Credit spreads are one of the cleanest “risk dials” in macro. When high-yield spreads widen, lenders demand more compensation to hold junk-rated debt, which often shows up before equities and crypto fully react. When spreads tighten, markets are usually more comfortable taking risk.

If you want quick definitions for terms like OAS, real yields, DXY, and recession indicators, see the Crypto Glossary.

Key Points

- High-yield spreads are a risk barometer, they widen when stress rises and liquidity tightens.

- The trend matters more than a single spike, persistence is the signal.

- High-yield often “moves first”, because credit reprices default risk faster than equities.

- Use high-yield spreads with real yields and the dollar, it helps filter false alarms.

Quick Answer

High-yield spreads (also called junk bond spreads or high-yield credit spreads) measure how much extra yield investors demand to own below-investment-grade debt versus US Treasuries. When these spreads widen for more than a few sessions, risk appetite is usually deteriorating. When they tighten steadily, markets are usually more comfortable taking risk.

Answer Block

High-yield spreads matter because they quantify stress in the credit system. A sustained widening in high-yield OAS (option-adjusted spread) often signals tighter financial conditions, rising default fear, and weaker risk appetite. A sustained tightening suggests easier conditions, improving confidence, and better support for risk assets. For a cleaner read, pair high-yield spreads with DXY and real yields to judge whether the macro tape is tightening or easing.

What Are High-Yield Spreads?

High-yield spreads are the extra yield demanded to lend to lower-rated companies instead of owning risk-free Treasuries.

- High-yield spreads: commonly refer to “junk” bonds, below investment grade.

- OAS (Option-Adjusted Spread): a standard way of measuring spread after adjusting for embedded options in bonds, so the comparison is cleaner.

- The popular series to track: ICE BofA US High Yield Index Option-Adjusted Spread (FRED code BAMLH0A0HYM2).

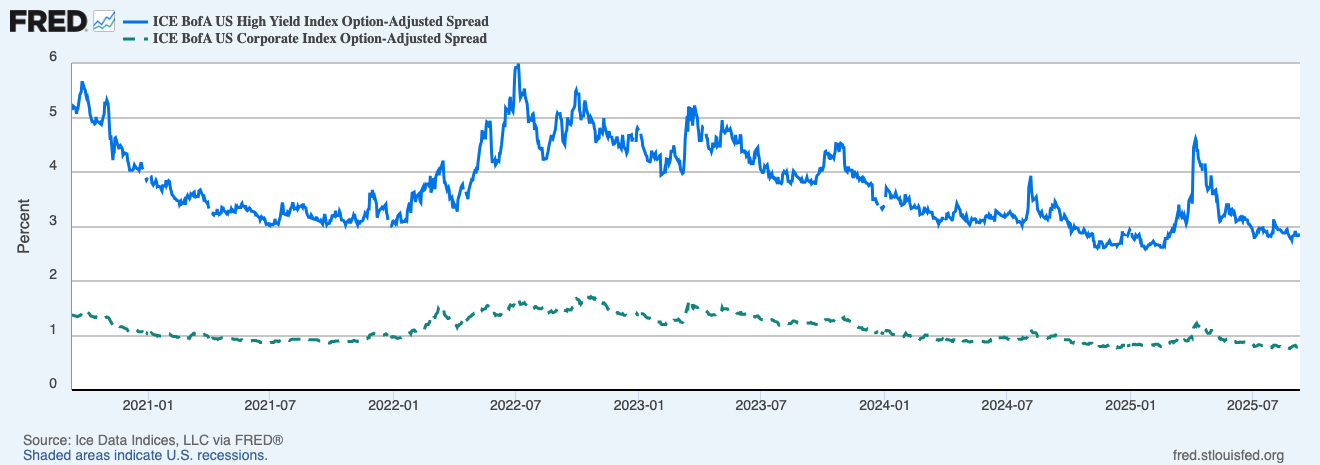

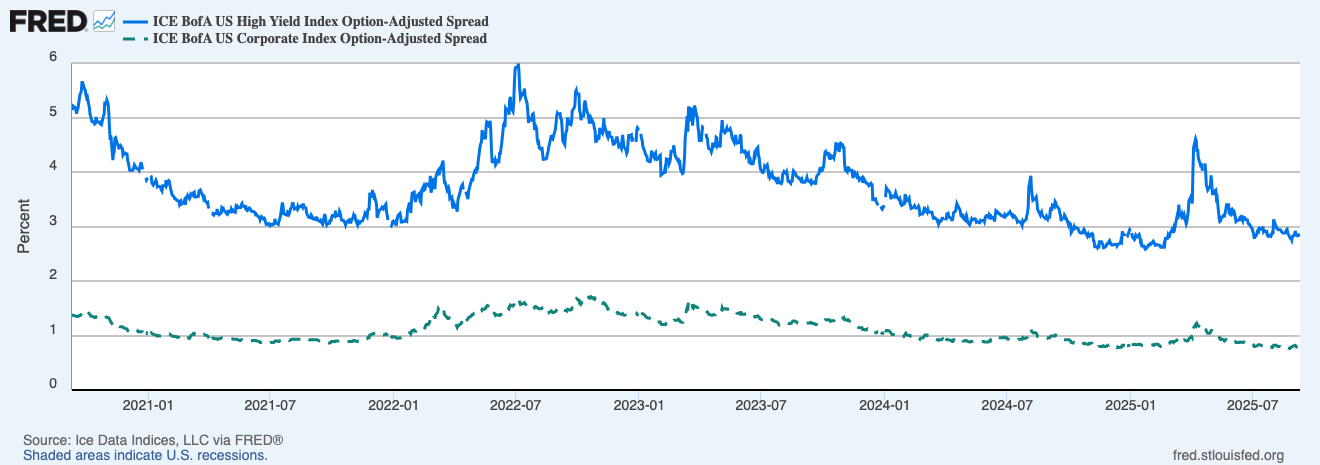

This chart shows how credit stress rises when spreads move higher and stay elevated. The key is the slope and persistence, not the one-day spike.

Why High-Yield Credit Spreads Often Lead Risk

Credit is where “can they pay” gets priced. Equity can stay optimistic for longer, but high-yield lenders tend to demand compensation quickly when conditions tighten.

- Default risk gets repriced fast, lenders pull back before the equity narrative flips.

- Funding conditions show up here early, refinancing becomes harder when spreads widen.

- Liquidity matters, widening spreads often align with tighter dollar conditions and higher real yields.

What Widening Spreads Usually Mean

Use this as a behavioural read, not a prediction engine.

- Widening high-yield spreads: risk is being repriced higher, conditions are tightening.

- Fast widening over a few sessions: stress event, liquidity scare, or macro shock.

- Slow grind wider for weeks: confidence fading, growth worries building, default fear creeping in.

For crypto, widening spreads often align with the “risk-off” combo, firmer dollar, higher real yields, and less tolerance for leverage.

What Tightening Spreads Usually Mean

- Tightening spreads: risk appetite is improving, credit is relaxing.

- Sustained tightening: markets are more willing to lend, financial conditions are easing.

- Tight spreads plus stable real yields: typically a friendlier environment for broader risk.

High-Yield Vs Investment-Grade, Why The Comparison Helps

Investment-grade spreads can move, but high-yield is where stress tends to show first.

- Investment-grade OAS series (example): ICE BofA US Corporate Index OAS (FRED code BAMLC0A0CM).

- If high-yield widens while investment-grade is stable: stress is concentrated in the weak part of the market.

- If both widen together: broader tightening, more macro-driven risk aversion.

This overlay helps separate “junk stress” from broader credit tightening. When both rise together and persist, risk assets usually feel it more.

Practical Guide Rails

No magic number, use regimes and persistence.

- High-yield spreads rising for multiple sessions: treat as tightening conditions.

- High-yield spreads chopping for a few days: noise is common, wait for follow-through.

- High-yield spreads falling for weeks: easing conditions, risk tolerance usually improves.

Best practice: don’t read spreads alone, confirm with DXY and real yields.

Common Traps To Avoid

This section is here to stop the most common misreads. Spreads can jump on headlines, what matters is whether the move sticks.

- One-off headline spikes: these happen, wait for persistence.

- Ignoring the dollar: a surging DXY can tighten conditions even before spreads fully react.

- Treating credit as a timer: spreads warn, they don’t schedule.

- Forgetting the macro mix: spreads, real yields, and the dollar together beat any single chart.

A Simple Workflow You Can Reuse

- Step 1: Check high-yield spreads (HY OAS), rising, falling, or flat.

- Step 2: Cross-check DXY and 10-year real yields, do they confirm tightening or easing.

- Step 3: Compare high-yield vs investment-grade spreads, is stress concentrated or broad.

- Step 4: Map the risk read to your market lens, tightening conditions usually reduce tolerance for high beta, easing conditions usually improve it.

- Step 5: Reassess after big macro prints, focus on what sticks beyond one session.

Mini FAQs

What Are Credit Spreads?

Credit spreads are the extra yield investors demand to hold corporate debt instead of US Treasuries. Wider spreads usually mean higher perceived risk.

What Is High-Yield OAS?

High-yield OAS (option-adjusted spread) is a standard measure of how much extra yield high-yield bonds offer versus Treasuries, adjusted for bond options.

Why Do Credit Spreads Widen?

They usually widen when growth fear rises, defaults are expected to increase, liquidity tightens, or investors demand more compensation for risk.

Are High-Yield Spreads The Same As Junk Bond Spreads?

In most everyday macro commentary, yes. “Junk bond spreads” is the common shorthand for high-yield spreads.

Do High-Yield Spreads Predict Recessions?

They can warn that conditions are deteriorating, but they are not a calendar. Use them with growth data and broader financial conditions.

If this helped you read high-yield spreads without getting faked out by noise, Alpha Insider is where the macro and on-chain dials get pulled into one repeatable process.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports

Legal & Risk Notice

This guide is for education only, not financial, investment, legal, accounting, or tax advice. Nothing here is a recommendation to buy, sell, or use any product or service. Cryptoassets are high risk, prices can go to zero, only use amounts you can afford to lose. Availability and legality vary by country, check your local rules before acting. You are responsible for your own decisions.

Discussion