Real yields are inflation-adjusted interest rates. A practical daily proxy is the 10-year TIPS real yield, published on FRED as DFII10. Gold does not pay a coupon, so when real yields rise, the opportunity cost of holding gold increases. When real yields fall, that carry cost drops and gold often finds support.

Key points

- Real yield means yield after inflation, not the nominal Treasury rate.

- DFII10 is a widely used proxy for the 10-year real yield, updated daily.

- Real yields up often pressures gold, because the opportunity cost rises.

- Real yields down often supports gold, especially when DXY is also weakening.

- Always check whether moves came from real rates or breakevens, because the driver changes the read.

If you want quick definitions for TIPS, breakevens, DXY, and CPI, see the Crypto Glossary.

What Are Real Yields

A real yield is the return on a bond after adjusting for inflation. In practice, many traders use the 10-year TIPS real yield series as a clean daily proxy.

- DFII10 rising usually means real rates are tightening.

- DFII10 falling usually means real rates are easing.

Because gold has no yield, real yields are one of its most important macro drivers.

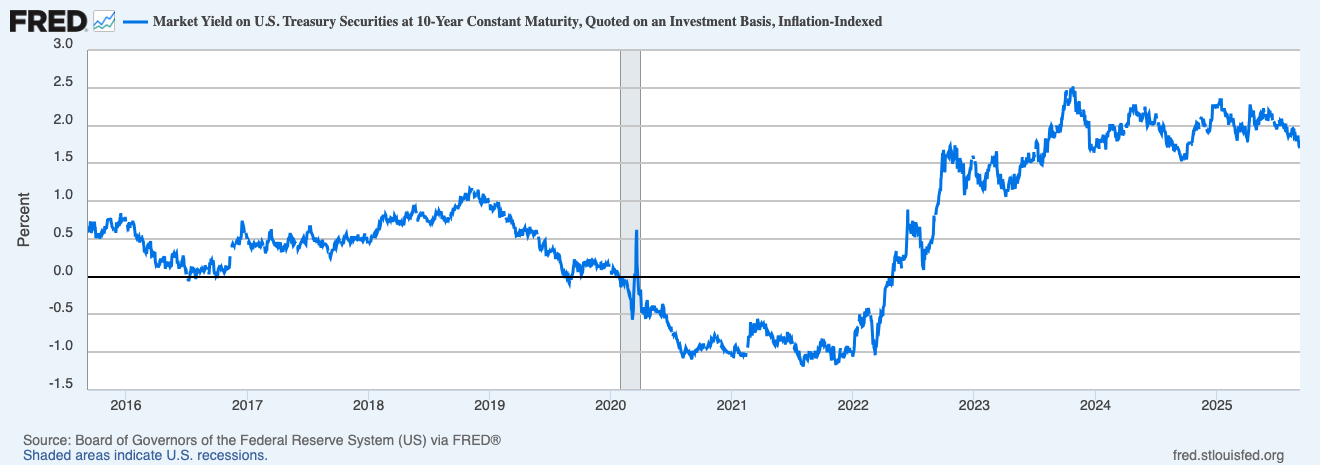

This level view since 2015 shows the slide into negative territory, the sharp climb in 2022, and the higher plateau through 2024 to 2025.

A weekly view of gold trend and momentum as real yields shifted.

How Gold And Real Yields Usually Behave

Real yields up, gold pressured

Higher inflation-adjusted returns increase the opportunity cost of holding gold.

Real yields down, gold supported

The carry cost falls and macro hedging demand can lift.

DXY adds bite

A firm dollar can mute gold even when real yields slip. A softer dollar can amplify the upside when real yields fall.

Practical Reads You Can Trust

Use these as clean, repeatable reads.

- Gold pushing higher while DFII10 drifts lower

A supportive mix for gold. It often aligns with easier conditions for duration assets too. - Gold stuck while DFII10 chops sideways near highs

Carry is still heavy, so rallies tend to fade faster. - DFII10 rolling over for several weeks and DXY softening

More room for trend continuation in gold. - Hot CPI lifts DFII10 but gold holds up

Positioning or safe-haven demand can offset. Wait for follow-through before fading the move.

Common Snags To Avoid

- One-day spikes around CPI or jobs

Wait for persistence across a few sessions. - Breakeven noise versus real-rate moves

Check whether the shift came from inflation expectations or the real leg. - Ignoring term structure

Front-end real yields can move differently to the 10-year. DFII10 is a strong anchor for swing decisions, but context still matters.

A Simple Workflow You Can Reuse

- Put DFII10 and XAUUSD weekly side by side. Mark direction and the latest higher-high or lower-low.

- Cross-check DXY. A softer dollar strengthens the gold read.

- Check breakevens to separate inflation-expectation moves from real-rate moves.

- Around CPI or FOMC weeks, reduce decision frequency. Re-assess once DFII10 confirms the break.

- For crypto overlap, falling real yields plus softer DXY is often the friendliest macro backdrop for beta.

Mini FAQs

Why use DFII10 specifically?

It is the standard 10-year TIPS real yield series, widely watched and updated daily.

Can gold rise with rising real yields?

Briefly, yes. Flight-to-safety flows or supply shocks can dominate. The sustained trend still tends to track the direction of real yields.

Do I need futures or is spot fine?

Spot XAUUSD is enough for the macro read. Futures matter mainly for carry mechanics and positioning analysis.

If this helped you line up gold with the real-yield driver, join Alpha Insider for Macro Heat dashboards, calendar previews for the next prints, and a weekly positioning watchlist. Fewer mistakes, cleaner execution, more conviction.

The Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports

Blueprint locked… your move.

Discussion