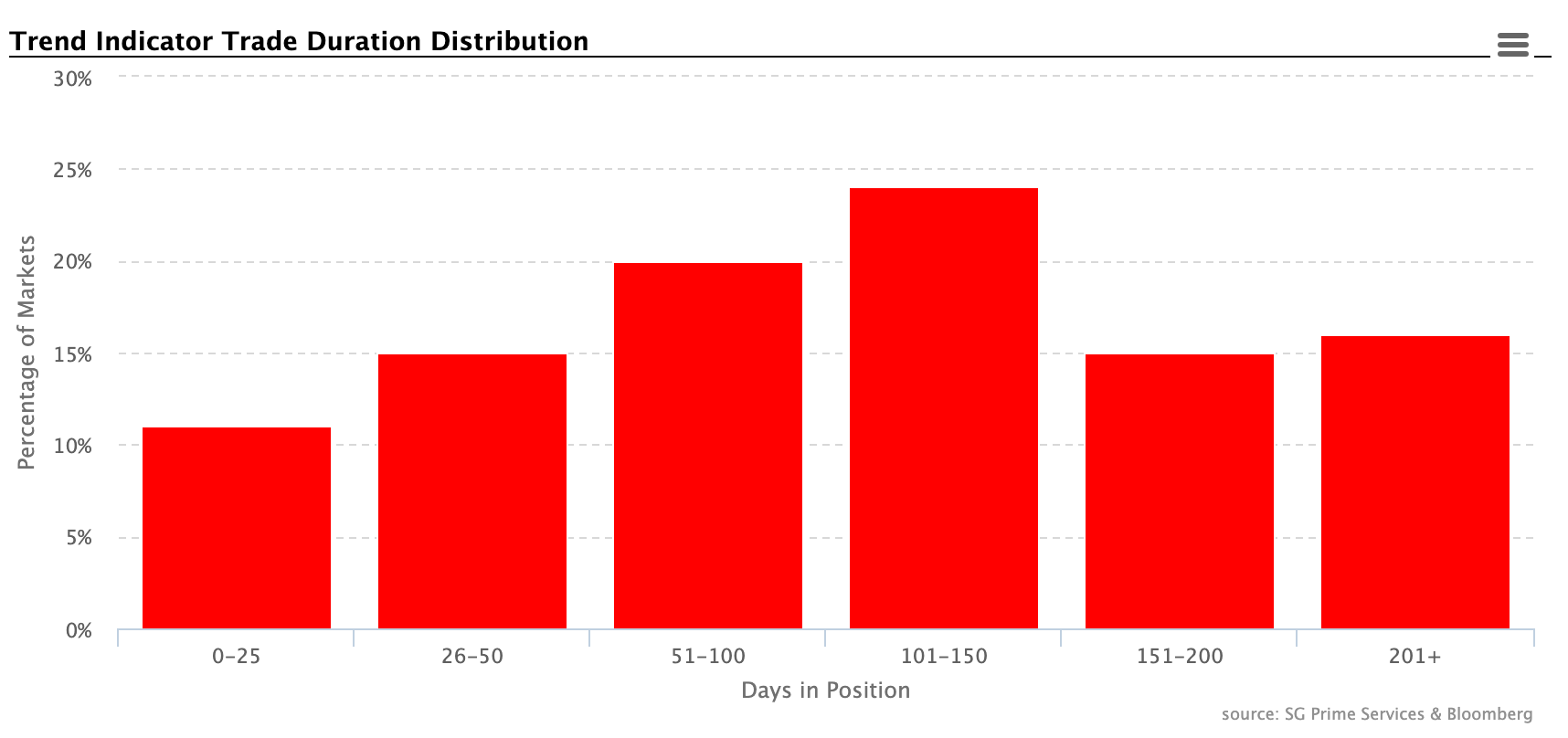

This distribution highlights that trend winners tend to run for months, not days. It reinforces why weekly confirmation beats reacting to one noisy session.

A liquid proxy you can overlay on your dashboard to gauge whether the trend sleeve is adding or cutting risk in real time.

How CTAs Interact With Markets You Trade

Rates First, Then Everything

Bond trends often start the rotation. If CTAs flip long duration and the move sticks, the downstream often looks like softer USD, stronger duration assets, and easier conditions for crypto beta.

Energy And Metals

Commodity trends can dominate cyclical equity themes and parts of credit. When trend models are long crude and copper together, the inflation impulse can tighten conditions.

Dollar Trend

A persistent DXY uptrend often means CTAs are long USD pairs, risk assets tend to face a headwind until that trend breaks.

A Simple Workflow You Can Reuse

- Step 1: Check a weekly trend benchmark (for example SG Trend style performance), is it grinding up or chopping.

- Step 2: Overlay a live proxy (DBMF, or another managed-futures proxy), higher highs and higher lows often signals the sleeve is adding, not chopping.

- Step 3: Cross-check volatility (VIX or MOVE), low vol plus trending markets tends to extend moves, vol spikes against their book often speeds up de-risking.

- Step 4: Translate to crypto context, CTA long bonds plus softer USD often aligns with better liquidity, CTA short bonds plus firmer USD often tightens the tape.

- Step 5: Act on persistence, wait for two to three weekly bars pointing the same way before leaning on the signal.

Common Traps To Avoid

- Month-end rebalances and roll periods can make proxies noisy for a few sessions, wait for follow-through.

- Equities can rally while CTAs are flat, this is not a day-trader’s signal.

- Single-market headlines rarely kill a portfolio trend unless the cross-asset cluster flips.

Mini FAQs

Do I Need A Paid Feed To Track CTAs?

No. Public trend indicator pages and managed-futures proxies are enough for a practical read.

Why Do Trend Models Lag Turning Points?

By design. They often sacrifice the first and last part of a move to capture the more durable middle.

Can CTAs Flip From Hedge To Risk Fuel?

Yes. When bonds and USD trend in a defensive way, they can hedge drawdowns, when those trends reverse, the same sleeve can become a buyer of risk.

If this helped you read slow-money flow without getting whipped by headlines, Alpha Insider is where Macro Heat dashboards, timing context, and weekly positioning get turned into a repeatable process.

Alpha Insider members also get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports

Legal And Risk Notice

This content is for educational purposes only and is not financial advice. Markets are volatile and you can lose money. Do your own research and consider your risk tolerance before making financial decisions.

Legal & Risk Notice

This guide is for education only, not financial, investment, legal, accounting, or tax advice. Nothing here is a recommendation to buy, sell, or use any product or service. Cryptoassets are high risk, prices can go to zero, only use amounts you can afford to lose. Availability and legality vary by country, check local rules before acting. You are responsible for your own decisions.

Discussion