What Are VIX and MOVE?

- VIX tracks implied volatility on the S&P 500 options surface… equity fear in one line.

- MOVE tracks implied volatility on US Treasury options… bond market stress in one line.

They answer different questions. VIX speaks to equity risk appetite, MOVE speaks to rates uncertainty and policy tension. When they disagree, that’s information.

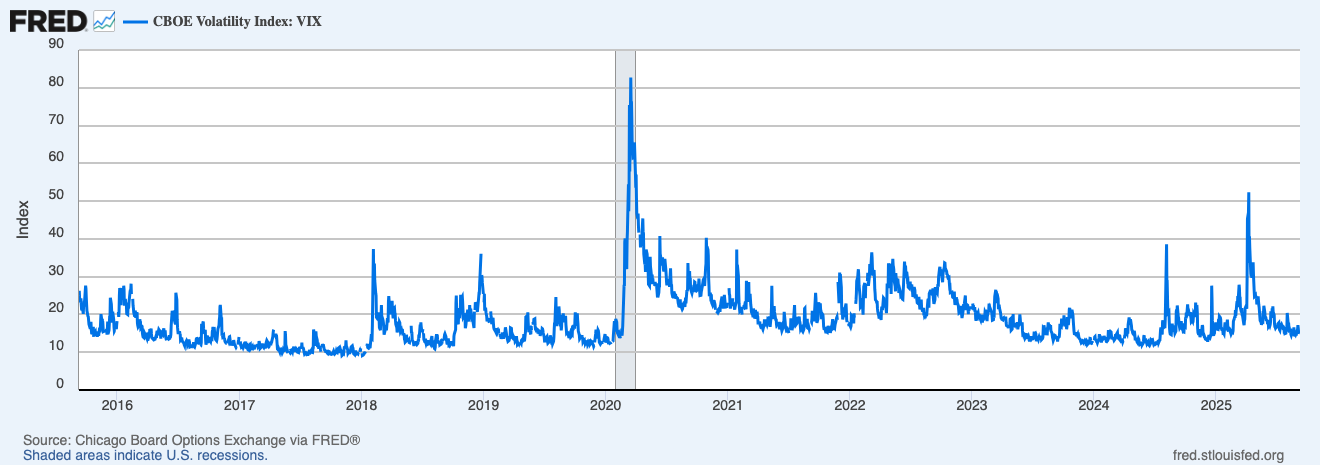

A decade of equity vol with the pandemic spike, post-2022 chop, and the low-vol regime that keeps getting punctured by data days.

Why They Don’t Always Sing From The Same Hymn Sheet

- Driver mix: equities lean on earnings and liquidity… bonds lean on inflation, policy, and issuance.

- Reflexivity: high MOVE lifts rate uncertainty, which can tighten financial conditions even when VIX looks sleepy.

- Transmission lag: bond stress often shows up first in MOVE, then trickles into VIX if growth is questioned.

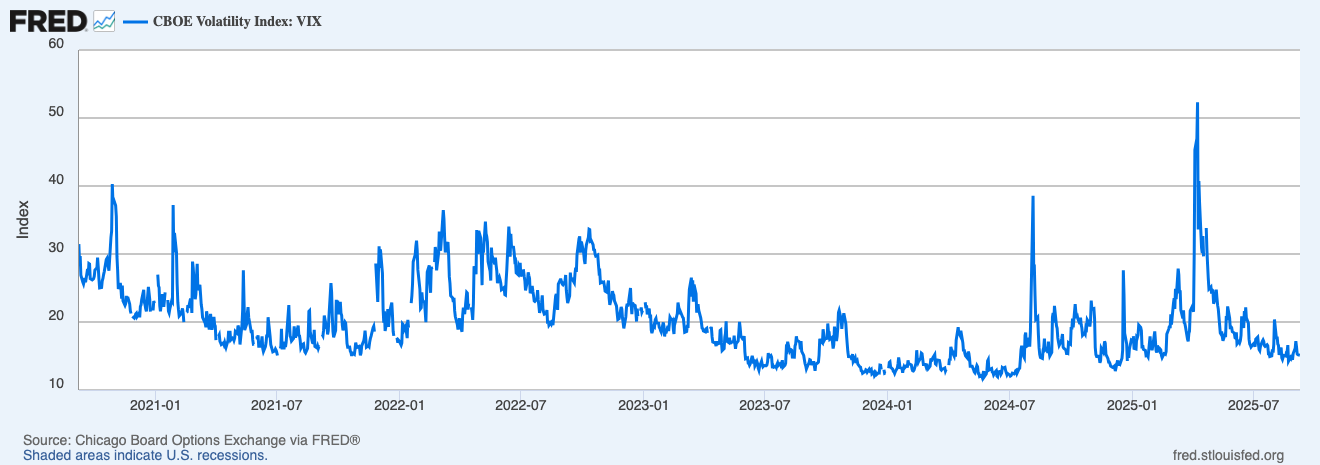

Zoomed view shows how VIX can stay tame for weeks, then pop around CPI, payrolls, or geopolitical shocks.

Bond-vol history with the 2022–23 rates shock, then a slow cool. Elevated MOVE with a calm VIX has often meant hidden tightness under the surface.

Practical Reads

- VIX low, MOVE high: bonds uneasy while equities relaxed… watch the dollar and real yields, risk can tighten without an equity headline.

- Both rising together: broad risk-off, respect exposure, size down.

- MOVE falling, VIX steady: easier policy backdrop, duration and high-beta breathe.

- Sharp VIX pop with flat MOVE: equity-specific shock… look to positioning, gamma, or earnings rather than macro.

Watch-outs

- Event clusters: CPI, FOMC, payrolls can lift MOVE first, VIX later… don’t front-run without confirmation.

- Quarter-end hedging: mechanical flows can bend VIX for a day or two.

- Zero-day options: OTM flows can mute VIX while realised vol rises… use realised metrics as a cross-check.

- Curve shape: VIX term structure in contango versus backwardation matters for carry trades.

A Simple Workflow You Can Reuse

- Put VIX and MOVE side by side… direction and persistence first.

- Check 10-year real yields and DXY… if MOVE is up with firmer real yields, tighten risk.

- Glance at credit spreads… if HY widens with MOVE up, equity calm is suspect.

- For crypto, line up implied vs realised vol and funding… don’t sell vol or add beta when MOVE is flashing.

- After big prints, reassess once vol sellers or buyers finish… let the dust settle, then act.

Mini FAQs

Is VIX a fear gauge or just an options price.

Both… it’s the S&P’s implied vol from options order flow. Treat it as a price of insurance, not a mood ring.

Does MOVE lead VIX.

Often during macro phases… rates uncertainty bleeds into everything. Still, equity shocks can be VIX-first.

What levels matter.

It’s the change and persistence that matter more… rising vol with tight financial conditions carries more weight than any magic number.

If this helped you separate equity vol from rates vol, join Alpha Insider for Macro Heat dashboards, calendar previews for key prints, and a weekly positioning watchlist. Fewer mistakes, cleaner execution, more conviction.

The Markets Unplugged members get:

➡️ Kairos timing windows to plan entries before the crowd moves

➡️ A full DCA Targets page with levels mapped for this cycle

➡️ Exclusive member videos breaking down charts in plain English

➡️ A private Telegram community where conviction is shared daily

➡️ A dedicated Macro Analysis page with regularly updated analysis and monthly reports

Tools in one place… crack on.

Discussion