Oil and copper are still two of the cleanest dials for the macro tape. Oil leans into inflation pressure, supply risk, geopolitics, and the dollar. Copper leans into global manufacturing, capex, China demand, and electrification. Alone, neither “times” anything… together, they often define the backdrop for risk.

Oil and copper still matter because they summarise the macro mix. Persistent oil strength often points to inflation pressure and tighter financial conditions, while persistent copper strength tends to track global manufacturing and China-led demand. Read them together with the dollar and real yields to judge whether markets are pricing reflation, a supply shock, or a growth scare.

If you want quick definitions for terms like breakevens, real yields, and PMIs, see the Crypto Glossary.

Key points

- Oil strength tends to keep inflation expectations supported and financial conditions tighter.

- Copper strength tends to reflect improving growth expectations and easing credit stress.

- The combined read matters more than any single move.

- Always cross-check the message with the dollar and real yields to avoid false signals.

Why Oil and Copper still matter

Two simple dials frame the macro tape…

- Oil leans into inflation, supply squeezes, geopolitics, and the dollar.

- Copper leans into manufacturing, capex, China construction and electrification.

You won’t time entries off one candle, but the direction and persistence of these two often set the background for risk.

Weekly structure for copper… a clean growth proxy that reacts to global manufacturing cycles and China policy pulses.

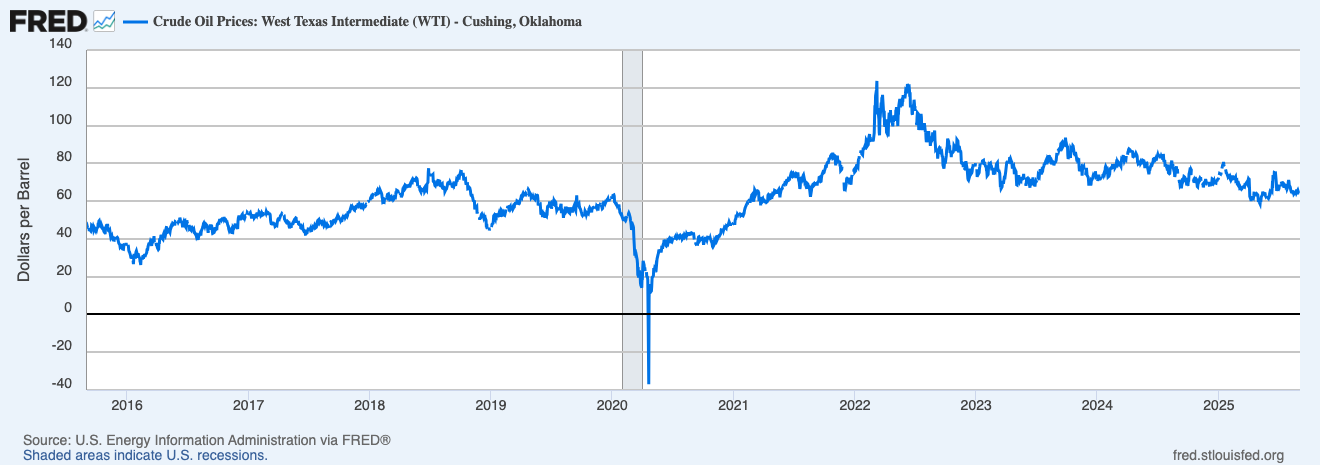

WTI through the hiking cycle… trends here feed inflation expectations, real yields, and the dollar.

What a Rising Oil Tape Usually Says

- Inflation impulse: persistent oil strength props up headline prints, can re-heat breakevens, nudges real yields.

- Policy tone: stickier inflation risk keeps the front end firm… tighter financial conditions, dollar support.

- Cross-asset: energy equities and related credit bid, high-beta tech and long duration can wobble if real yields firm.

- Crypto: stronger dollar plus firmer real yields is a headwind… funding has to clear a higher hurdle.

What a Rising Copper Tape Usually Says

- Growth pulse: copper tends to perk up ahead of PMI turns… factories and build-out demand, innit.

- China lens: stimulus headlines and property relief often show up here before they hit PMIs.

- Cross-asset: cyclicals breathe, curve steepeners get traction, credit nerves calm.

Read Them Together… Not in Isolation

- Oil up, copper up: classic reflation… watch breakevens and the 5s10s curve… good for cyclicals, mixed for duration.

- Oil up, copper flat/down: supply shock, not growth… respect risk as real yields and the dollar can tighten.

- Oil down, copper up: softer inflation with firm growth… friendly for duration and beta.

- Both down: growth scare vibes… confirm with PMIs, HY spreads, and MOVE.

Watch-Outs

- One-off OPEC headlines can spike oil without a macro shift… wait for follow-through.

- Copper warehouses and LME squeezes can distort price short-term… check PMIs and freight for confirmation.

- Dollar swings invert the read… a surging DXY can cap both even if fundamentals are fine.

- Seasonality and maintenance windows in energy can add noise around spring and autumn.

A Simple Workflow You Can Reuse

- Open WTI and HG1! on weekly… mark trend direction and key levels.

- Cross-check DXY and 10-year real yields… do they amplify or mute the message.

- Pair with PMIs and breakevens… growth vs inflation mix decides whether it’s reflation or a shock.

- For crypto… size up when copper trends higher and the dollar is rolling over; size down when oil grinds up with firmer real yields.

- Reassess after major data or OPEC meetings… react once moves stick for more than a session.

Mini FAQs

Why not use Brent instead of WTI.

Brent is fine for a global read… pick one and be consistent. The signal is the persistence, not the brand.

Is copper still a good proxy with EVs and new demand.

Yes… electrification lifts its structural floor, but the cyclical swings still map to PMIs and China policy.

Can crypto rally while oil rips.

Sure, if the dollar is falling and liquidity is improving. That’s why you always pair these charts with DXY and real yields.

If this helped you read growth and inflation tells without the noise, join Alpha Insider for Macro Heat dashboards, calendar previews for the next prints, and a weekly positioning watchlist. Fewer mistakes, cleaner execution, more conviction.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports

Sorted… now execute.

Discussion