Key Points

- Realised profit and realised loss measure what happens when coins are actually spent on-chain… whether holders lock in gains or lock in losses.

- Unlike unrealised indicators, these metrics track completed behaviour, so they are useful for spotting capitulation, relief rallies, and late-cycle profit-taking conditions.

- Realised profit tends to rise when holders distribute into strength. Realised loss tends to spike when panic selling or forced selling dominates.

- The strongest reads come from relative balance and persistence, not one-day spikes… watch whether profits dominate for weeks, or losses dominate for weeks.

- Use these metrics with confluence, confirm with cost basis tools like realised price bands and MVRV, and behaviour tools like SOPR and realised PnL ratio.

- Weekly reads are usually enough for most people… daily prints can be noisy and event-driven.

- This guide is part of the Bitcoin on-chain series. For the full library of indicators and explainers, see the Bitcoin on-chain indicators hub.

- If any terms feel unfamiliar, use the Crypto Glossary, then return here.

Quick Answer

Realised profit and realised loss track how much profit and loss is being locked in when Bitcoin is spent on-chain. When realised profits dominate, holders are distributing into strength and the market is digesting gains. When realised losses spike and dominate, holders are capitulating and selling at a loss, which can align with stress regimes and late-bear exhaustion when it persists. Use these measures as behaviour confirmation, then cross check cost basis and flow indicators to understand whether supply is being absorbed or redistributed.

What Are Realised Profit and Realised Loss?

Realised Profit and Realised Loss measure the USD value of gains or losses that were actually locked in on-chain when coins moved. They are not paper gains. They record what holders accepted at the moment of spending.

How Are They Calculated?

- For each spent output, compare its value when created with its value when spent.

- If the spend value is higher, the difference contributes to Realised Profit.

- If the spend value is lower, the difference contributes to Realised Loss.

- Aggregate across all spends for the chosen period.

Because they capture finalised outcomes, these series tell you how the market is behaving at turning points.

Why These Metrics Matter

- They identify whether rallies are being distributed into or absorbed.

- They reveal capitulation when losses are locked in aggressively.

- They help separate healthy pullbacks from trend damage by showing how participants choose to exit or hold.

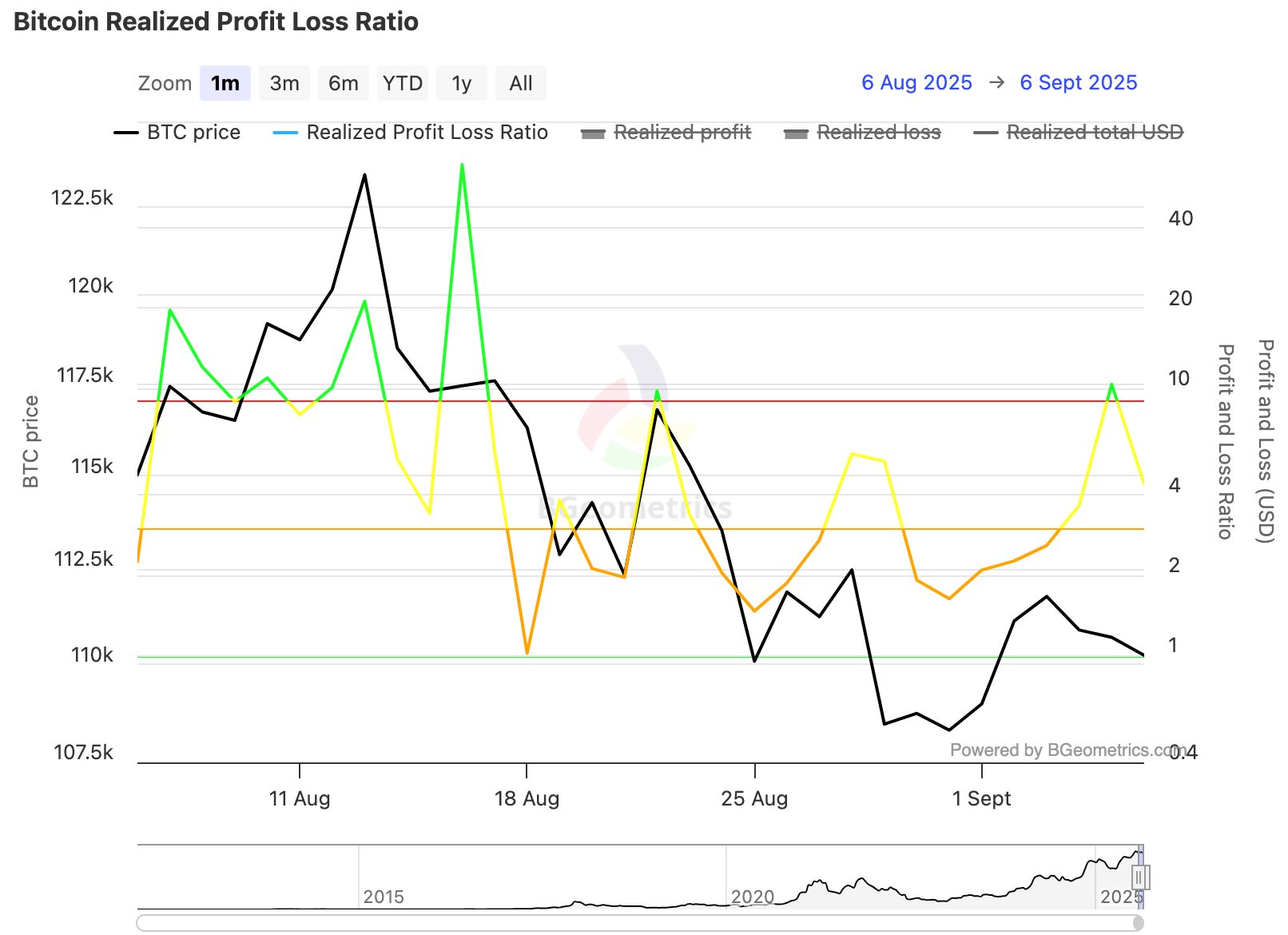

Reading the Attached Charts

1) Profit/Loss Balance at a Glance

This panel tracks the ratio of realised profit to realised loss. Peaks point to profit-taking dominance, troughs point to loss realisation dominance around pullbacks.

How to read it:

- Ratios above 1 show profit-taking outweighing loss-taking. In established advances this can be fine if price digests the flow.

- Repeated spikes in the ratio while price stalls often signal distribution.

- Moves below 1 during drawdowns reflect capitulation. A swift recovery back above 1 suggests losses were absorbed.

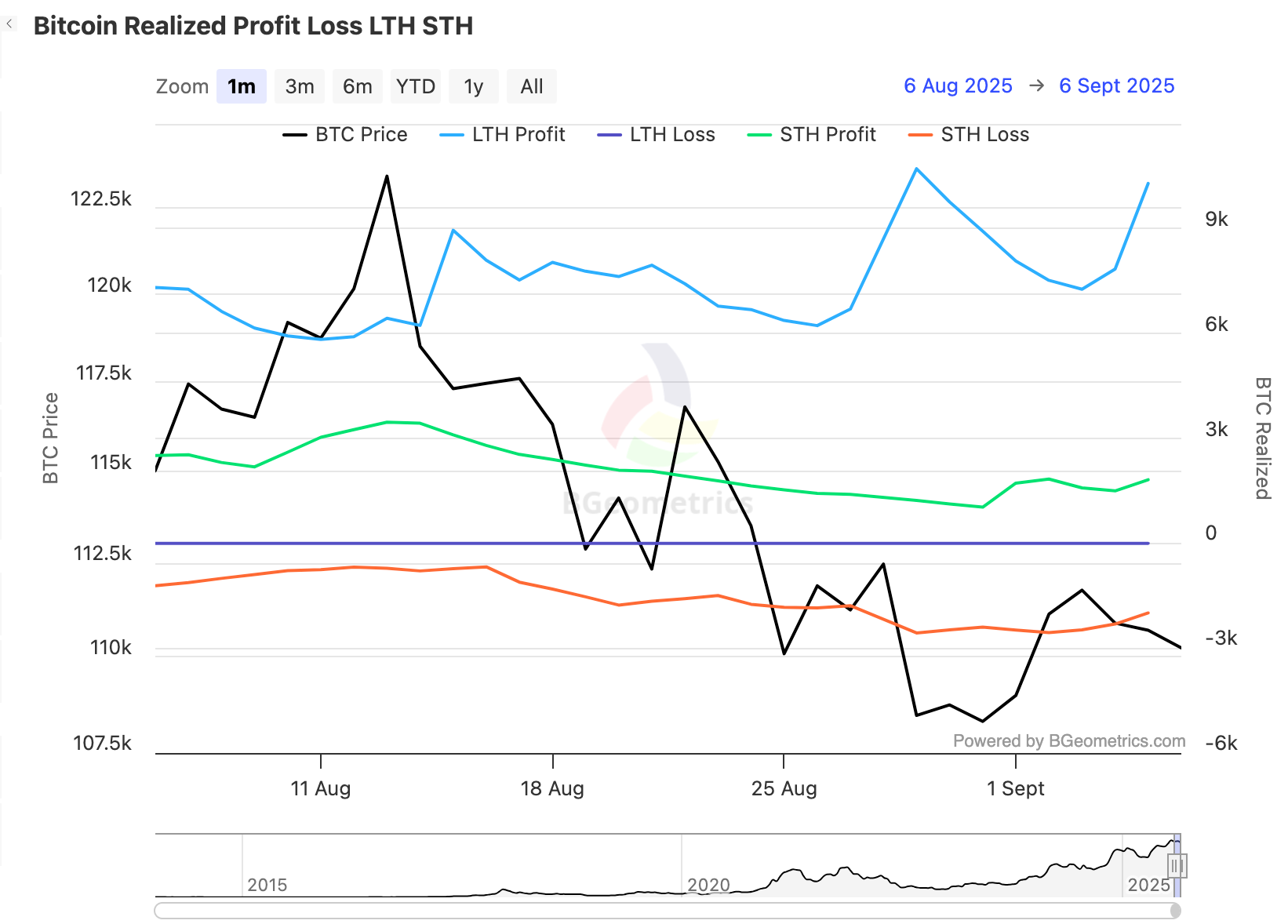

2) Who Is Doing The Realising? LTH vs STH

This panel splits realised outcomes between short-term holders and long-term holders.

How to read it:

- Rising STH Profit with modest LTH Profit is typical of trend health. Recent buyers realise gains while older hands remain steady.

- A jump in LTH Profit while price fails to push on is a distribution warning from older supply.

- An uptick in STH Loss during pullbacks is expected; if losses remain elevated yet price stabilises, absorption is occurring.

- Persistent LTH Loss is rare and usually marks late-bear capitulation phases.

3) Net Realised Profit/Loss (NRPL)

This chart nets profit and loss to show whether the period closed in surplus or deficit.

How to read it:

- Positive NRPL during price strength is normal. Watch the persistence of large surpluses without price progress for distribution risk.

- Negative NRPL during drops can mark capitulation. A quick return to neutral or surplus while price stabilises is constructive.

- Divergences between NRPL and price help flag stress. Price down with shrinking losses can precede relief.

What Capitulation and Euphoria Look Like

- Capitulation: loss prints rise quickly, NRPL turns negative, the Profit/Loss Ratio dips below 1 and remains there for several sessions. STH Loss leads, sometimes followed by brief LTH Loss near extremes.

- Euphoria: profit prints dominate, the ratio holds far above 1, NRPL shows large sustained surpluses. If LTH Profit accelerates while price stalls, risk of distribution rises.

Practical Use With Confluence

- Pair with aSOPR to test whether profits are absorbed around the 1.0 line.

- Add Realised Price bands to see if pullbacks are revisiting cohort cost basis.

- Check Dormancy or CDD to verify whether old coins are driving the move.

- Use URPD to identify cost-basis clusters likely to react when revisited.

Common Traps To Avoid

- Treating one spike as a signal. Persistence and context matter.

- Ignoring cohort split. LTH moves carry different weight to STH churn.

- Reading in isolation from liquidity venues. Exchange netflows help validate whether realised outcomes are feeding supply.

A Simple Workflow You Can Reuse

- Start with Realised Profit/Loss Ratio. Is the balance favouring profits or losses, and is it persistent.

- Open LTH vs STH to identify the cohort behind it.

- Check NRPL for surplus or deficit and look for divergences versus price.

- Cross-check with aSOPR and Realised Price bands to judge absorption.

- Decide: distribution risk, absorption with continuation, or capitulation turning point.

Mini FAQs

What is the difference between realised profit and unrealised profit?

Unrealised profit is paper gain held on wallets. Realised profit is only counted when coins are actually spent and gains are locked in.

Does high realised profit mean the market will dump?

Not necessarily. High realised profit can be absorbed for long periods. Risk rises when realised profit stays high and other indicators show distribution pressure is broadening.

Does high realised loss always mean a bottom is in?

No. Loss spikes can happen early in a drawdown too. The more useful read is persistence, repeated loss dominance can signal capitulation, especially when selling pressure begins to fade afterward.

How does this relate to SOPR?

SOPR shows the average profit or loss multiple on spent coins. Realised profit and loss show the total magnitude being locked in. They complement each other.

What should confirm a realised profit or realised loss read?

Use realised price bands or realised cap for cost basis context, SOPR or realised PnL ratio for behaviour confirmation, and exchange netflows to check whether selling is hitting venues.

How often should these be checked?

Weekly is usually enough for most readers. Daily checks can overreact to event-driven bursts.

If this helped you read capitulation and euphoria more cleanly, Alpha Insider members can access deeper Bitcoin on-chain analysis and commentary here.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in clear, simple terms

➡️ A private Telegram community where conviction is shared daily

Built for calmer weekly reads… with behaviour placed in context.

Legal And Risk Notice

This content is for education only and does not constitute financial advice. Crypto assets are volatile and you can lose money. Always do your own research and consider your risk tolerance.

Discussion