Imagine looking at a BTC chart and seeing time itself organised, quiet rails stepping into the future and a soft window where a turn is most likely to occur. No neon arrows. No breathless signals. Just a calm map that lets you prepare. You set your alerts, write your plan, and go live your life. When the market finally reaches that moment, you are not surprised, you are ready. That feeling is KAIROS.

What is KAIROS

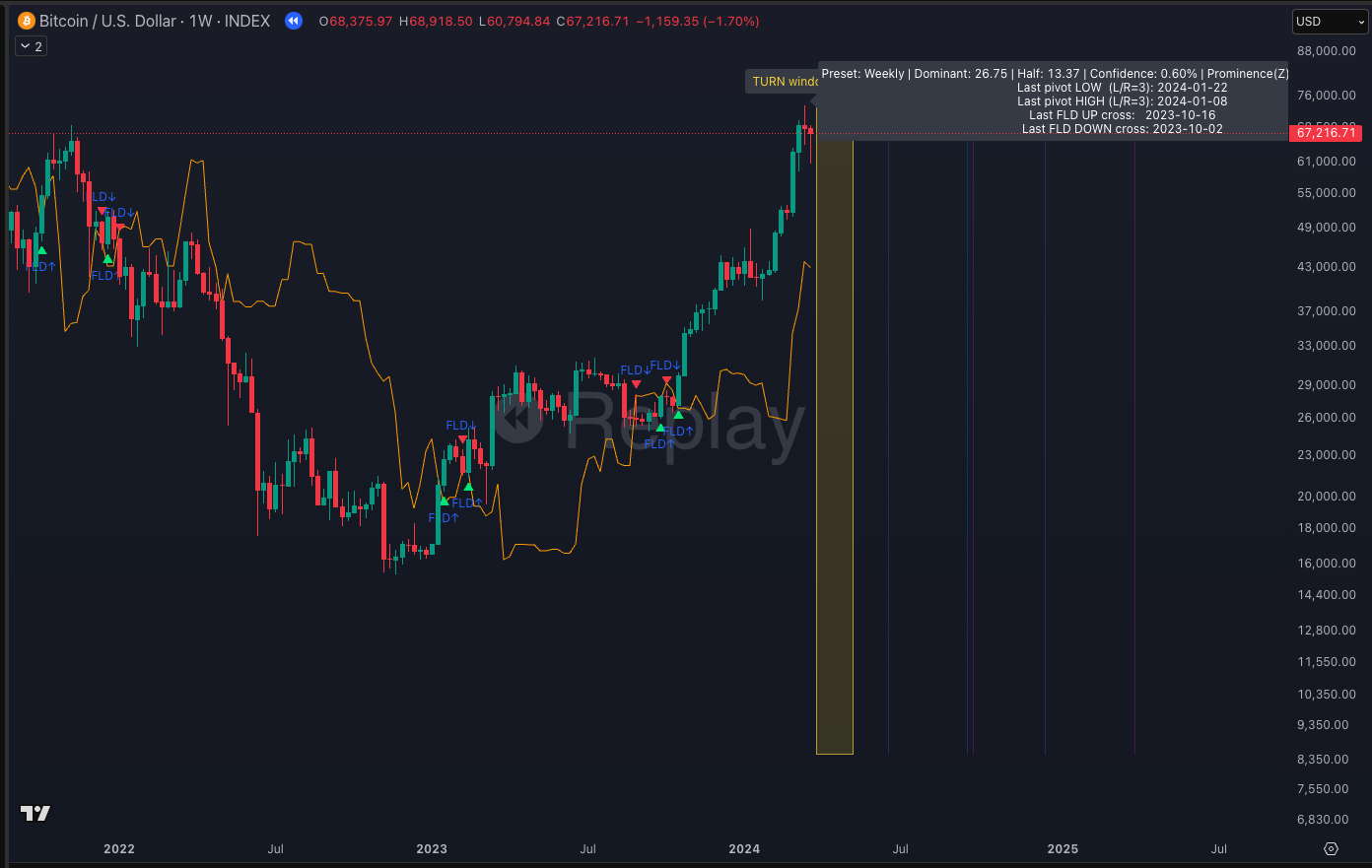

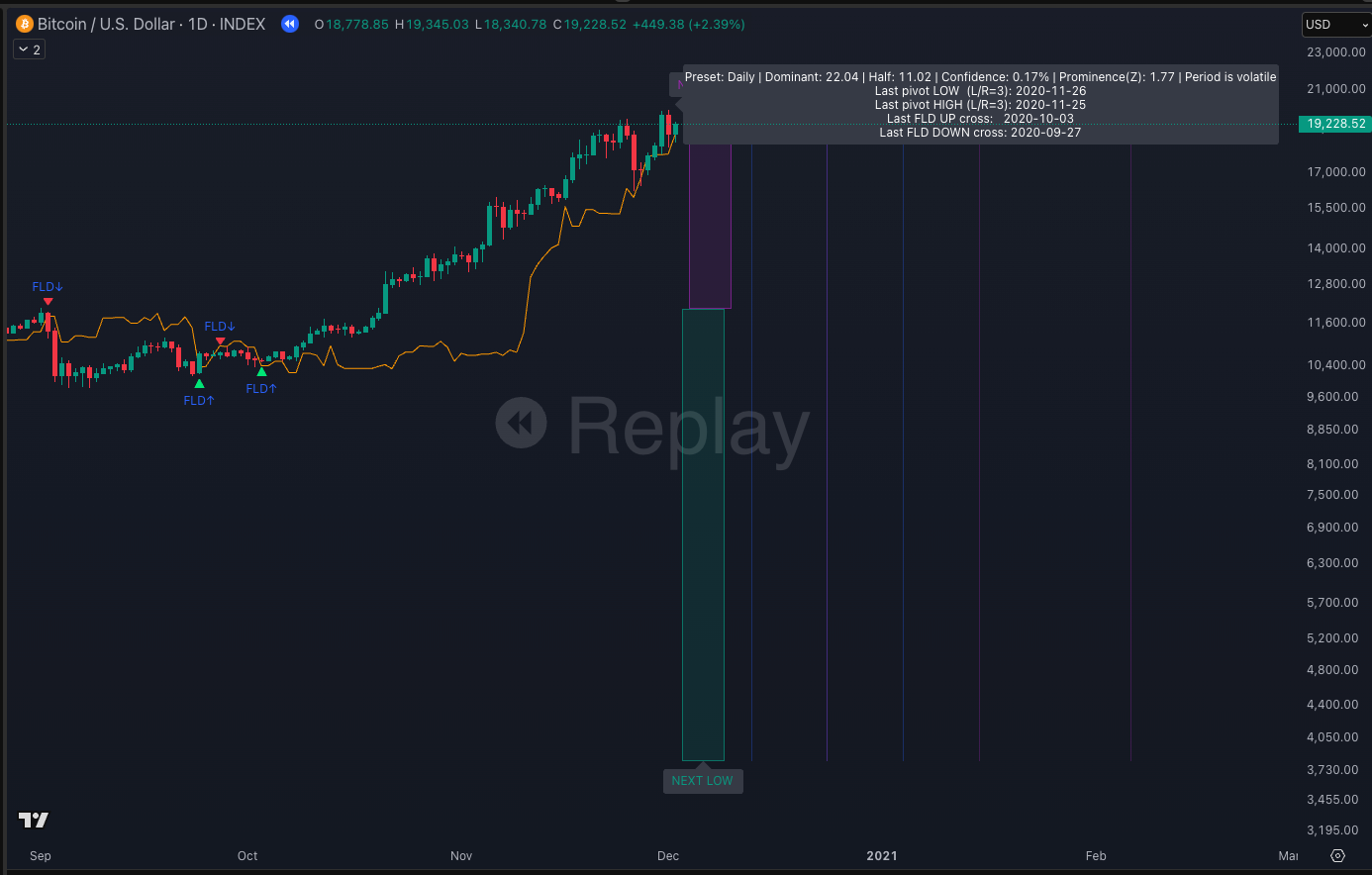

KAIROS is a timing framework for crypto. It estimates the market’s dominant cycle, projects half and full cycle guides into the future, and highlights windows where highs, lows, or turns tend to cluster. Inside those windows we look for simple confirmation, most often an FLD cross, and then we act according to plan. KAIROS is not another pile of signals. It is a way to structure time so your analysis, risk, and execution line up at the right moment.

The Vision

KAIROS is not about predicting the exact candle. It is about recovering rhythm, turning markets from constant noise into passages of time that you can plan around. After years of experience with Elliott wave and volume, I kept returning to the same truth: my best decisions had less to do with the latest pattern and more to do with waiting for the right moment. KAIROS exists so we can wait well.

Think of it as a shared sense of timing for our community. Each week we will point to the windows ahead that matter, discuss what kind of behaviour fits those windows, and show how confirmation can tip a bias into action. Not a crystal ball; a timetable.

What KAIROS changes in your trading

- You stop forcing trades. Most days are not special. KAIROS makes that visible so discipline feels natural, not heroic.

- You plan earlier. When a potential high or low window approaches, you are already journaling the scenario, levels, and risk.

- You act with context. Elliott structure, volume character, and confirmation, for example an FLD cross, align inside the timing window.

- You trade less, better. The goal is not more signals; it is fewer, decisive moments.

How we will use it together

You will see KAIROS featured in member videos and weekly posts:

- The calendar of relevance: which weeks or days matter for BTC and ETH, and why.

- Case studies: how prior windows resolved, and what we learn when they do not.

- Confluence: how wave counts, volume footprints, and sentiment play differently within a High, Low, or Turn window.

- Preparation: alerts, invalidation, and the If/Then plan we will execute only when the market proves it.

This is not a user manual. It is a practice: observe, prepare, wait, confirm, execute, review.

Why this works, and when it does not

Strengths

- Reframes time. Markets stop feeling urgent. You know when to care.

- Builds patience. The window is coming, you do not need to invent a setup.

- Clarifies risk. We anchor to prior pivots or ATR and measure targets with the market’s own rhythm.

- Plays well with Elliott wave and volume. Timing windows often mark where structure completes and where effort or absorption flips.

- Honest confidence. If the dominant cycle is not strong, we say so and we downshift expectations.

Limitations

- It is a window, not a promise. A zone of higher probability, not a single bar or guaranteed reversal.

- Windows can shift. In volatile regimes, the rhythm breathes; we will flag that and adapt size and expectations.

- News can override cycles. Sudden macro shocks can blow through otherwise clean timing.

- Liquidity matters. KAIROS is most reliable on BTC, ETH, and liquid majors; thin markets smear the signal.

- Confirmation is still required. Timing without proof is temptation. We wait for it.

The mindset KAIROS teaches

- Respect the ordinary. Most time is setup time. That is not wasted, it is where professionalism lives.

- Let the market invite you. A timing window with confirmation is an invitation. Everything else is a distraction.

- Journal the why, not just the what. We record the window context, the confirmation, and the outcome. Wins and misses both build the edge.

What to expect each week

- A simple forward view of windows, High, Low, and Turn, on Daily and Weekly for BTC, with ETH and key pairs when relevant.

- Scenario maps: what would confirm the long or short idea inside each window, and what invalidates it.

- Post-mortems: we learn as much from a missed window as from a perfect hit.

- Live reminders: when a window approaches, you will know what you are waiting for, and what you are ignoring.

A final, sincere note

KAIROS will not make you omniscient. It will make you patient. It will not replace your judgment. It will focus it. If you have ever felt right idea, wrong timing, this is our shared solution: not louder signals, but better moments.

Welcome to KAIROS. Let us trade the time that matters.

Discussion