What Is M2?

M2 is broad money in the banking system… currency in circulation, checking deposits, savings deposits, small time deposits, and retail money funds. It is a stock, not spending. When it grows quickly, financial conditions often feel easier. When growth slows or turns negative, conditions tighten and risk takes notice.

Real M2… and why you should care

Real M2 adjusts the nominal stock for inflation. If nominal M2 is flat while prices rise, real money power is falling. Markets respond to growth rates and inflection points more than absolute size.

US M2 vs Real M2

This overlay shows how the inflation adjustment creates a very different path… real M2 rolled over even as nominal stayed high.

This series highlights the pandemic jump, the 2022–23 dip, and the recent stabilisation… levels matter less than acceleration.

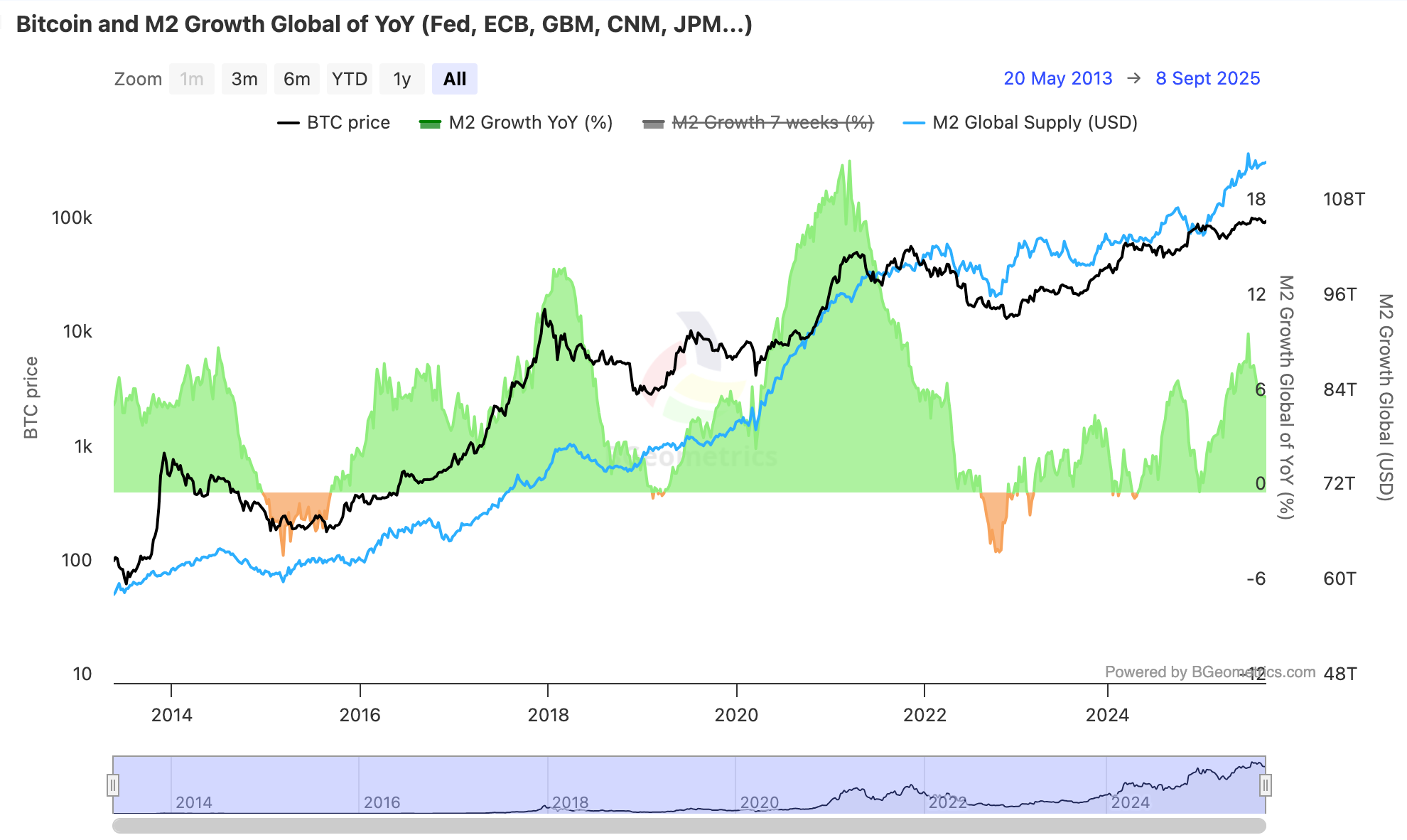

This chart pairs BTC price with global M2 growth and the global M2 level… useful for context when the US series alone looks noisy.

How M2 feeds into risk

- Liquidity tone: faster M2 growth often comes alongside easier policy and looser financial conditions… supportive for duration assets and crypto beta.

- Impulse vs trend: a turn higher in growth is usually more informative than a high level that is fading.

- Cross-checks: combine M2 with RRP, bank reserves, real yields, and DXY… if they point the same way, conviction rises.

Things people get wrong

- Treating M2 as a timing tool… it’s a backdrop, not a trigger.

- Ignoring inflation… nominal steadiness with rising prices equals real erosion.

- Looking at the US alone during global cycles… the BGeometrics panel helps.

- Chasing one month prints… wait for persistence.

A simple workflow you can reuse

- Check YoY and 3-month annualised for M2 and real M2… are they turning.

- Cross-reference RRP and bank reserves to judge plumbing.

- Look at 10-year real yields and DXY… do they confirm easier or tighter conditions.

- For crypto positioning… compare perp funding/basis with cash yields; if carry does not clear the hurdle, size down.

- Reassess after big policy weeks… react, don’t predict.

Mini FAQs

Does M2 cause price moves.

No… it’s a climate indicator. Markets care when the direction of growth changes.

Why did real M2 fall while nominal stayed high.

Inflation eroded purchasing power… the inflation adjustment took the shine off the headline stock.

Is global M2 better than US M2.

For BTC and large caps, the global read often tracks risk tone more cleanly… use both.

If this helped you separate liquidity from headlines, join Alpha Insider for Macro Heat dashboards, calendar previews for key prints, and a weekly positioning watchlist. Fewer mistakes, cleaner execution, more conviction.

The Markets Unplugged members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports

Tools in one place… crack on.

Discussion