Key Points

- The fear and greed index in crypto is a sentiment indicator that summarises market emotion on a 0 to 100 scale.

- Crypto sentiment indicators do not predict price… they help you measure whether the crowd is fearful, neutral, or euphoric.

- Fear and greed index levels explained: values near the low end represent fear and stress, while values near the high end represent greed and optimism.

- Extreme fear vs extreme greed: extreme fear can show forced selling and panic conditions, while extreme greed can show crowded positioning and late-cycle behaviour.

- How to use fear and greed index in crypto trading: treat it as context, then cross-check with trend, support and resistance, and momentum indicators.

- The index can stay extreme for longer than beginners expect… so it is not a timing tool on its own.

- If any terms feel unfamiliar, use the Crypto Glossary for quick definitions, then return to this lesson.

Quick Answer

The fear and greed index in crypto is a market sentiment indicator that compresses multiple sentiment inputs into a single 0 to 100 reading. Lower values suggest fear and risk-off behaviour, while higher values suggest greed and risk-on behaviour. Extreme fear can appear near panic selling and sharp drawdowns, while extreme greed can appear when rallies are crowded and expectations are stretched. The best way to use the index is as a context filter, not a standalone signal. Confirm it with trend direction, key support and resistance zones, and momentum tools such as RSI or volume behaviour.

Where This Lesson Fits

Lesson 24 explained psychological support and resistance and why round numbers become decision zones. Lesson 25 adds the emotional layer behind those reactions by introducing crypto sentiment indicators and the fear and greed index, so you can judge whether the crowd is fearful, complacent, or euphoric.

This lesson is part of the Technical Analysis for Beginners series. For the full lesson map and all supporting guides, visit the Technical Analysis for Beginners Hub.

What Are Crypto Sentiment Indicators?

Sentiment indicators measure how people feel and behave, not the underlying fundamentals.

They help answer a practical question:

What is the crowd most likely to do next… panic, chase, or hesitate?

Crypto sentiment indicators can include:

- volatility-based fear measures

- momentum and trend strength measures

- positioning and funding measures in derivatives

- social and news intensity measures

- market dominance and rotation measures

Sentiment tools are useful because markets often overshoot when emotion dominates decision-making.

What Is The Fear And Greed Index In Crypto?

The fear and greed index is a single number designed to summarise market emotion.

It typically runs from 0 to 100.

- Lower readings suggest fear

- Higher readings suggest greed

It is popular because it is simple, but the simplicity can also mislead beginners if it is treated like a buy and sell button.

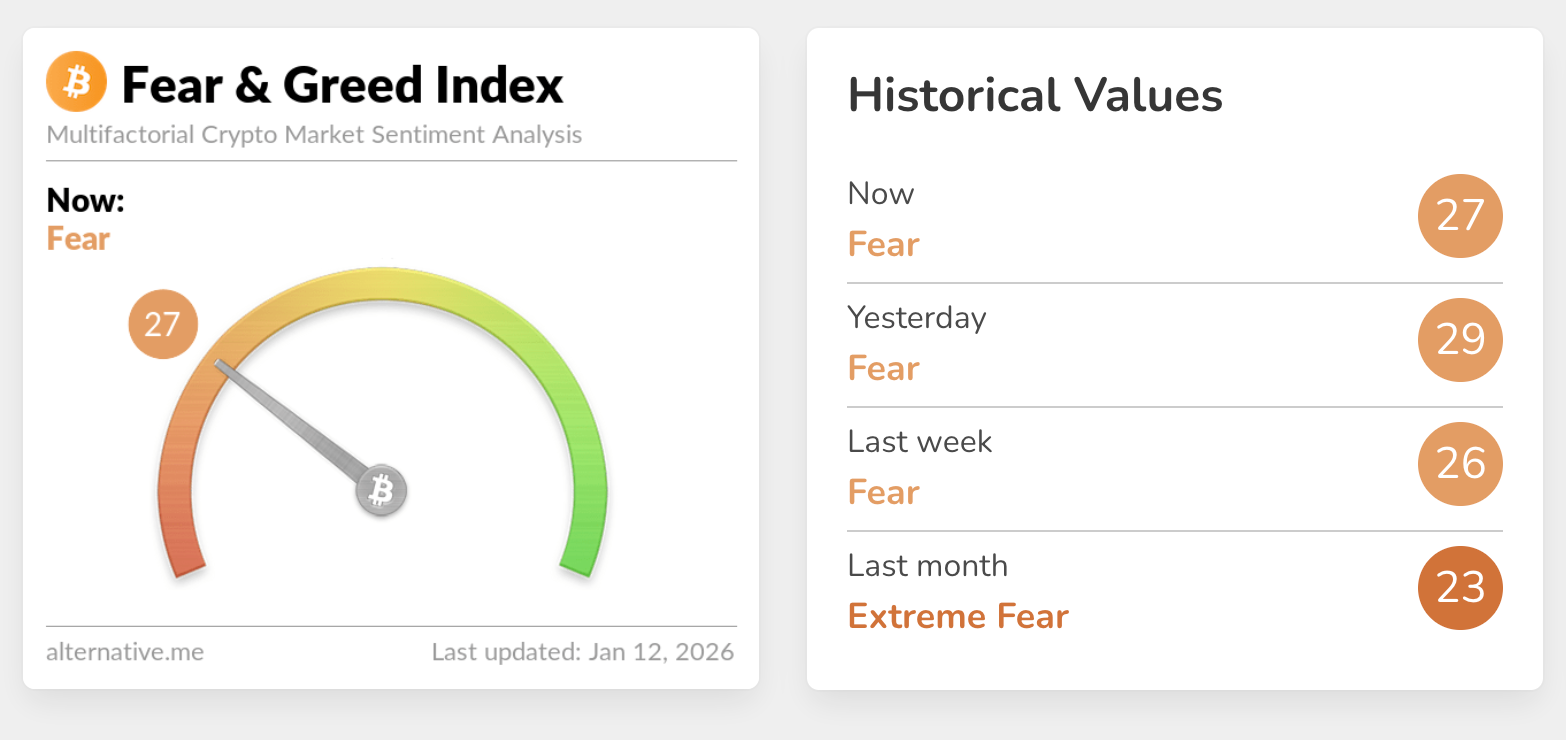

This image should show a 0 to 100 scale from extreme fear to extreme greed. Use it to explain how sentiment is categorised into zones, not exact turning points.

Fear And Greed Index Levels Explained

Different providers label the zones slightly differently, but the idea is consistent.

A common way to interpret the scale is:

- 0 to 24: extreme fear

- 25 to 49: fear

- 50: neutral

- 51 to 74: greed

- 75 to 100: extreme greed

Do not treat 75 or 24 as magic numbers. Treat them as a reminder that emotion is stretched.

Extreme Fear Vs Extreme Greed, What They Usually Look Like

Extreme fear often shows up when:

- price is falling fast

- headlines are overwhelmingly negative

- people are rushing to reduce risk

- volatility expands and confidence breaks

Extreme greed often shows up when:

- rallies feel obvious and crowded

- people believe pullbacks will not happen

- leverage and overconfidence rise

- volatility can compress even while risk builds underneath

Both extremes can persist. That is why sentiment is context, not timing.

How To Use Fear And Greed Index In Crypto Trading

This lesson is educational, not a trade instruction manual. The goal is to help you interpret sentiment correctly.

Use a three-step routine.

Step 1: Check The Trend First

Sentiment is interpreted differently depending on trend.

Mark:

- is the market trending up, trending down, or ranging

- is price above or below key moving averages

- are major support and resistance zones nearby

In a strong uptrend, high greed can persist. In a strong downtrend, fear can persist.

Step 2: Use Sentiment As A Risk Filter

Sentiment is most useful when it tells you the crowd is leaning too hard one way.

That reaction can come from:

- late buyers chasing after a long move

- panic selling after a fast drop

- emotionally driven decisions replacing structured analysis

When sentiment is extreme, you tighten your standards for confirmation and stop assuming the next move is guaranteed.

Step 3: Confirm With Evidence From Earlier Lessons

Sentiment becomes far more useful when it aligns with chart evidence.

Cross-check sentiment with:

- support and resistance behaviour

- breakouts and fakeouts logic from Lesson 21

- RSI momentum and divergence from Lessons 13 and 17

- Bollinger Band volatility context from Lesson 15

- volume behaviour from Lesson 12

If sentiment is extreme but price is not reacting at meaningful levels, treat it as background noise.

Is The Crypto Fear And Greed Index Accurate?

It is accurate at describing sentiment… not at predicting the next candle.

It is a summary tool, which means it can be late.

It can also stay extreme for long periods, especially during strong trends.

A more useful question is: is it consistent with what price and volume are doing at key levels?

If it is, it adds confidence. If it is not, it warns you not to overtrust one data source.

Common Mistakes With Sentiment Indicators

- treating extreme fear as an automatic bottom

- treating extreme greed as an automatic top

- ignoring trend context

- ignoring the role of key levels

- changing your plan because a sentiment number changed

Sentiment is a lens… not a steering wheel.

Mini FAQs

What is the fear and greed index in crypto?

It is a market sentiment indicator that summarises crowd emotion into a 0 to 100 reading, from fear to greed.

How do you use fear and greed index in crypto trading?

Use it as context, then confirm with trend direction and key levels, and cross-check with momentum and volume tools.

What do fear and greed index levels mean?

Lower readings suggest fear and stress, higher readings suggest greed and optimism. Extreme zones suggest emotion is stretched.

What is extreme fear vs extreme greed?

Extreme fear often reflects panic and forced selling behaviour. Extreme greed often reflects crowded optimism and late chasing behaviour.

Is the crypto fear and greed index accurate?

It is useful for measuring sentiment, but it is not a reliable timing tool on its own and can stay extreme for long periods.

What are other crypto sentiment indicators?

Common examples include funding rates, open interest changes, volatility measures, and broad positioning and flow indicators.

Next Lesson

In this lesson you learned what crypto sentiment indicators are, how the fear and greed index in crypto works, how fear and greed index levels are commonly interpreted, and how to use sentiment as context rather than a standalone decision tool.

You have now completed Lessons 13 to 25 of the Start Smart Technical Analysis series.

Before you move on, take Quiz 2 to lock in what you learned across this module, including RSI, MACD, Bollinger Bands, Fibonacci retracement, RSI divergences, stochastic oscillator, double tops and bottoms, head and shoulders, breakouts and fakeouts, risk management, stops and targets, psychological levels, and sentiment indicators.

Next, Lesson 26 introduces VWAP, a volume-weighted benchmark used to judge whether price is trading at a premium or discount relative to average activity:

After the quiz, continue the next module using the Technical Analysis for Beginners Hub.

If this lesson helped you read sentiment without getting pulled into the crowd’s emotion, Alpha Insider is where these tools are applied consistently inside a structured curriculum, with clear routines and real market context.

Alpha Insider members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in clear, simple terms

➡️ A private Telegram community where conviction is shared daily

Less emotion… more evidence.

Legal And Risk Notice

This content is for education and information only and should not be considered financial, legal, or tax advice. Crypto assets are volatile and high risk. You are responsible for your own research and decisions, and you should consider seeking independent professional advice where appropriate.

Discussion