Key Points

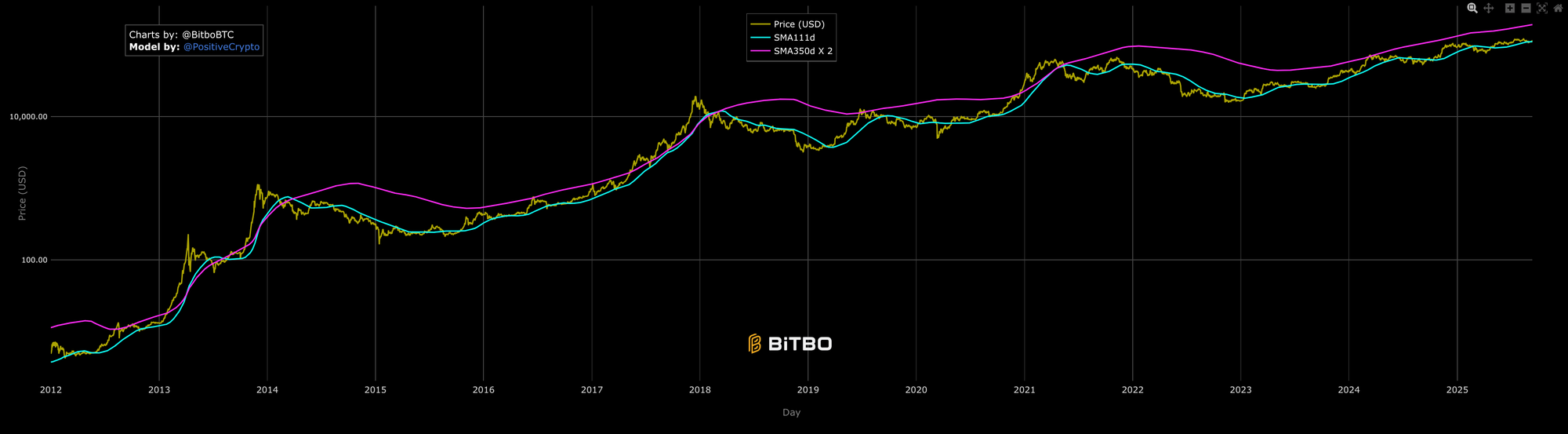

- Pi Cycle Top triggers when the 111-day moving average meets or crosses 2 times the 350-day moving average, a simple way to flag extreme extension versus a long baseline.

- The 111/350 cross without the 2 times band is slower and works better as backdrop context than as a top trigger.

- The indicator is best treated as a heat check, not a precise timing tool.

- Crosses can be early. Market peaks are usually a process, not a single candle.

- Confirmation matters. Pair Pi with behaviour and cost basis indicators such as SOPR, realised profit and loss, realised price bands, MVRV, and spending-age tools like CDD or VDD Multiple.

- Weekly reviews are usually enough for most readers.

- This guide is part of the Bitcoin on-chain series. For the full library of indicators and explainers, see the Bitcoin on-chain indicators hub.

- If any terms feel unfamiliar, use the Crypto Glossary, then return here.

Quick Answer

Pi Cycle Top is a moving-average heat indicator that has historically clustered around late-cycle extension phases. It triggers when the 111-day average meets or crosses 2 times the 350-day average, which typically happens after a strong run compresses the gap between fast trend and long baseline. The 111/350 cross without the 2 times band is slower and better for regime context than tops. Use Pi as a weekly risk temperature check, then confirm with on-chain behaviour and cost basis indicators before forming a view.

What Is The Pi Cycle Top And The 111 To 350 DMA Cross?

Pi Cycle Top triggers when the 111-day simple moving average meets or crosses 2 times the 350-day simple moving average. It is best treated as a heat check, highlighting periods where price has become unusually extended versus a long-term baseline.

The 111-day versus 350-day cross without the 2 times band is slower and typically works better as broader regime context rather than a top signal.

This shows price with the 111-day and 2 × 350-day averages. Crosses cluster near past blow-offs because parabolic runs pull the 111-day far above the long baseline.

What It Captures And Why It Can Trigger Early

- Rapid extension: Strong advances can compress the gap between the 111-day average and the 2 times 350-day level, pushing the indicator toward a trigger.

- Late-cycle behaviour: The trigger often appears before the final peak. Market tops are usually a sequence of stages, initial high, consolidation, and a final push, rather than a single moment.

- Regime sensitivity: The signal is more informative in sustained trends. In sideways markets it may stay inactive for long periods, which is a feature, not a flaw.

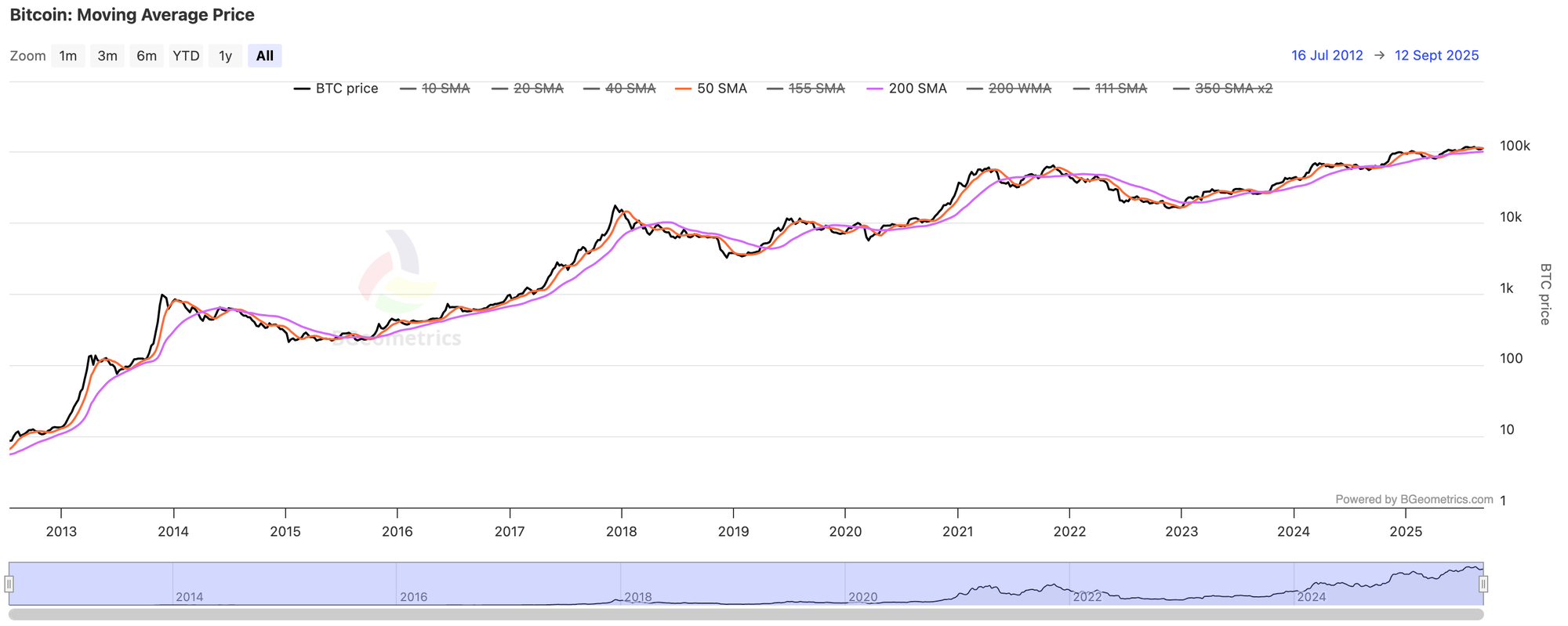

Set the short MA to 111 and the long to 350. Watch the spread widen during advances and contract during digestion… the re-convergence phase is where risk cools.

What It Does Not Do And Common Misreads

- It is not an automatic sell trigger: A cross can appear before a final extension phase, or during a prolonged sideways period.

- It is not designed to time bottoms: This is a top-side heat tool, not a downside valuation or capitulation indicator.

- It does not include flows or liquidity: ETF demand, issuance dynamics, and macro conditions can dominate price action even when moving averages look stretched.

- It can miss complex topping patterns: Double tops and rolling distributions can produce an early trigger near the first peak, with a later peak occurring without a fresh signal.

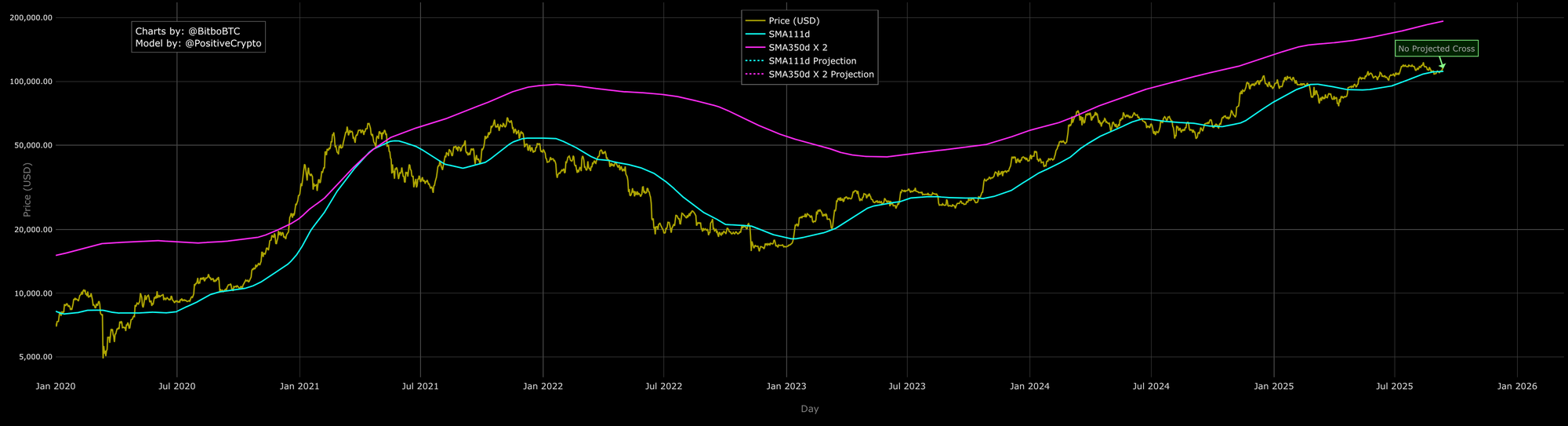

Projection panels estimate whether a new cross is likely on current trajectories. Use it to plan… not to predict the exact day.

Practical Guide Rails For Interpretation

- Price above the 111-day and 350-day averages, with the 111-day rising: This usually aligns with a healthier trend regime, where pullbacks tend to resolve more cleanly than in late-cycle conditions.

- The 111-day rolling over toward the 350-day after an extended run: This often signals momentum is fading and the market is becoming more vulnerable to failed breakouts and longer consolidation.

- A Pi Cycle trigger or near-touch: Treat this as a prompt to tighten risk awareness. Focus on confirmation from breadth, cost basis context, and on-chain behaviour rather than assuming the cross alone is decisive.

- Near-heat readings with weak breadth: Be cautious about interpreting the move as fresh trend continuation. In these conditions, confirmation matters more than speed.

How To Pair Pi With Other Indicators

- Pi heat plus spending-age pressure (CDD or VDD Multiple): If older supply is moving in size, it can support a distribution read. Confirm with flows and realised behaviour before treating it as decisive.

- Pi heat with profit-taking still being absorbed (SOPR above 1 and a healthy realised profit to loss balance): This can suggest the market is still accepting realised gains. Risk can still be rising, but confirmation from multiple indicators matters.

- Post-cooldown improvement (111-day turning up after a reset, with derivatives pressure easing): This combination can align with a healthier regime than late-cycle extension, particularly if broader participation improves.

- Momentum deterioration (111-day rolling over toward, or below, the 350-day with weakening breadth): This can signal a transition from trend to distribution or consolidation, where confirmation becomes more important than single-indicator reads.

What The Chart Typically Shows

Across cycles, Pi Cycle triggers tend to cluster around late-cycle extension phases, but not always on the exact candle high. The gap between the moving averages often widens during strong advances, then begins to narrow as momentum slows and the market digests gains. When the averages are not converging, it often suggests consolidation is more likely than an immediate final acceleration.

A Reusable Workflow You Can Apply

- Keep three charts available: Pi Cycle Top history, a 111-day versus 350-day view, and the Pi projection chart used by your chosen provider.

- Each week, label the backdrop. Conditions are usually healthier when price holds above the 111-day and 350-day averages with the 111-day rising. Conditions become hotter when the 111-day presses toward the 2 times 350-day level.

- Look for confluence before drawing conclusions. A near-trigger is more meaningful when it aligns with spending-age pressure (CDD or VDD Multiple) and cohort rotation tools such as RHODL.

- Treat cooling as a process. A cleaner reset often includes the 111-day flattening and turning up again, behaviour indicators stabilising, and broader participation improving.

- Review weekly and focus on persistence rather than headlines.

Mini FAQs

What is the Pi Cycle Top indicator?

It triggers when the 111-day moving average meets or crosses 2 times the 350-day moving average, acting as a heat check for late-cycle extension.

Why 111 and 350, and why the 2 times band?

They are empirical settings that have historically captured fast trend acceleration versus a long baseline. The 2 times band is a stretch line, not a guarantee.

What is the difference between Pi Cycle Top and the 111/350 cross?

Pi Cycle uses the 2 times 350-day band and is more top-side focused. The raw 111/350 cross is slower and more useful as broad regime context.

Does a Pi Cycle cross mean the top is in immediately?

No. Crosses can be early and peaks are often a process. Treat it as a prompt to tighten attention and check confirmation indicators.

Can Pi Cycle logic be used on altcoins?

The moving-average concept can be applied, but liquidity and cycle behaviour differ. Any use on alts needs extra confirmation and wider error bars.

What should confirm a Pi Cycle Top signal?

Confirm with profit-taking behaviour (SOPR, realised profit and loss, realised PnL ratio), cost basis context (realised price bands, MVRV), and spending-age or flow indicators (CDD, VDD Multiple, exchange netflows).

How often should it be checked?

Weekly is usually enough. Focus on persistence and confluence, not day-to-day noise.

If this helped you treat Pi Cycle as a heat filter rather than a timing trigger, Alpha Insider members can access deeper Bitcoin on-chain analysis and commentary here.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in clear, simple terms

➡️ A private Telegram community where conviction is shared daily

Built for steadier cycle context… week to week.

Discussion