Key Points

- The Puell Multiple compares Bitcoin miner revenue today against its 365 day average, so it shows whether miner income is unusually high or low versus the past year.

- It is most useful as a cycle context tool, because miner profitability pressure and relief often clusters near extremes.

- It is not a standalone timing signal… it works best when confirmed by cost basis, profit and loss, and flow indicators.

- Use a weekly view to reduce noise, and pay attention to time spent in a band, not a single spike.

- This guide is part of the Bitcoin on-chain series. For the full library of indicators and explainers, see the Bitcoin on-chain indicators hub.

- If any terms feel unfamiliar, use the Crypto Glossary, then return here.

Quick Answer

The Puell Multiple measures miner revenue in USD relative to its one year average. High readings mean miners are earning far above the recent norm, which can increase distribution risk. Low readings mean miner revenue is stressed, which has historically clustered closer to bear market exhaustion. Use it as a profitability context layer, then confirm with cost basis and flow data before forming a view.

What Is the Puell Multiple?

The Puell Multiple compares the daily USD value of Bitcoin miner issuance with its 365-day average. It is a way to see whether miners are earning unusually high or low revenue relative to the past year, which often aligns with cycle extremes driven by profitability pressure or relief.

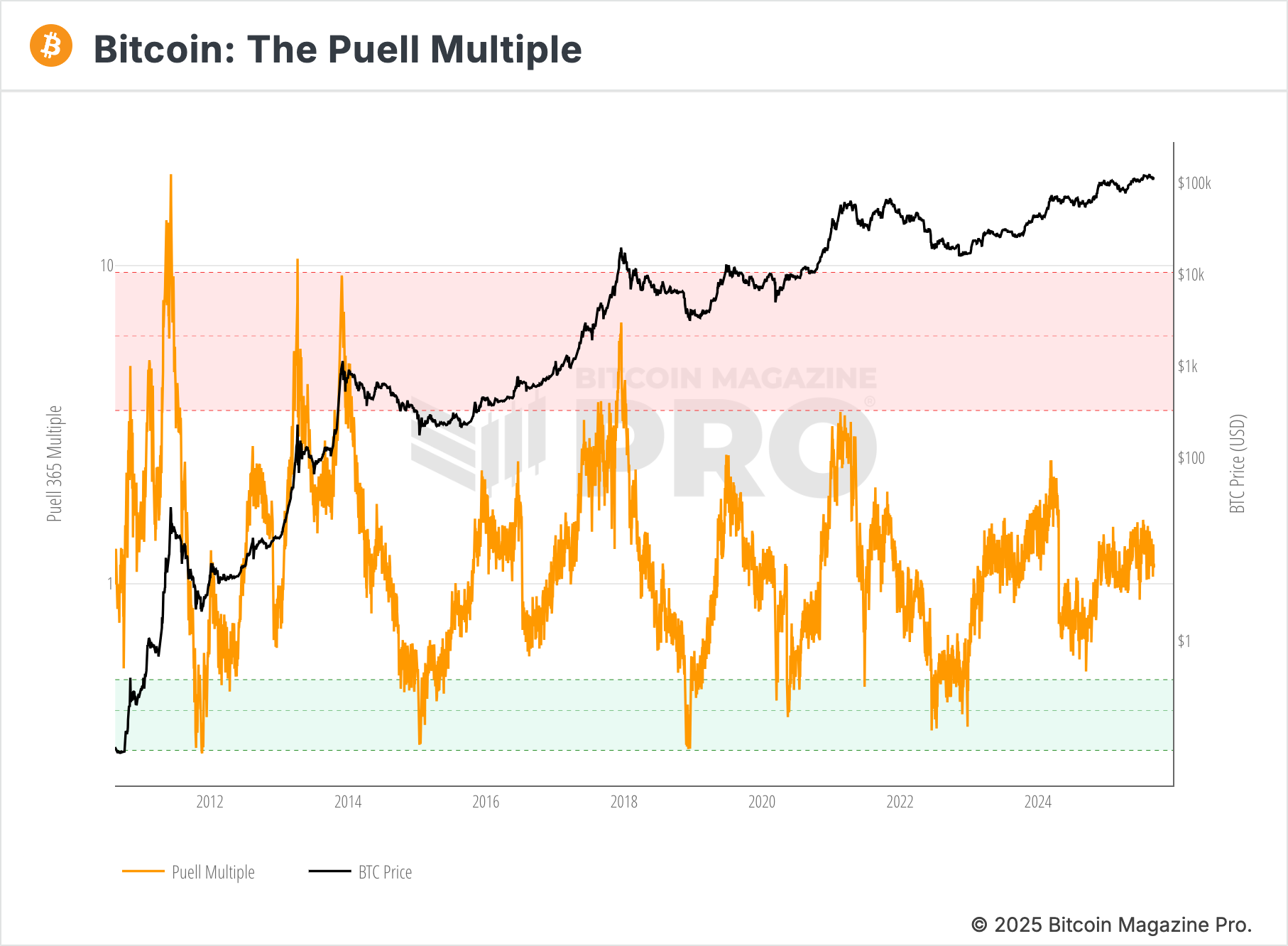

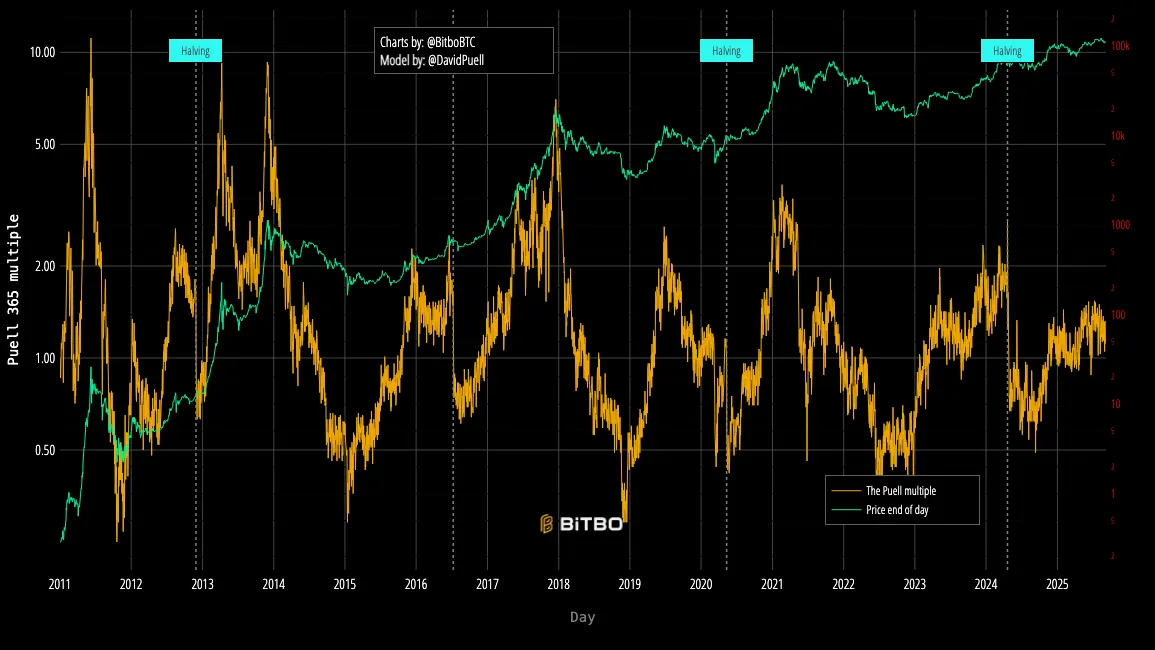

This chart shows miner revenue relative to its yearly average with colour bands that help frame top and bottom risk.

How Is Puell Multiple Calculated?

- Calculate the daily issuance value: new BTC mined that day × spot price in USD.

- Compute the 365-day moving average of that issuance value.

- Puell Multiple = Daily issuance value ÷ 365-day average issuance value.

Values above 1.0 indicate miners are earning more than the yearly average in USD terms. Values below 1.0 indicate revenue is below the yearly average.

Why Miner Revenue Matters

- Supply pressure: miners need to sell some production to cover costs. Revenue stress can tighten supply to exchanges, while windfall revenue can encourage more distribution.

- Cycle context: extreme profits have coincided with late-cycle euphoria before major tops; deep stress has coincided with capitulation areas near bottoms.

- Macro sensitivity: Puell folds in price, issuance, and halving effects, giving a clean profitability lens.

Interpreting the Bands

Treat ranges as guides, not triggers. Bands shift as issuance declines across halvings.

- < 0.5: severe miner stress, often seen around cyclical bottoms.

- 0.5–1.0: subdued conditions that favour accumulation phases.

- 1.0–2.0: neutral to constructive expansion.

- 2.0–4.0: elevated revenue; monitor for distribution.

- > 4.0: historically associated with late-cycle risk.

Practical Reads

- Trend and persistence: a brief spike can be noise; sustained elevation in high bands while other indicators warm increases risk.

- Post-halving behaviour: issuance drops can pull Puell lower for months; use percentiles to compare across cycles.

- Reaction to price drops: if price falls but Puell stays high, miners may still have strong USD revenue, supporting distribution.

Use Puell With Confluence

Combine Puell with:

- Realised Price bands (Market, LTH, STH): check whether miner distribution meets rising cost basis or weak support.

- SOPR and Realised PnL: confirm whether profits are actually being realised into the market.

- Exchange netflows and miner-to-exchange flow: validate if high Puell coincides with greater miner selling pressure.

Common Pitfalls

- Reading fixed thresholds as absolutes without considering halvings and changing miner economics.

- Ignoring the duration spent in a band; persistence matters more than a single print.

- Using Puell in isolation without checking whether coins are actually moving to venues.

A Simple Workflow You Can Reuse

- Open Puell Multiple (weekly) and note current band and direction.

- Cross-check Market/LTH/STH Realised Price for valuation support.

- Check aSOPR and Realised Profit/Loss for distribution or absorption.

- Glance at miner-to-exchange flows on a weekly view.

- Decide: manageable miner revenue with support, or elevated revenue aligning with distribution risk.

Mini FAQs

Does a high Puell Multiple always mean a top is near?

No. High readings can persist while demand absorbs supply. Risk rises when Puell is elevated and other indicators confirm distribution.

Why can Puell stay low after halvings?

Issuance drops reduce miner revenue mechanically. Compare regimes using percentiles and surrounding context, not fixed thresholds alone.

Is the Puell Multiple a timing tool by itself?

No. Treat it as a miner profitability layer that works best with valuation, profit and loss, and flow confirmation.

What timeframe is best for Puell reads?

Weekly is usually enough for most readers. Daily moves can be noisy and often do not change the regime read.

What should Puell be compared with for confirmation?

Use realised price bands for cost basis context, SOPR or realised profit and loss for spending pressure, and miner to exchange flows for distribution confirmation.

If this helped you, Alpha Insider members can access deeper Bitcoin on-chain analysis and commentary here.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in clear, simple terms

➡️ A private Telegram community where conviction is shared daily

Built for clearer decisions, week after week.

Legal And Risk Notice

This content is for education only and does not constitute financial advice. Crypto assets are volatile and you can lose money. Always do your own research and consider your risk tolerance.

Discussion